S&P 500 Rally Hits a Wall at End of Banner Quarter: Markets Wrap

(Bloomberg) -- The stock market waned in the final stretch of a solid quarter, with traders keeping a close eye on any news regarding the US presidential race and remaining cautious ahead of Sunday’s elections in France.

Traders are rearranging their positions in the aftermath of the debate between Joe Biden and Donald Trump. Biden’s shaky performance boosted sentiment around Trump’s odds for securing a second term in the White House. Private prisons, oil and health-insurance firms — some of the groups that would potentially win from another Trump presidency — rallied, while renewable energy and pot stocks sank. Treasury curve-steepening also followed the presidential debate.

The New York Stock Exchange As US Stocks Rise

“A very bad night for Biden,” said Libby Cantrill at Pacific Investment Management Co. “For markets, the biggest takeaway from last night is that deficits will remain high and tariffs are likely going up, especially if Trump gets elected. The question is when this will be priced-into markets.”

After gaining almost 1% earlier Friday, the S&P 500 fell to around 5,460. Long-term Treasuries largely underperformed shorter maturities. Bonds had earlier gained as inflation data bolstered bets on Federal Reserve rate cuts. The dollar edged lower, while capping its sixth-straight week of gains.

In late hours, the biggest US banks took turns announcing higher payouts to investors after easily passing the Fed’s annual stress test earlier this week.

| For insightful and quick analysis on what’s moving markets, subscribe to the Markets Wrap. |

S&P 500's Rally Wanes

The US presidential election and its aftermath promises investors big market swings in the second half of the year, said Goldman Sachs Group Inc.’s Scott Rubner.

“I would be looking to trim exposure up here post July 4th,” Rubner wrote.

Andrew Brenner at NatAlliance Securities reiterated his commment that a Trump victory in the debate would put pressure on the long-end of the bond market.

“Massive steepening,” Brenner said. “Again, we don’t like talking about politics, but everyone believes Trump won the debate on a weak performance from Biden. Fears of what tariffs, lack of concern for the deficit (both parties), and continued fear of increasing Treasury issuance, will do for the curve... Steepen it out... That is what we have seen today.”

To rate strategists at Barclays Plc watching the presidential debate Thursday night, the trade was clear: buy inflation hedges in the US Treasury market.

With Trump appearing more likely to unseat Biden in the November election, the market should “be pricing in a considerable risk of higher-than-target inflation in the coming years, and this is from a starting point of our thinking they already offered structural value,” Barclays strategists Michael Pond and Jonathan Hill said in a note.

Treasury 30-Year Yields Jump

JPMorgan Chase & Co.’s Marko Kolanovic says the S&P 500 will falter in coming months in the face of mounting headwinds, from a slowing economy to downward earnings revisions. The gauge is poised to plunge to 4,200 by year-end, a roughly 23% drop from current levels.

