5 Reasons to Buy Disney Stock Hand Over Fist Right Now

Shares of The Walt Disney Company (NYSE: DIS) have taken investors on a less-than-magical thrill ride in recent times. The stock is up 13% in 2024, but also down 17% from its 52-week high set in March -- and far below the heights it reached in early 2021.

While this type of volatility can be frustrating, it may also offer an opportunity to pick up shares in a great company at a discount. Here are five reasons why Disney stock could be a screaming buy right now.

1. Solid fundamentals with upside to earnings

The recent weakness in shares of Disney goes back to its first-quarter earnings (for the period ended March 31), highlighted by some mixed results and muted guidance. Earnings per share (EPS) beat estimates, but annual revenue growth of 1.3% came in slightly below expectations.

That being said, it's important to consider the big picture, which includes plenty of reasons for investors to be optimistic. The top-line weakness in Q1 is in the context of timing effects. Disney didn't have any major theatrical releases during the quarter, affecting revenue in its entertainment segment.

The bigger story should be the momentum in streaming services. Disney added 6 million Disney+ core subscribers to start the year, including a 17% increase from the U.S. and Canada. The trends helped the direct-to-consumer business to finally turn a profit for the first time.

That milestone has implications for profitability to continue climbing. Disney is reiterating its full-year free cash flow target of $8 billion, marking a noticeable shift from $4.9 billion in fiscal 2023 and $1 billion in 2022. Overall, this is a case where despite the stock price sell-off, the financial outlook is improving.

2. A surprising box office blockbuster

One big win for Disney is the impressive box office numbers from its latest theatrical release, Inside Out 2. The animated film has grossed $724 million in just two weeks and is poised to become the first $1 billion movie of 2024.

The hope is that upcoming Disney releases, including Deadpool vs. Wolverine and Alien: Romulus, will capture some of the same box office magic. Investors can look forward to seeing the effect of these films reflected in company results later this year.

3. Streaming bundles can unlock value

Another catalyst to watch for with Disney stock is the company's plan to reshuffle its streaming offerings. With several distinct properties between the Disney+, Hulu, and ESPN channels, the goal is to give customers more choices by expanding distribution with more bundling formats.

Disney, alongside Warner Bros. Discovery and FOX, is launching a sports-programming joint venture streaming service in the coming months combining ESPN, TNT Sports, ABC, and FOX Sports. The ability to bring in new viewers while keeping existing subscribers engaged should be positive for earnings and unlock company value.

Group of people watching TV streaming service.

4. Theme park expansion to drive long-term growth

Maybe the strongest part of Disney's global empire has been its Experiences segment covering theme parks, resorts, and cruise line operations, where revenues climbed by 10% year over year last quarter.

Disney plans to leverage the ongoing demand into a significant expansion, investing $60 billion over the next decade across its global properties, including new lands at the Anaheim Disneyland location and Florida's DisneyWorld Resorts. The effort to increase capacity sets a runway for long-term growth within a strategy to keep Disney a leader in entertainment.

5. A compelling valuation

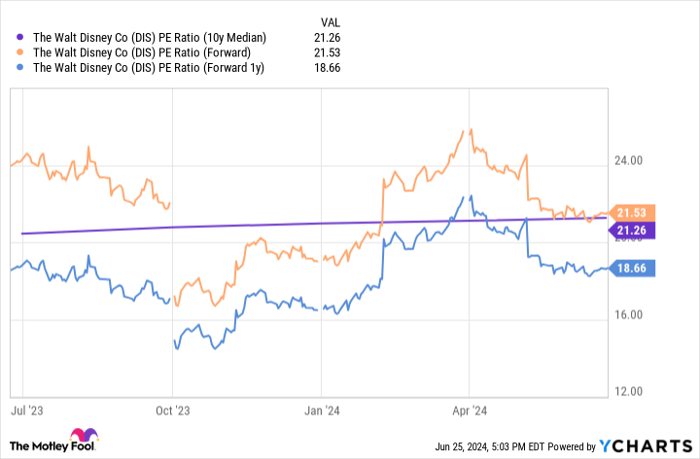

Finally, the main reason I'm bullish on Disney is my view that the stock is simply undervalued. Shares are trading at 21 times its 2024 consensus EPS of $4.73, according to the average of Wall Street estimates.

While this forward price-to-earnings ratio (P/E) is in line with the company's 10-year average for the multiple, the metric looks increasingly attractive into 2025, where Disney is forecast to reach EPS of $5.49. This implies a 1-year forward P/E of 18.6.

DIS PE Ratio (10y Median)

Ultimately, Disney's strengths and earnings momentum can justify a wider valuation premium from here. The upside here is the potential that results over the next few quarters can outperform expectations, thereby serving as a catalyst for the stock.

Is now the time to buy Disney stock?

There's a lot to like about Disney, with shares well-positioned to rebound in my opinion. As long as economic conditions remain resilient, the company's renewed focus on profitable growth should be rewarded by the market over time. The stock can be a good option for investors as part of a diversified portfolio.

Should you invest $1,000 in Walt Disney right now?

Before you buy stock in Walt Disney, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walt Disney wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $759,759!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walt Disney and Warner Bros. Discovery. The Motley Fool has a disclosure policy.