Cava Stock Has Soared 114% Thus Far in 2024: Is the Best Yet to Come?

Investors love a growth story, especially one in its early stages. So it is no surprise to see Wall Street fawning over restaurant upstart Cava (NYSE: CAVA).

The Mediterranean fast-casual concept that has modeled itself after the likes of Chipotle and Sweetgreen has seen its stock soar more than 100% in less than six months to start 2024. It is growing locations quickly and building an ardent fan base around the country.

What's next for Cava stock? Can it rise even further? Time to investigate and find out.

The first national Mediterranean restaurant brand

Cava sells Mediterranean-style food such as hummus, pita bread, and harissa chicken. It allows customers to create their own bowls and sandwiches with a variety of 38 ingredients, meaning there are countless combinations that customers can build with their orders.

With no scaled restaurant chain across the United States, Cava has a ton of white space ahead of it to build a national brand.

At the end of last quarter, the company had 323 locations, up 23% year over year. Each restaurant generates $2.6 million in revenue annually, a number that is also growing year over year.

Even better, Cava is growing while still generating a profit. It posted a restaurant-level profit margin of 25.2% in the first quarter of 2024 and $19 million in consolidated operating income over the last 12 months. With strong unit economics, it looks like this company can self-fund its growth while still remaining profitable.

New store locations can drive growth

With just over 300 locations in the United States, Cava has plenty of room to keep growing. For reference, Chipotle has more than 3,000 locations and thinks it can eventually double that number.

This year, Cava expects to open at least 50 new restaurants. If it can keep up this pace and then slowly accelerate unit-count as it scales up, Cava should have around 1,000 locations within 10 years. On just its current average unit volume (AUV) for each restaurant, that equates to $2.6 billion in annual revenue, compared to $655 million over the last 12 months.

Assuming some benefit from same-store sales growth -- which has been positive every quarter since Cava went public -- and AUV could hit $3.5 million or higher. That equates to $3.5 billion in revenue.

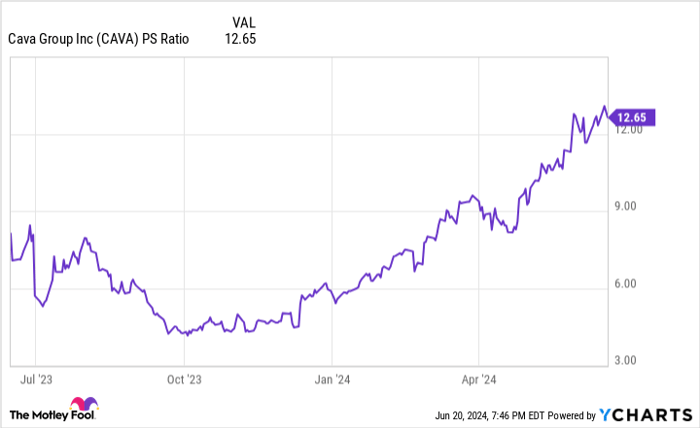

CAVA PS ratio

A high stock price implies high growth expectations

Although $3.5 billion in revenue within 10 years sounds exciting, that has no bearing on whether the stock is cheap today. Investors need to relate this number with Cava's current market capitalization, which is $10.5 billion after rising more than 100% this year. That is a trailing price-to-sales ratio (P/S) of more than 10, which is quite expensive for a restaurant concept.

Taking a forward perspective, let's try to estimate what the chain might earn in profits 10 years from now if it can hit 1,000 locations. On a 25% restaurant-level profit margin, Cava can likely do 15% consolidated profit margins after subtracting overhead costs, which are similar to Chipotle.

That 15% profit margin applied to a $3.5 billion annual revenue estimate is $525 million in annual earnings. Compare that to the stock's current market cap of $10.5 billion, and Cava has a 10-year forward price-to-earnings ratio (P/E) of 20. That is below the S&P 500 average of 28.

But here's the problem: This is an estimated P/E 10 years in the future. Seeing such a high P/E on 10-year forward earnings estimates shows what expectations are now embedded in Cava's stock price.

At these levels, the shares look overvalued. It might keep moving higher in the short term, but Cava's stock will likely struggle over the next few years after rising 100% so far in 2024.

Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool recommends Cava Group and Sweetgreen. The Motley Fool has a disclosure policy.