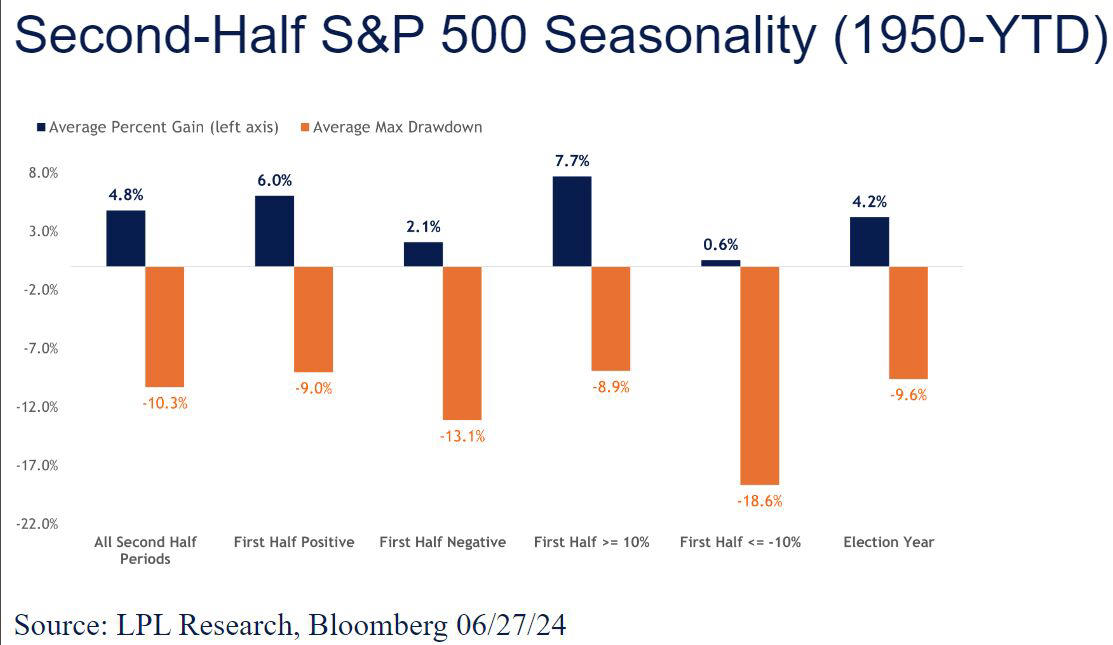

Stocks are heading into the second half having gained almost 15% this year. Historically, a strong first half tends to be followed by above-average second-half returns, according to Adam Turnquist at LPL Financial.

“While elevated valuations, overbought conditions, and underwhelming market breadth point to a potential pause ahead, seasonal trends suggest momentum could continue in the second half,” he noted.

The S&P 500 has followed up a positive first-half return with an average second-half gain of 6%, Turnquist added. Furthermore, when first-half gains were 10% or higher, the index posted average gains of 7.7% in the second half, with 83% of occurrences producing positive results.

Source: LPL Financial

Earlier in the session, traders kept a close eye on economic data.

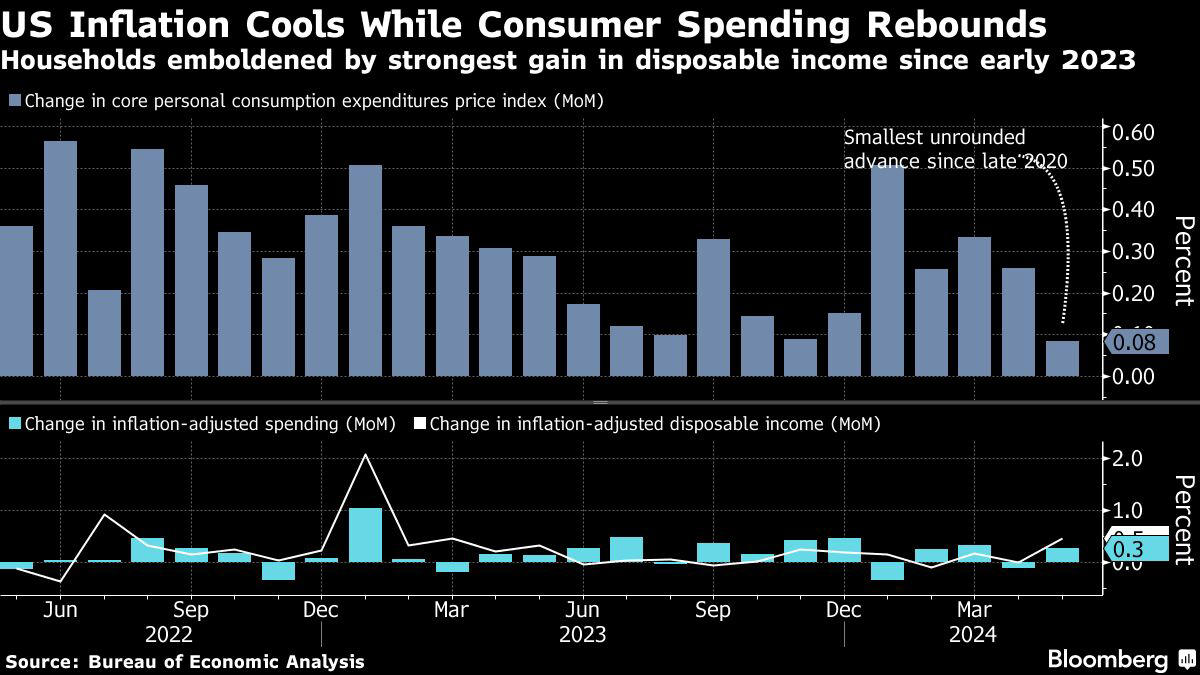

US consumer sentiment declined by less than initially estimated on expectations inflationary pressures will moderate. The Fed’s preferred measure of underlying US inflation decelerated. Household spending rebounded and incomes showed solid growth, offering some hope that price pressures can be tamed without lasting damage to consumers.

