Where Will Alphabet Stock Be in 3 Years?

Share prices of Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) have outperformed the Nasdaq-100 Technology Sector index over the past three years, delivering gains of 51% as compared to the 26% gains clocked by the index. However, investors might expect more from the search engine leader thanks to the emergence of new catalysts.

Let's take a closer look at what's likely to supercharge Alphabet's growth over the next three years and see if it can help the stock deliver stronger gains.

Alphabet is growing at a faster pace this year

Alphabet finished 2023 with revenue of $307.4 billion, an increase of just 10% from the previous year. Revenue had a compound annual growth rate of 19% between 2020 (when it reported $182.5 billion) and 2023. Its growth dipped last year because of a slowdown in the digital advertising market.

While several rivals reported AI breakthroughs, the setbacks Alphabet encountered in trying to jump onto the artificial intelligence (AI) bandwagon also contributed to Alphabet's performance drop. For instance, Meta Platforms delivered impressive growth last year and cornered more share of the digital ad market by integrating AI tools into its advertising and social media platforms.

The good news for Alphabet investors is that it has started 2024 on a brighter note. Revenue in the first quarter of the year increased 16% year over year to $80.5 billion. Net income also increased 61% to $1.89 per share.

AI seems to be playing an important role, with Alphabet offering improved AI tools to advertisers to help drive better returns on their investments. For instance, the company has integrated its Gemini AI model into its Performance Max (PMax) ad campaigns, and this seems to be driving advertisers' returns. On its April earnings conference call, management said that advertisers using PMax asset generation are 63% more likely to publish a campaign with good or excellent ad strength.

Management also said that advertisers using generative AI to create ad components such as headlines and product descriptions saw a 5% improvement in conversions without any increase in costs. The company's focus on bringing AI to its ad tools could pay off big time since advertisers are expected to spend $107 billion on AI-based marketing in 2028 as compared to $15 billion in 2021.

AI is also giving Alphabet's Google Cloud a lift. Cloud revenue increased 28% year over year in the first quarter to $9.6 billion, with cloud-based AI services gaining impressive adoption among customers.

Alphabet says that it has added over 1,000 new products and features to Google Cloud in recent months, and this seems to have helped it gain ground. The company's share of the cloud computing market increased by a single percentage point in the first quarter on a year-over-year basis to reach 10%.

That might not sound like a huge improvement, but Google Cloud is the third-largest cloud infrastructure provider behind the likes of Microsoft and Amazon, which together control 56% of this market. So if Google manages to claw away share from its rivals, its cloud revenue could keep improving in the long run.

The market for cloud-based AI services is expected to generate $274 billion in annual revenue in 2029 as compared to $67 billion this year, according to Mordor Intelligence. And Alphabet has a couple of solid catalysts with its AI-powered advertising and cloud computing that could help its growth accelerate.

Healthy growth seems to be in the cards for the next three years

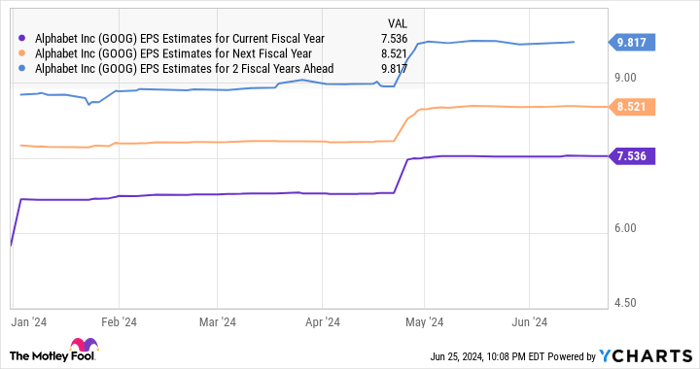

Alphabet finished 2023 with earnings of $5.80 per share. The following chart tells us that its bottom line could increase by 30% in 2024, which would be an acceleration over the 27% growth it recorded last year.

GOOG EPS estimates for current fiscal year;

Analysts have increased their outlook for Alphabet for the next couple of years as well. A look at the chart above shows Alphabet's 2026 earnings growth is expected to be healthier than its projected rate for 2025. And Alphabet could end up beating the projections thanks to the catalysts discussed. But even if Alphabet's earnings increase to $9.82 per share and the company maintains its current price-to-earnings ratio of 28 at that time, its stock price could jump to $275. That would represent 49% growth from current levels.

The earnings multiple used here is a conservative one; the U.S. technology sector has an earnings multiple of 47, and tech stocks whose growth is being fueled by AI tend to command richer multiples.

So if Wall Street decides to reward Alphabet stock with a richer multiple, there is a good chance that it could deliver stronger gains over the next three years than what's estimated above. That's why investors looking to buy an AI stock that's trading at a relatively attractive valuation should consider taking a closer look at Alphabet.

Should you invest $1,000 in Alphabet right now?

Before you buy stock in Alphabet, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.