Best Stock to Buy Right Now: Amazon vs. Disney

The S&P 500 has consistently hit record highs in 2024, rising 15% year to date. Easing inflation and excitement over the tech industry have made Wall Street bullish, suggesting that now could be an excellent time to expand your portfolio.

Two companies worth considering are Amazon (NASDAQ: AMZN) and The Walt Disney Company (NYSE: DIS). They both have powerful positions in entertainment and are home to some of the most popular streaming platforms.

Thanks to a booming retail division and a budding advertising business, Amazon is on a promising growth trajectory. Meanwhile, recent earnings from Disney indicate a recovery could be underway after a challenging few years.

Below, I'll take a closer look at these entertainment giants and determine whether Amazon or Disney is the better buy right now.

Amazon

Amazon's business has appeared unstoppable over the last year as its stock soared 46% since last June. The rise came alongside impressive financial gains, with quarterly operating income and free cash flow up 99% and 1,000%, respectively, since last June.

The retail giant has profited from an impressive turnaround in its e-commerce business. This time last year, Amazon faced the aftermath of an economic downturn in 2022 that led to significant declines in its retail segments. However, cost-cutting measures and market improvements enabled the company's e-commerce business return to profitability, hitting close to $6 billion in operating income in the first quarter of 2024 after posting $349 million in losses the year before.

Meanwhile, Amazon is strategically using its significant cash reserves to diversify its business. The tech giant introduced ads to its streaming service Prime Video, boosting advertising services revenue by 24% year over year in Q1 of this year.

Additionally, the company has achieved a lucrative role in artificial intelligence (AI) with Amazon Web Services (AWS). The cloud platform is sinking billions into the industry, expanding its library of AI tools, and venturing into chip design. Businesses worldwide are increasingly turning to cloud services to integrate AI into their workflows, and AWS is well-positioned with its leading 31% market share in cloud computing.

Amazon has growth catalysts in multiple industries, which could make its stock a reliable buy this June.

The Walt Disney Company

Disney hasn't had it as easy as Amazon over the last year. Its stock is down 41% since 2021 after repeated hits to its business. The company has faced challenges as it recovers from COVID-19 closures (which halted its theatrical and amusement park division) and navigates rising costs. The declining cable TV market has also hurt business.

However, recent developments suggest Disney is moving in the right direction, making its stock a compelling long-term option. The company's free cash flow has risen 193% over the last 12 months, which could be a promising sign for its future.

After being a sore spot for investors in recent years, Disney's steaming business has finally hit profitability. In Q2 2024, revenue in the company's direct-to-consumer segment rose 13% year over year. Meanwhile, streaming operating income came to $47 million after the company reported $587 million in losses the year before.

Additionally, Disney scored at the box office this month as Inside Out 2 hit $155 million in its debut weekend, outperforming Warner Bros. Discovery's Dune: Part Two as the biggest opening of 2024 so far. The Pixar film is the first movie to launch above $100 million since Warner Bros. Discovery's Barbie was released last July and will likely provide a much-needed boost to Disney's entertainment segment this quarter.

Is Amazon or Disney the better buy right now?

Amazon and Disney are some of the world's most recognizable brands, achieving immense brand loyalty with consumers. These companies rule their respective industries. However, recent events mean their stocks are trading at vastly different valuations.

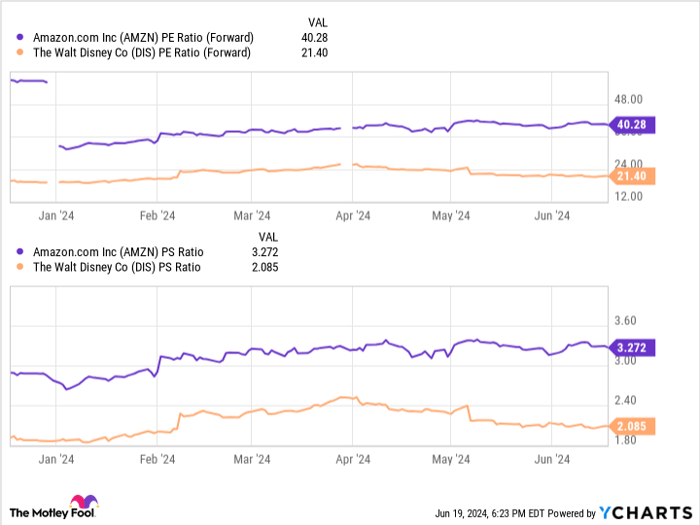

AMZN PE Ratio (Forward) Chart

This chart shows Disney has a significantly lower forward price-to-earnings ratio and price-to-sales ratio than Amazon, indicating it's the better-valued stock by a long shot.

However, valuation isn't the only thing to consider. Amazon is the financially healthier business after soaring earnings this past year. Meanwhile, its stock increased more than 1,000% over the last decade, compared to Disney's 21% rise. Furthermore, Amazon's positions in e-commerce, AI, and streaming potentially make its business more diverse than Disney's, which could also mean it's the more reliable long-term option.

As a result, I would say Amazon's stock is worth its premium price tag and more likely to deliver bigger gains than Disney in the coming years. If I had to choose one, it would be Amazon. However, it could be worth also picking up a few shares of Disney while it's trading at a bargain and could be on the brink of a recovery.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Walt Disney, and Warner Bros. Discovery. The Motley Fool has a disclosure policy.