“From the market’s perspective, today’s PCE report was near perfect,” said David Donabedian at CIBC Private Wealth US. “The Fed’s favorite inflation indicator not only showed inflation was moving towards the Fed’s inflation target, but that the economy is resilient. Consumer spending was on the rise and take-home pay was also up after a couple of sluggish months.”

To Seema Shah at Principal Asset Management, while the inflation data is a relief and will be welcomed by the Fed, the policy path is not yet certain.

“A further deceleration in inflation, ideally coupled with additional evidence of labor market softening, will be necessary to pave the way for a first rate cut in September,” she noted.

US Inflation Cools While Consumer Spending Rebounds | Households emboldened by strongest gain in disposable income since early 2023

“The soft inflation data will build the case that the Fed can start cutting rates in the coming months,” said Jeffrey Roach at LPL Financial. “As long as incomes grow at a healthy clip, consumers will keep spending. The key is the labor market and so now, we should shift our attention to next week’s nonfarm payroll release for a fresh look into the job market.”

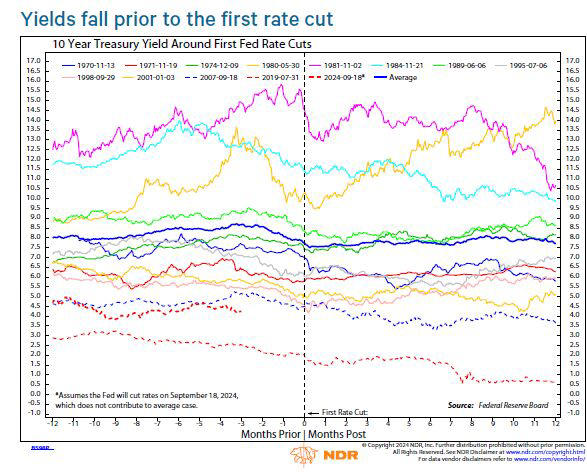

The timing of the first rate cut matters because bonds rally in anticipation of that cut, according to Joe Kalish at Ned Davis Research.

“Any second half bond market outlook is contingent on Fed policy,” he said. “The timing of the first rate cut has historically been important for the bond market, as yields tend to peak 2-3 months before the first rate cut.”

Source: Ned Davis Research

Corporate Highlights:

Nike Inc.’s management team, led by Chief Executive Officer John Donahoe, is facing growing criticism from Wall Street as a prolonged sales slump sparked the stock’s biggest rout since the company went public in 1980.Uber Technologies Inc. and Lyft Inc. agreed to a series of worker benefits to resolve a longstanding state lawsuit in Massachusetts that challenged drivers’ employment status as independent contractors, putting a stop to the companies’ bid to take the issue before voters in November.Rite Aid Corp. has been cleared to exit bankruptcy after winning court approval on a restructuring plan that’s poised to save the ailing pharmacy chain from liquidation by handing control of the business to key creditors.Microsoft Corp.’s $13 billion investment into OpenAI Inc. is set to come under added scrutiny from European Union’s antitrust watchdogs, who are poised to quiz rivals about the AI firm’s exclusive use of Microsoft’s cloud technology.Nokia Oyj has agreed to buy Infinera Corp. in a $2.3 billion deal that will expand the company’s networking products for data centers and increase its presence in the US, a potentially key source of growth as the boom in artificial intelligence drives demand for server capacity.

| For a breakdown of sector performance in the S&P 500 every day after the closing bell, please see the new S&P 500 Sector Wrap. |

Some of the main moves in markets:

Stocks

The S&P 500 fell 0.4% as of 4 p.m. New York timeThe Nasdaq 100 fell 0.5%The Dow Jones Industrial Average fell 0.1%The MSCI World Index fell 0.3%

Currencies

The Bloomberg Dollar Spot Index fell 0.1%The euro was little changed at $1.0710The British pound was little changed at $1.2641The Japanese yen was little changed at 160.92 per dollar

Cryptocurrencies

Bitcoin fell 2.2% to $60,082.15Ether fell 1.8% to $3,377.67

Bonds

The yield on 10-year Treasuries advanced 11 basis points to 4.39%Germany’s 10-year yield advanced five basis points to 2.50%Britain’s 10-year yield advanced four basis points to 4.17%

Commodities

West Texas Intermediate crude fell 0.3% to $81.53 a barrelSpot gold fell 0.2% to $2,324.07 an ounce

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Jessica Menton, Alexandra Semenova, Felice Maranz, Carmen Reinicke, Emily Forgash, Natalia Kniazhevich and Ye Xie.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.