Smooth Sailing or Rough Seas Ahead? Is Carnival Stock a Buy?

Shares of cruise line Carnival Corporation (NYSE: CCL) have jumped nearly 15% over the past week, driven by standout business results reported in Q2 earnings. The company continues to see robust demand following the pandemic, which has helped drive the business back to profitability.

Things look promising, with earnings expected to ramp up over the next two years. However, investors may want to approach the stock cautiously. Economic storm clouds on the horizon threaten Carnival's business, and extreme measures taken during COVID-19 have skewed the stock's valuation.

These risks mean the stock isn't as much of a slam-dunk as the latest results make it out to be. Here is what you need to know.

Promising near-term business momentum

Carnival shined with strong second-quarter earnings, which were headlined by strong demand. Management noted record-level booking volumes for 2025 cruises, which is excellent for Carnival because it means fewer price cuts to fill empty cabins. Management indicated that the cumulative 2025 bookings are above 2024 in occupancy and pricing.

Strong bookings set the table for more robust earnings as these translate to revenue and profits. The company lost $0.06 per share in 2023, but earnings are estimated to swing to a positive $1.13 per share in 2024 and $1.49 next year. Shares look attractive at first glance; the stock trades at just 16 times 2024 earnings estimates and 12 times 2025 estimates.

Between 2012 and 2020, the stock traded at an average price-to-earnings ratio of over 19, so one could argue the stock has investment upside over the next 18 months, especially given how strong booking momentum is.

But you can't look at just earnings

Unfortunately, the stock has issues you can't see when looking at Carnival's potential earnings growth.

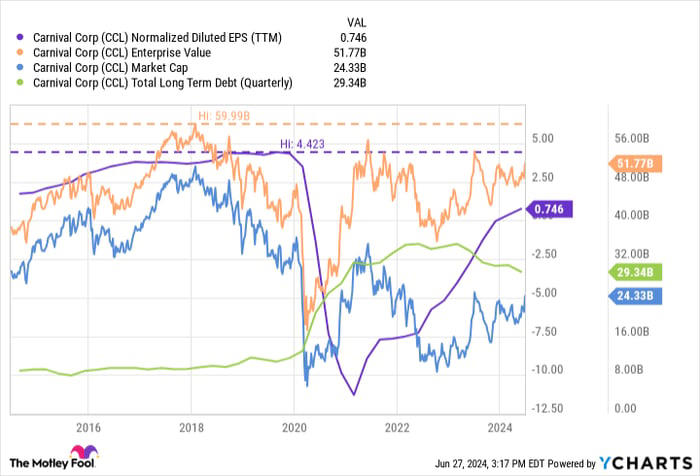

Carnival's enterprise value already sits within shouting distance of pre-pandemic highs. Enterprise value is important because there is more to a company than how much people are willing to pay for its stock -- like debt, for example. Enterprise value is the combination of the company's net debt (what it owes minus cash) and the market value of its stock.

Carnival had modest debt before the pandemic and earned $4.42 per share in profits. So, the stock's market cap contributed to most of its enterprise value, which peaked at $60 billion. However, management had to borrow a lot of money to keep the company alive during the pandemic.

Today, that extra debt has bloated Carnival's enterprise value to near pre-pandemic highs, even though the stock is worth a lot less:

CCL Normalized Diluted EPS (TTM)

In other words, there isn't much room for investment returns unless debt decreases or the stock achieves a higher enterprise value.

Yes, Carnival's enterprise value could technically go up. But why would it? Carnival has way more debt than it once did and makes far less money today. Even 2025 earnings estimates of $1.49 per share are a fraction of what it made before COVID-19. Nothing here screams, "Carnival's business is worth more than it once was!"

Fading consumer strength could unravel future earnings

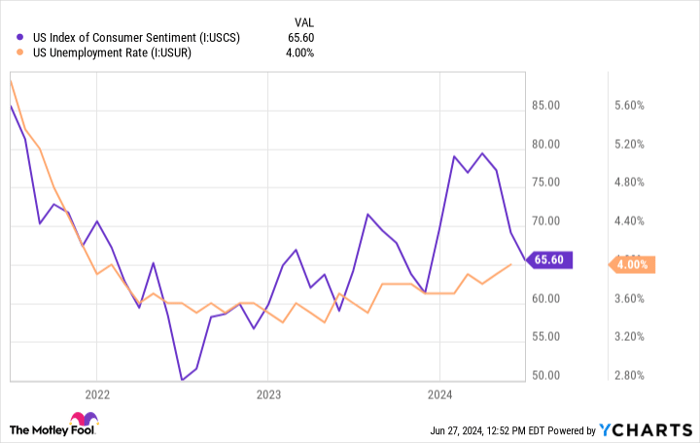

There could also be a risk of a worsening economy dumping water on Carnival's strong business momentum. Recent data points to weakening consumer spending, which doesn't bode well for a business like Carnival that sells a discretionary product. Vacations are arguably the first budget item to go when times are tough.

The U.S. unemployment rate has risen after bottoming out near multi-decade lows. Additionally, consumer sentiment has slipped from nearly 80 at the beginning of the year to 65:

US Index of Consumer Sentiment

These trends have begun hurting other businesses that sell discretionary products and services. For example, pool products distributor Pool Corporation recently walked back its 2024 guidance due to dramatically weaker spending on new pools and pool remodels. A cruise is significantly cheaper than a new pool, but eventually, vacations could see the chopping block if consumer data continues to go the wrong way.

Carnival needs improving financials and growth to justify a higher enterprise value. While Q2 earnings were promising, potential consumer struggles threaten growth. It's hard to see the stock as a buy today. Potential consumer struggles and a bloated enterprise value leave more room for the downside than the upside.

Should you invest $1,000 in Carnival Corp. right now?

Before you buy stock in Carnival Corp., consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Carnival Corp. wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.