Stock market strategy: Deploy ‘buy on dips’, use corrections of 3-5% for lumpsum investments, says ICICI Securities

Stock market strategy: One should adopt “Buy on dips” strategy and corrections of 3-5% in markets can be used for making lumpsum investments, ICICI Securities said.

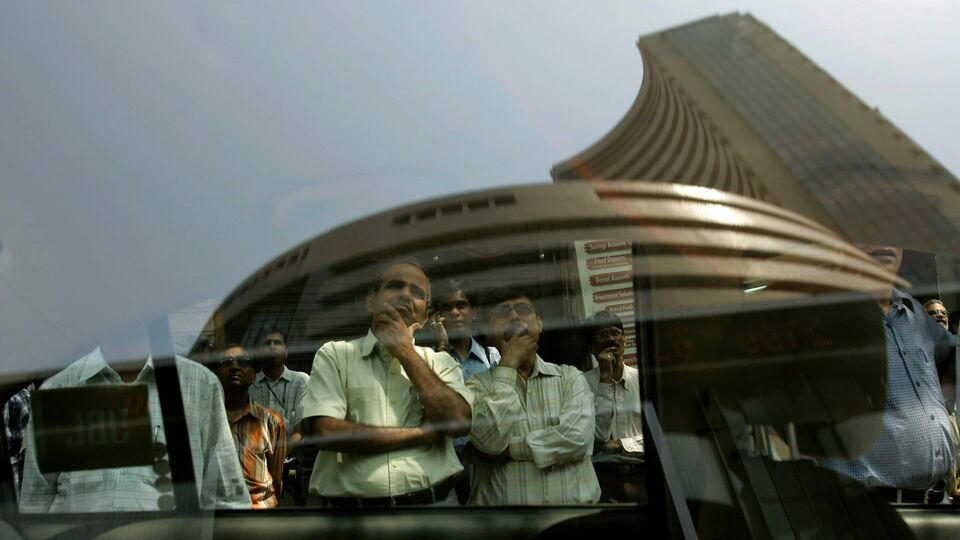

The Indian stock market took a breather on Friday as the benchmark indices, Sensex and Nifty 50, were trading half a percent lower each. After witnessing a drop last month driven by profit booking and cautious approach by investors ahead of the Lok Sabha elections 2024, the domestic markets seem to have stabilised this month and the benchmark indices have been testing new record highs

Analysts at ICICI Securities believe that the government policy direction would remain broadly consistent after the formation of a coalition government at the center by BJP along with its allies, securing a third term for Prime Minister Narendra Modi.

In the quarter ended March 2024, at the Nifty index levels including financials, topline and bottom-line growth came in healthy at 10% and 12.4% respectively, ahead of ex-financials data of 5.5% and 7.4%, thereby implying better show by banks and NBFCs.

“Interestingly, over the past few quarters, broader markets led by mid & small caps have reported better earnings growth than headline Nifty index, thereby justifying our relative overweight stance on mid & small cap space,” ICICI Securities said in a report.

For Q4FY24, in the listed space, which includes ~4,000 companies, aggregate topline and bottom-line growth is placed at 8.5% and 11.2%, respectively. Moderation of growth over the last two quarters is on expected lines; primarily on a high base, while margins have now stabilized, it noted.

Going forward, the brokerage firm expects Nifty earnings to grow at a CAGR of 16.9% over FY23-26E.

“We are valuing NIFTY at 25,000 i.e. 20x PE on FY26E Nifty EPS of ₹1,250,” ICICI Securities said.

Indian markets are expected to remain volatile over the short term and the future trajectory will remain guided by key risks that may get manifested in the form of global growth slowdown, escalated geopolitical tensions (if any), event risk due to general elections globally and monetary policy divergence, said the brokerage report.

Equity Strategy

“We retain a positive view on Equities, however we expect volatility to be sticky around current levels in coming months. Hence one should adopt “Buy on dips” strategy and corrections of 3-5% in markets can be used for making lumpsum investments,” ICICI Securities said.

Investors can also increase SIP allocation in multi/flexi cap funds focused on Blended investment (Mix of Value & Growth) style of investment. Allocation towards thematic funds focusing on banking, auto and infrastructure sector can be considered, it added.

Within the banking sector, it prefers PSU banks as they are expected to outperform Private banks.

Large caps are expected to outperform mid & small caps over next few months due to their recent underperformance versus small/midcap and expectation of higher FPI inflows.

Debt Market Strategy

We are close to the peak of interest rates and rates have already started trending down, hence, according to ICICI Securities, investment in long duration mutual funds can be considered at the current juncture.

Arbitrage funds which offer tax efficient returns are ideal for short term parking upto 6-12 months, it said.

The yields in the 3-5 years AAA corporate bond segment are trading around 7.5-7.6%. Hence, exposure to actively managed funds in 3-5 years will offer decent accrual yields with potential capital gains once the yield falls. Also, Blended/Medium Term funds with a balanced exposure to decent quality AA and AAA assets are also likely to generate good returns as they play a mix of accrual and duration, the brokerage suggested.

Read all Stock Market News Updates here

Disclaimer: The views and recommendations made above are those of individual analysts or broking companies, and not of Mint. We advise investors to check with certified experts before making any investment decisions.