US Debate Fallout Spurs Prison, Oil Stocks; Renewables Lag

(Bloomberg) -- Equities traders across multiple sectors are rearranging their positions in the aftermath of the much-anticipated presidential debate between President Joe Biden and former President Donald Trump.

Biden’s shaky performance boosted sentiment around Trump’s odds for securing a second term in the White House. The result: shares of private prisons, credit-cards companies and health insurance firms — the groups that would potentially win from another Trump presidency — are trading higher on Friday, while renewable energy and cannabis stocks are in the red.

“While the election outcome is still uncertain, volatility is almost guaranteed ahead of the election and the result will impact markets and government policy,” Solita Marcelli, chief investment officer for the Americas at UBS Global Wealth Management, wrote in a note to clients.

Marcelli added that investors should consider their exposure to US consumer discretionary and renewable sectors, which could suffer under a Trump presidency and a Republican Congress. On the flip side, UBS sees opportunity in the financial sector, which is “currently not pricing the potential for lower regulation that could materialize.”

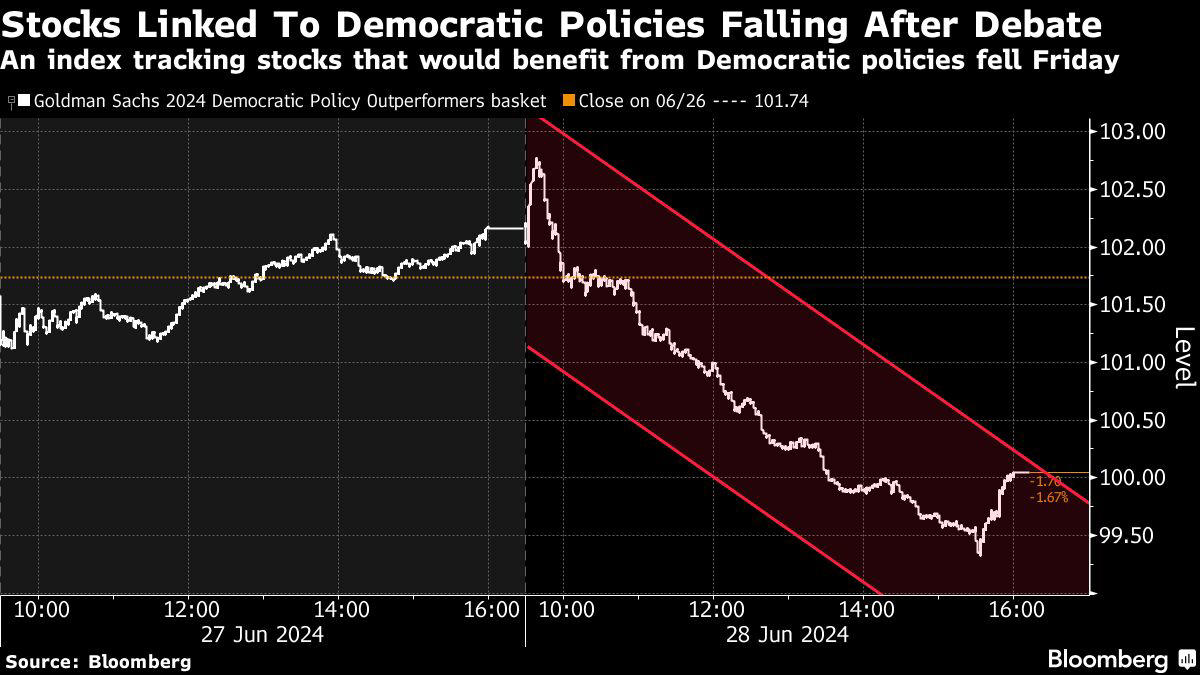

Stocks Linked To Democratic Policies Falling After Debate | An index tracking stocks that would benefit from Democratic policies fell Friday

Here are key sectors and stocks moving after the debate.

Health Insurers

Shares of health insurance providers moved higher as the debate outcome “bodes well” for the group, according to RBC Capital analyst Ben Hendrix, who sees clear expectations for regulatory pressures to lift on managed care companies in a second Trump administration.

UnitedHealth Group Inc. gained 4.7% while Humana Inc, which is trading without a dividend, rose about 3%. CVS Health Corp, which owns insurer Aetna, ended the day 1.2% higher.

“A second Trump term would ease regulatory and reimbursement headwinds weighing on the managed care stocks, particularly the Medicare Advantage leaders,” Hendrix wrote in a Friday note.

Private Prisons

Prison stocks are rising as investors perceived Trump’s tough-on-immigration rhetoric as a positive sign for correctional facility companies. GEO Group Inc. and CoreCivic Inc. shares rose 6.3% and 6.1% respectively on Friday, with GEO poised for a potential contract with U.S. Immigration and Customs Enforcement for a facility in Newark, NJ.

“There is an expectation that if Trump is the president, the number of folks getting monitored will increase,” which would lead to improvements for GEO Group and CoreCivic, Compass Point analyst Ed Groshans says.

Credit Cards

Credit card companies are outperforming on Friday, with Discover Financial Services rallying the most in four months and Capital One Financial Corp. up the most in two months. Vital Knowledge’s Adam Crisafulli pointed out the pair as being among stocks gaining on perceptions of benefiting in a Trump win, as the pending deal for Capital One to acquire Discover “would presumably have higher odds of closing.”

Crisafulli’s note also called out the strength in Synchrony Financial as one of the credit card companies that “could benefit from easier late fee rules.” Synchrony, which gained 6.7%, had also picked up a bullish rating from Baird.

Fossil Fuels

Energy stocks are among the best performing S&P 500 sectors Friday even as Brent crude and West Texas Intermediate prices edged lower. Shares of Baker Hughes Co. led the sector higher, while Valero Energy Corp., Phillips 66, Targa Resources Corp. and Occidental Petroleum Corp. all gained. Trump has been seen to have a pro-oil stance and earlier this month Trump told Senate Republicans he would restart oil drilling in Alaska’s Arctic National Wildlife Refuge if elected.

Renewable Energy

Solar energy stocks are trending lower on Friday, with Sunrun Inc. shedding 11%, the most since March, and First Solar Inc. dropping 9.8%. Renewable energy solutions provider Sunnova Energy International Inc. fell 14%.

“As a knee jerk reaction, anything that’s good news for Republicans tends to be perceived as not as good news for renewables and vice versa because Democrats have a more climate focused agenda compared to Republicans, all else being equal,” Raymond James analyst Pavel Molchanov said.

Cannabis

Cannabis company shares are falling Friday, as access remains a political issue. The MJ PurePlay 100 Index, which tracks the sector, ended the day 4.9% lower. Tilray Brands Inc., Canopy Growth Corp. and Curaleaf Holdings Inc. all slipped more than 3%.

Trump Media

One stock linked directly to Trump was lower Friday, reversing its course after soaring as much as 17% in premarket trading. Shares of Trump Media & Technology Group Corp. fell 11%, notching a second day of declines.

--With assistance from Bre Bradham and Angel Adegbesan.

(Updates stock moves at market close)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.