The Best Growth ETF to Invest $1,000 in Right Now

The great thing about exchange-traded funds (ETFs) is they allow you to check off many investing boxes simultaneously. Whether you want to cast a wide net, focus on a specific geographic location, home in on a particular industry, or target a specific investing style, there's likely an ETF to fit your needs.

One drawback to broad ETFs is there's no way for them to deliver the hypergrowth returns that can occasionally come from positions in individual companies. However, that doesn't mean ETFs can't produce market-beating returns, especially those with a growth focus.

If you have $1,000 available to invest now and want to add exposure to growth stocks to your portfolio, the Vanguard Growth ETF (NYSEMKT: VUG) is a great option that has stood the test of time.

Operating in the risk versus reward sweet spot

Investing is generally a risk versus reward trade-off. The riskier an investment is, the greater the return investors expect to see when things go right. The safer an investment is, the more its potential upside is likely to be limited.

Growth stocks typically fall into the first category. With the potential for higher returns generally comes higher volatility and risk. That being said, the Vanguard Growth ETF occupies the sweet spot between risk and reward.

Because it is growth focused, the ETF is constructed to be able to beat the market (as represented by the S&P 500). At the same time, it holds roughly 200 large-cap and megacap stocks, offering investors diversification across a wide range of high-quality companies. The impacts of any single company's poor performance -- or even numerous companies' poor performances -- are cushioned by the results of the portfolio's winners.

A history of outperforming the market

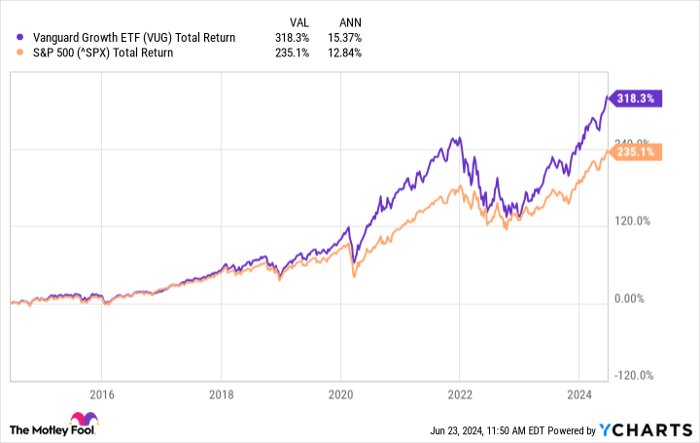

Arguably, the main allure of growth stock investing is the potential to beat the market, and the Vanguard Growth ETF has done just that since its Jan. 2004 inception. In the years since, it has returned around 820% compared to the S&P 500's 600%. If someone had invested $1,000 in the fund at its inception and held on, their position would be worth about $9,200 today.

The differences in returns between the fund and the S&P 500 have become more pronounced over the past few years as the growth rates of megacap tech companies (those with market caps of more than $200 billion) have accelerated greatly.

VUG Total Return Level Chart

There's no guarantee as to how the ETF will perform from here, but its track record highlights its potential to deliver strong long-term returns.

The ETF has an extremely low expense ratio of 0.04% (or $0.40 in annual fees per $1,000 invested with the fund), so investors can keep nearly all of their gains. It's a much lower-fee option than other popular growth-focused ETFs, such as Cathie Wood's ARK Innovation ETF, which has an expense ratio of 0.75%.

Led by the "Magnificent Seven" stocks

The "Magnificent Seven" stocks have a huge influence on the Vanguard Growth ETF, and you can see their share of the fund's holdings below:

- Microsoft (12.60%)

- Apple (11.51%)

- Nvidia (10.61%)

- Alphabet (7.54%)

- Amazon (6.72%)

- Meta Platforms (4.21%)

- Tesla (1.98%)

While these companies have earned their title due to their economic importance and dominance of their respective industries, the fact they make up over 55% of the portfolio means the ETF may not be as diversified as some investors like.

However, if your desire is to find a growth fund, it's hard to argue against a strategy that lets these companies lead the way. For perspective, Alphabet was the worst performer of the bunch over the past decade, and it still averaged annualized returns of more than 20% during that span.

They still have plenty of opportunities too. Industries such as cloud computing, artificial intelligence, and electric vehicles are poised to be high-growth industries for the foreseeable future, and these companies are leading the charge in those areas.

As the Magnificent Seven go, so does the ETF, but it does include holdings from every major non-tech sector:

- Basic Materials: 1.3%

- Consumer Discretionary: 18.3%

- Consumer Staples: 0.6%

- Energy: 1%

- Financials: 2.4%

- Health Care: 7.5%

- Industrials: 8.3%

- Real Estate: 1.4%

- Technology: 58.2%

- Telecommunications: 0.8%

- Utilities: 0.2%

Its concentration in tech stocks means you probably don't want the Vanguard Growth ETF to be the foundation of your portfolio, especially if you already own shares of Magnificent Seven companies. But it remains a great option for investors seeking exposure to balanced growth.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Growth ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $774,526!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Stefon Walters has positions in Apple and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Tesla, and Vanguard Index Funds-Vanguard Growth ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.