The worrying graph that proves interest rates could still rise

- AMP graph shows services inflation getting worse

- READ MORE: Why government spending is a danger

A concerning graph compiled by economic experts has revealed interest rates in Australia could still rise - simply because inflation is now a homegrown problem with immigration at record-high levels.

The consumer price index surged by 4 per cent in the year to May, up from 3.6 per cent in April, putting inflation even further above the Reserve Bank's 2 to 3 per cent target.

That means Australia borrowers face more rate hikes even though Canada and the European Union have this month both cut interest rates.

Inflation is rising in Australia, but is falling in a range of rich-world nations including the United Kingdom, the U.S. and Sweden.

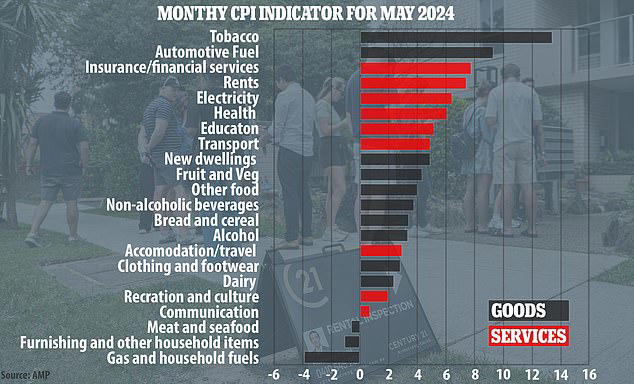

AMP economists Shane Oliver and My Bui have compiled a new graph highlighting how services, as opposed to goods, made up six of the top 10 items for big price rises.

These items were also all above the broader inflation rate of 4 per cent, showing Covid supply chain constraints are no longer the key driver of inflation.

'Service prices are more persistent and are the main concern for the Reserve Bank at the moment,' AMP said.

'The upside surprise in the monthly inflation data in the past three months is a warning for the bumpy path of the disinflation process, especially as services inflation seems to be picking up.'

A graph has revealed interest rates in Australia could still rise - highlighting how services, as opposed to goods, made up six of the top 10 items for big price rises and demonstrating inflation is now a homegrown problem with immigration at record-high levels

Labor's revised stage three tax cuts, coming into effect on July 1, are expected to be spent on essential services, with prices for rents, electricity, healthcare and insurance rising at levels well beyond the consumer price index.

'On the one hand, people have a little bit more money in their pockets,' Ms Bui told Daily Mail Australia.

'They will probably save a large amount of these tax cuts - if it's spent, it's probably being used on paying the electricity bills which are still very high right now, paying rents, paying health insurance rather than going out and eating.'

This meant another rate hike in August, when the RBA next meets, was a 45 per cent chance.

'I think 45 per cent is pretty high,' Ms Bui told Daily Mail Australia.

Coalition frontbencher James Paterson said Australian borrowers needed to brace for possibly two more rate rises.

'Unfortunately, there is a very risk real of an interest rate rise or maybe two interest rate rises between now and the end of the year or early next year,' he told Sky News on Thursday.

AMP economists Shane Oliver and My Bui (pictured) have compiled a new graph highlighting how services, as opposed to goods, made up six of the top 10 items for big price rises

Ms Bui said Australia's high population growth was putting pressure on rents along with demand for both goods and services, with a record 547,300 migrants, on a net basis, moving to Australia in 2023.

That was the most ever for a calendar year based on mainly skilled migrants and international students, minus permanent departures.

'We've had population growth quite a bit in the past year as well and that's driven aggregate demand for these essential items a little bit,' she said.

On the chart of price rises, tobacco had the biggest increase of 13.4 per cent, followed by petrol on 9.3 per cent but both of these items are also dearer because of federal government excise.

The next six on the list were services, with rents increasing by 7.4 per cent, electricity costs rising 6.5 per cent, health costs up 6.1 per cent, education climbing 5.2 per cent and transport up 4.9 per cent.

'So, yes, part of it was home-driven given stronger demand for everything,' Ms Bui said.

'If you look at the biggest services items, they're more non-discretionary - things that people actually have to pay for, they don't really have a choice on that.'

The Reserve Bank this month left interest rates on hold at a 12-year high of 4.35 per cent.

But more bad news in the more comprehensive June quarter inflation data on July 31 could see the RBA raise rates after it meets again on August 5 and 6.

Read more