For the First Time in 65 Years, This Recession Indicator Has Been Wrong -- but Wall Street Isn't Out of the Woods Just Yet

Over the last century, no asset class has come remotely close to rivaling the annual average return that stocks have brought to the table. However, predicting what equities will do over a span of weeks, months, or even a few years simply can't be done with any accuracy.

Since this decade began, the iconic Dow Jones Industrial Average (DJINDICES: ^DJI), broad-based S&P 500 (SNPINDEX: ^GSPC), and innovation-powered Nasdaq Composite (NASDAQINDEX: ^IXIC) have vacillated between bear and bull markets on a couple of occasions. Although we're undeniably in a bull market right now, there's no assurance as to what the next couple of quarters have in store for Wall Street.

However, these uncertainties don't stop investors from leaning on select indicators and metrics to try to gain an advantage. One such recession-forecasting tool, which had previously not been wrong in 65 years, looks to have broken its flawless prediction streak. However, investors would be wise not to assume Wall Street is in the clear.

A staggered stack of financial newspapers with one visible headline that reads Recession Fears.

This phenomenal forecasting tool is perfect no more

When back-tested to 1959, the Conference Board Leading Economic Index (LEI) had a flawless track record of predicting U.S. recessions under a very specific set of circumstances.

The LEI is a monthly reported, 10-component index that attempts to anticipate shifts in the U.S. business cycle by about seven months. Three of its variables are financial in nature and include a proprietary Credit Index and the returns of the S&P 500. The other seven nonfinancial components consist of measures that include average weekly unemployment insurance claims, private housing building permits, the ISM Manufacturing New Orders Index, and average consumer expectations for business conditions, among other factors.

Although the Conference Board LEI is reported monthly and its growth rate is listed on a trailing-six-month basis, the most telling statistic has been the LEI's year-over-year change.

Historically, any year-over-year decline in the LEI ranging from 0.1% to 3.9% has served as something of a warning for Wall Street and investors. While it's not indicative of downside to come in the U.S. economy or stock market, it bears monitoring.

Meanwhile, every previous instance where the LEI has fallen by at least 4% on a year-over-year basis has been followed by an eventual recession. Even though stocks and the U.S. economy aren't tied at the hip, a recession tends to weaken corporate earnings, ultimately leading to an underperformance for equities. Approximately two-thirds of the S&P 500's drawdowns have occurred after, not prior to, a U.S. recession being declared.

But despite a recent year-over-year decline of up to 8% in the Conference Board LEI, no recession has materialized. With the year-over-year drop in the LEI now moderating to less than 5% as of April 2024, it's safe to say that this previously flawless indicator has had its first-ever false-positive reading.

History suggests the U.S. economy and stocks may still be in trouble

While an improvement in the LEI is music to the ears of optimistic investors, it's not the only unique indicator closely correlated with moves lower in the Dow, S&P 500, and Nasdaq Composite throughout history.

For instance, we're currently witnessing the first meaningful decline in U.S. M2 money supply since the Great Depression. M2 money supply considers everything in M1 (cash and coins in circulation, along with demand deposits in a checking account) and adds in money market accounts, savings accounts, and certificates of deposit (CDs) below $100,000.

For the last nine decades, M2 has been rising with virtually no interruption. A steadily growing economy should require more cash and coins to facilitate transactions. But since peaking in April 2022, M2 money supply has fallen 3.94% from its all-time high. A decline in M2 suggests that consumers will be forced to reduce discretionary purchases, which can tip the U.S. economy into a recession.

As you'll note from Reventure Consulting CEO Nick Gerli's post on X, the platform formerly known as Twitter, there have been only five instances since 1870 where M2 has fallen by at least 2% on a year-over-year basis. Even though M2 is ever-so-slightly higher on a year-over-year basis right now, it remains, as noted, close to 4% below its all-time high.

