China Outlook Worries Linger Even After Strong Factory Showing

(Bloomberg) -- Worries over the outlook for China’s economy remained even after a private gauge of factory activity rose to a three-year high amid indications that manufacturer confidence is sagging.

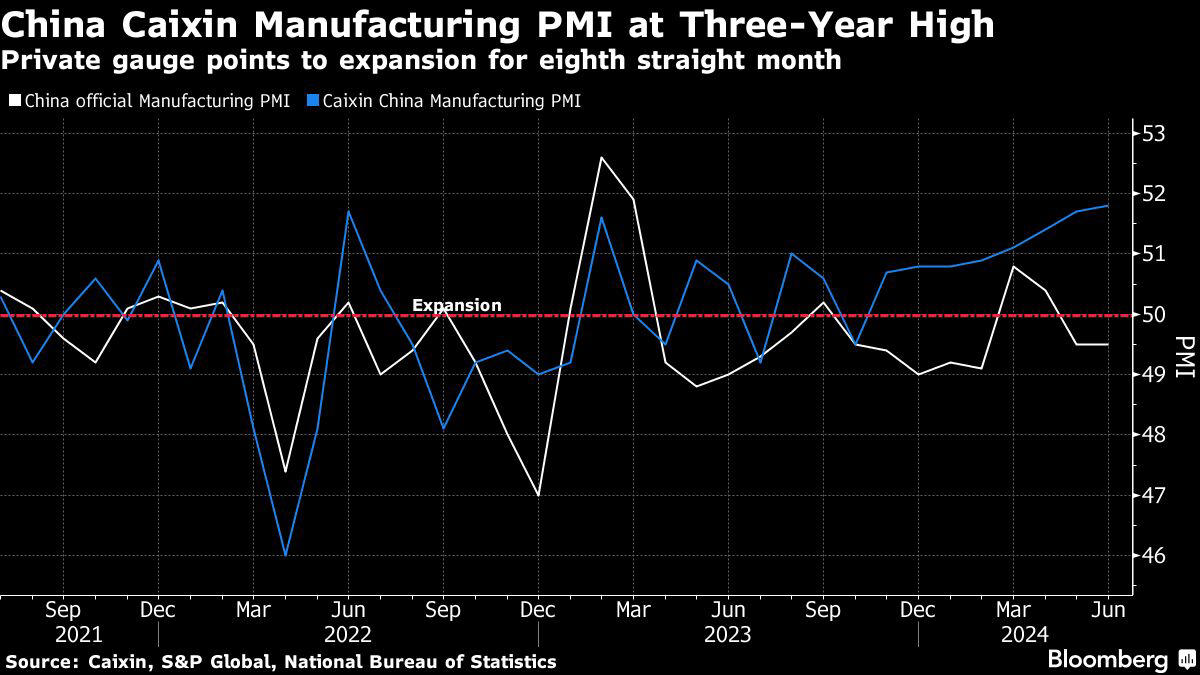

The Caixin manufacturing purchasing managers index climbed to 51.8 last month, the strongest reading since May 2021. That topped a median forecast of 51.5 by economists polled by Bloomberg. A reading above 50 suggests expansion.

The result was tempered by a gauge of company managers’ expectations for future output falling to the lowest since late 2019, though it remained in positive territory. The exact numbers for that gauge weren’t publicly available.

“Insufficient market confidence and effective demand remain key challenges,” Wang Zhe, senior economist at Caixin Insight Group, said in a statement. He called on Beijing to strengthen measures to shore up the real estate market and boost consumption, among other measures.

The onshore 10-year government yield declined two basis points to 2.18%, the lowest since Bloomberg began tracking the data in 2002, as investors continued to snap up the notes amid pessimism about the domestic economy and expectations for further stimulus.

The benchmark CSI 300 Index of Chinese equities was down 0.2% as of the midday break, while the yuan was steady at 7.2679 versus the dollar.

China Caixin Manufacturing PMI at Three-Year High | Private gauge points to expansion for eighth straight month

China’s economic recovery has been uneven this year, with manufacturing at times a bright spot while consumption has been weighed down by a prolonged real estate crisis. On Sunday, official data showed factory activity contracted for a second straight month in June, and a sub-index of new orders at factories inched lower as demand weakened.

Strong exports have kept production lines at Chinese factories humming while domestic demand remained stubbornly subdued. The prospects for overseas shipments are uncertain amid rising trade barriers erected by major partners such as the US, European Union and Brazil, while the nation’s businesses and consumers are reluctant to spend due to persistent property slumps and a gloomy job and income outlook.

Manufacturers are also facing headwinds from China’s deflationary pressures. Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd., said that because prices for good are falling, “the high Caixin PMI reflects exporters’ hard work but little improvement in revenues or profits.”

The gauge would likely weaken in the coming months, Xing added.

The Caixin manufacturing PMI often paints a rosier picture than the official data does. The two surveys cover different sample sizes, locations and business types, with the Caixin poll focusing on smaller and export-oriented firms.

What Bloomberg Economics Says...

“The marginal rise in China’s Caixin PMI print does little to counter the worrisome message from official surveys — the economy is struggling, with weak demand dragging on production. Still, a relatively robust Caixin reading suggests exports may continue to support growth in the coming months, although it probably won’t overcome weakness on the domestic side. Without stronger and quicker stimulus delivery, we see an increasing risk that GDP growth will miss the official 5% target for 2024.”

— Eric Zhu, economist

Read the full report here.

Also on Sunday, new data showed that the downturn in China’s residential real estate sector slowed further in June after the government worked to put a floor under the housing market in some of its biggest cities.

The value of new-home sales from the 100 biggest real estate companies dropped 17% from a year earlier to 439 billion yuan ($60 billion), compared with a 34% decline in May, according to preliminary data from China Real Estate Information Corp. Sales jumped 36% from May.

--With assistance from Zhu Lin.

(Updates throughout.)

Most Read from Bloomberg

©2024 Bloomberg L.P.