This Stock Is Down 42% This Year, but Wall Street Sees a 73% Upside

The S&P 500 has reached records this year, but it's somewhat misleading. It's a market-value-weighted index, and much of its gains come from a few stocks with high market caps like Nvidia, which is up about 150% this year, and Meta Platforms, which is up about 40%.

Many other stocks are feeling pressure from inflation and high interest rates. Bill Holdings (NYSE: BILL) stock is down about 42% year to date, but Wall Street sees it heading 73% higher. Let's see why.

Why Bill is capturing market share and attention

Bill is a financial platform for small businesses. It connects all of a company's financial transactions, like accounts payable and receivable, into one unified platform where everything is recorded to flow together seamlessly. It does the heavy lifting, which frees up employees to do creative and analytical work. That saves a company time and money.

It's attracting many small businesses that are recognizing what this kind of investment can do for them. It had 460,000 small business clients as of the end of the 2024 fiscal fourth quarter (ended March 31) and 5.8 million network members and growing.

Bill makes money both through client subscription plans and payment processing, and like many companies that operate similar businesses, it makes most of its money in payment processing -- 67% of revenue comes from processing payments. That means it takes a tiny fee every time it processes some kind of payment, and since it works with hundreds of thousands of clients processing payments all the time, that adds up quickly. The subscription plans are the clients signing up for Bill's services, and the members are the financial institutions that are connected to the network so clients can manage and move money.

Bill has plenty of growth drivers that include organic growth, new customers, international expansion, and upselling. It's an asset-light business with a high gross margin that came in at 83% in the third quarter.

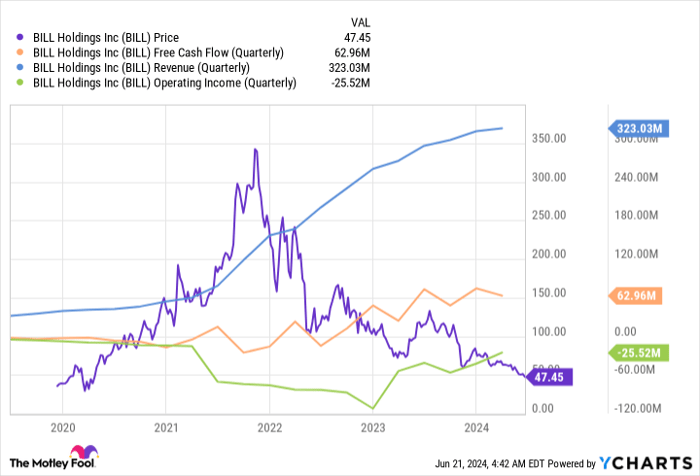

Bill Holdings in one chart

Bill has been generating strong revenue since it became a public company in late 2021. This is slowing in the pressured economy, but it's still at double-digit percentage levels, and it's generating more free cash flow. However, its share price is falling.

BILL

What you'll notice in the chart is that operating income is negative. I left out earnings per share (EPS) from the chart so it wouldn't be too complex, but EPS is positive. That's positive result comes from some tax benefits, but operating income is still negative. It halved from last year, which is impressive, but it's struggling to return to levels from two years ago. The operating income is a more accurate indication of how Bill's business is doing.

The chart looks like Bill's price has been falling while overall it's making progress. But Wall Street is taking a broader view of Bill's business. Its core clientele is suffering right now in the inflationary environment. Even if Bill is getting more clients and adding network partners, the bread and butter of its business is processing fees. As business slows amid economic pressures, it's harder for Bill to turn an operating profit. It's making some good decisions to become more efficient, such as lowering employee count. But this is not the environment for it to scale its business.

Opportunity or value trap?

What that means for investors is that this could be an opportunity. Bill's price is plummeting on short-term factors. But once they pass, its business should flourish. It's making moves to become a more efficient operation, and when it has the chance to scale and become profitable, it will by default be more resilient when facing future challenges.

But is Bill stock a value today? It trades at a price-to-sales ratio of 4 and a forward price-to-earnings ratio of 21. These are low multiples for a high-growth company.

Wall Street thinks it's undervalued. The average price target for Bill stock from Wall Street analysts is about 73% higher than today's price, with a high of 132%. The lowest price target is 24% higher, which means every covering analyst sees it moving up quite a bit.

Bill has a strong long-term outlook, and considering how much it's fallen, even the short term looks good right now, making Bill a candidate as a buy right now. However, I would still only recommend it for risk-tolerant investors.

Should you invest $1,000 in Bill Holdings right now?

Before you buy stock in Bill Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bill Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bill Holdings, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.