During the previous four instances where pullbacks of this magnitude were observed in M2 money supply (1878, 1893, 1921, and 1931-1933), the U.S. economy dipped into a depression and contended with a double-digit unemployment rate. Even though a depression is highly unlikely today, notable drops in M2 historically correlate with economic weakness and challenging times for Wall Street.

Furthermore, stocks are historically expensive.

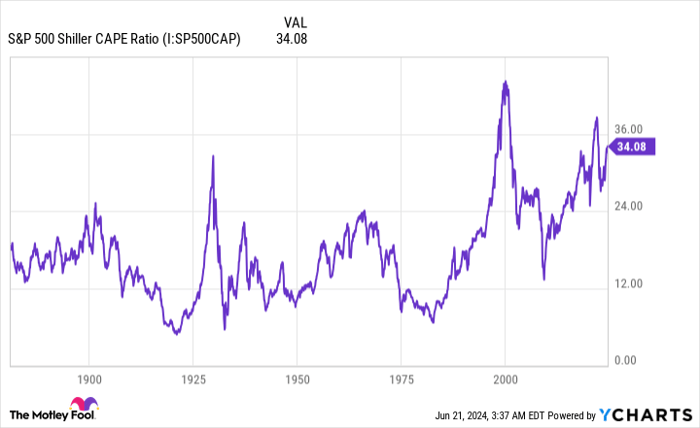

S&P 500 Shiller CAPE Ratio

As of the closing bell on June 20, the S&P 500's Shiller price-to-earnings (P/E) ratio, also known as the cyclically adjusted price-to-earnings ratio, or CAPE ratio, stood at 35.64. The Shiller P/E is based on average inflation-adjusted earnings over the last 10 years.

Even accounting for lower interest rates and ease of access to information (thanks, internet!) increasing earnings multiples over the last 30 years, a Shiller P/E of nearly 36 represents one of the highest readings during a bull market rally, when back-tested to 1871.

Only six times in 154 years has the Shiller P/E surpassed 30 during a bull market rally. The five previous occurrences all led to the Dow, S&P 500, and/or Nasdaq Composite losing between 20% and 89% of their respective value. History strongly suggests that extended valuations aren't sustainable on Wall Street.

A smiling person looking out a window while holding a financial newspaper in their hands.

Say hello to the one metric that's always on your side

With stocks historically pricey and M2 money supply notably below its all-time high, the writing would appear to be on the wall that a sizable downturn in equities is forthcoming. Although these select indicators have never been wrong, the Conference Board LEI shows there can be a first time for everything.

If you want a metric that's truly in your corner as an investor and has a lengthy track record of being right, look no further than time.

While it's impossible to predict what the U.S. economy or stock market will do over shorter periods, things become crystal clear the more you look to the horizon.

For example, we know that the U.S. economy works its way through economic expansions and recessions over time. What you might not realize is that these expansions and contractions aren't linear. Whereas most recessions resolve in under a year, there have been two periods of growth since the end of World War II that endured longer than 10 years.

This variance between economic weakness and strength translates to the stock market, too.

One year ago, the analysts at Bespoke Investment Group published a data set that compared the length of bear and bull markets in the S&P 500 since the start of the Great Depression in September 1929. As you can see from Bespoke's post on X, the bulls are in charge far more often than the bears. While the average S&P 500 bear market has lasted just 286 calendar days, the typical bull market since September 1929 has stuck around for more than 1,000 calendar days.

To add to the above, 13 of the 27 bull markets in the S&P 500 over a 94-year period have lasted longer than the lengthiest bear market.

Throughout history, every correction and bear market in the Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have eventually been whisked away by a bull market rally. Though we'll never know ahead of time precisely when these downturns will occur, how long they'll last, or how steep the decline will be, we do know that time favors the patient.

Regardless of what's to come for the stock market, investors with a long-term mindset will be well positioned to grow their wealth on Wall Street.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,295!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $39,207!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,019!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of June 11, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.