1 Incredible Artificial Intelligence (AI) Stock to Buy and Hold for the Next 10 Years

Artificial intelligence (AI) has become the single hottest investing trend over the past year and a half, and there is a good chance the rapid proliferation of this technology will continue to be a key growth driver for the stock market over the next decade as well.

After all, the global AI market is expected to generate almost $2.6 trillion in annual revenue in 2032 as compared to an estimated $538 billion last year. Buying and holding solid semiconductor stocks for the long run is one of the best ways to capitalize on this huge opportunity. That's because training and deploying AI models isn't possible without AI chips.

This explains why top companies and governments have been lining up to buy chips from the likes of Nvidia, sending shares of the graphics specialist soaring thanks to the stunning growth on its top and bottom lines. However, you should also consider buying another chipmaker to make the most of the AI boom: Taiwan Semiconductor Manufacturing (NYSE: TSM).

TSMC is a solid play on the AI chip boom

Popularly known as TSMC, the Taiwan-based foundry giant is at the heart of the AI semiconductor market as its process nodes are allowing customers such as Nvidia to produce powerful chips. For example, Nvidia's Hopper architecture, which allowed the company to become the dominant player in the AI chip market, was based on TSMC's 4N manufacturing process.

And now, Nvidia is going to manufacture its next-generation Blackwell AI processors using TSMC's 4NP process. However, Nvidia is not the only one queueing up to get its hands on TSMC's chips. Intel has reportedly tapped TSMC's 3-nanometer (nm) chip-production line to manufacture processors for notebooks.

It is worth noting that Intel itself is a chip manufacturer, unlike Nvidia, which only designs its chips and outsources their fabrication to TSMC. However, Intel has fallen behind in the race to develop advanced chips, which is why it has been tapping TSMC for manufacturing. Given that TSMC has been consistently pushing the envelope on the product-development front and is set to move to more advanced process nodes, such as 2nm, it won't be surprising to see continued demand from the likes of Intel and Nvidia.

As it turns out, these are not the only chipmakers that have turned to TSMC to power their AI ambitions. From Qualcomm to AMD to Apple to Broadcom to Marvell Technology, the list of TSMC's customers is long and illustrious. As a result, the company's factory-utilization rate remains very high. For instance, TSMC's 3nm chip-production line reportedly had a utilization rate of 95% last month.

Such solid demand explains why TSMC's business is booming in 2024. Its revenue in the first five months of the year has increased 27% year over year. That's a nice turnaround from last year when the company's revenue dipped on account of poor end-market demand. Looking ahead, TSMC's revenue growth should remain solid as the company capitalizes on its terrific foundry market share of 62% and flexes its pricing power.

TSMC enjoys a lead of almost 50 percentage points over the second-place foundry company, Samsung. This explains why the company is in a position to reportedly raise prices for its chips. At the same time, investors should note TSMC is going to increase the production capacity of its advanced chips by 60% through 2026 so it can fulfill more AI-related orders.

In all, it can be said TSMC is pulling the right levers to ensure it continues to make the most of the long-term opportunity AI has to offer. This could help boost the company's revenue significantly over the next decade as the AI chip market is expected to generate a whopping $372 billion in revenue in 2032, up from just $15 billion in 2022.

Investors can expect healthy gains over the next decade

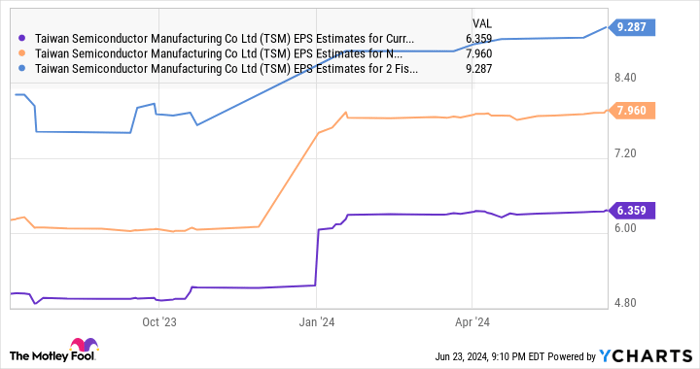

Analysts are expecting TSMC's earnings to increase at an annual rate of 21% over the next five years. However, as the following chart indicates, the company's earnings per share (EPS) growth estimates have seen a significant bump in the past year.

TSM EPS Estimates for Current Fiscal Year Chart

Per the chart above, TSMC's earnings could increase nearly 23% this year from 2023's $5.18 per share. Next year, however, its bottom line is forecasted to grow at a faster pace of 25%. The estimate for 2026 has also been moving higher, and it won't be surprising to see this semiconductor stock outpacing analysts' estimates in the long run considering the huge end-market opportunity it is sitting on.

The Next Platform, an online publication that covers high-performance computing and hyperscale data centers, estimates AI could send TSMC's overall top line to $180 billion in 2030. That would be a nice jump from its 2023 revenue of $69 billion. Keep in mind the AI chip market could continue growing beyond the end of the decade as well.

That's why investors looking to add an AI stock to their portfolio would do well to buy this chipmaker before it adds to the 61% gains it has clocked so far in 2024.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom, Intel, and Marvell Technology and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.