4 Reasons to Buy Enterprise Products Partners Stock Like There's No Tomorrow

One of the stocks I've personally owned for the longest time is Enterprise Products Partners (NYSE: EPD), having first bought it back in 2008. Despite owning the stock for over 15 years, I think it is still one of the most attractive high-yield energy stocks to buy today.

Let's look at four reasons why, if I didn't already own it, I'd be buying the stock today like there is no tomorrow.

1. Enterprise Products is a consistent performer

If you've ever heard the descriptor "sleep well at night stock," Enterprise is the epitome of that term. The company has been one of the most consistent operational performers over the past two decades of any stock in any industry. This stems from its largely fee-based contract structure, which historically has made up about 85% of its gross operating profits, with about half of its fee-based revenue coming from take-or-pay contracts, where the company gets paid whether its customers use its service or not.

Meanwhile, given its large integrated midstream system, the company has a lot of natural hedging and arbitrage opportunities built into the business. This means that when one area of its business may struggle, it often leads to opportunities in other areas. This dynamic helps the company post steady, largely growing results year after year, even during difficult periods such as the Great Recession, the oil price collapse in 2014-15, and the COVID-19 pandemic.

Enterprise's consistency can also be seen in its distribution to shareholders, which it has been able to grow each year for the past 25 years.

2. Enterprise Products offers a growing distribution with a high yield

One of the first things that draws investors to Enterprise Products is its high yield, which is currently 7.3%. A high yield by itself is not a reason to own a stock, but Enterprise's distribution is well covered by its cash flow, and its balance sheet is in good shape. These are two of the important considerations when looking at the safety of a company's dividend payout.

Last quarter, Enterprise had a robust distribution coverage of 1.7 times based on its distributable cash flow (DCF), which is its operating cash flow minus maintenance capital expenditures (capex). Meanwhile, the company ended the first quarter with 3 times leverage, which it defines as net debt adjusted for equity credit in junior subordinated notes (hybrids) divided by adjusted interest, taxes, depreciation, and amortization (EBITDA). This has come down from the over 4 times leverage it was at in 2017.

Taken together, Enterprise Products is well positioned to continue its impressive streak of growing its distribution in the years ahead.

Pipeline leading to processing facility.

3. Enterprise Products has growth opportunities

After reducing its growth capex during the early stages of the pandemic, Enterprise is beginning to ramp it back up. That's good news for investors, as the company consistently generated a return of about 13% on its growth projects over the past six years. This means for every $1 billion in growth capex the company spends, it generates about $130 million in gross operating profit each year.

The company currently has over $6.9 billion of approved major growth projects under construction and expects to spend between $3.25 billion to $3.75 billion in growth projects this year and next. That's up from the $1.6 billion to $1.8 billion it spent on organic growth projects in 2021 and 2022.

Meanwhile, earlier this year, the company received a long-awaited deepwater port license for its Sea Port Oil Terminal (SPOT) project. If the project gets built, it would turn Enterprise into an important player in the crude export market.

With its natural gas transportation network, especially in the Permian, Enterprise is also well positioned to get its fair share of projects to help support the growing use of natural gas energy to support the power needs of data centers and artificial intelligence (AI). AI consumes a massive amount of energy, and natural gas will likely be the primary energy source to give these data centers the cheap, reliable energy they need over the next several years.

4. Enterprise Products has an attractive valuation

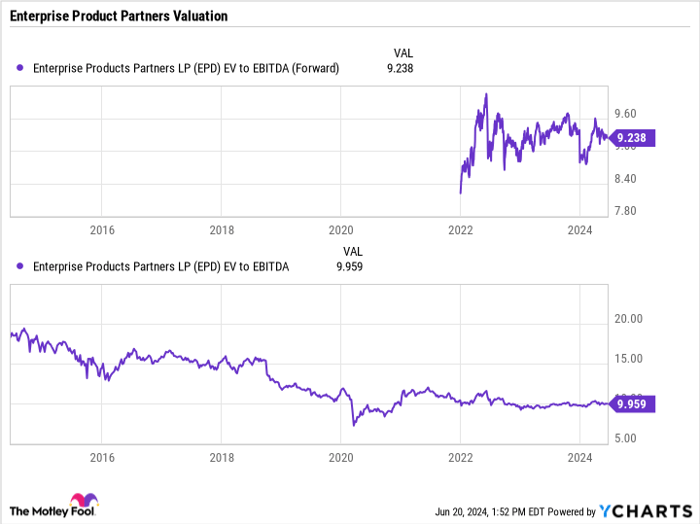

Despite its strong balance sheet and growth opportunities in front of it, Enterprise Products trades a very attractive valuation on an enterprise value to forward earnings before interest, taxes, depreciation, and amortization basis (EV/EBITDA) of 9.2 times. Given the debt and capex spending in the midstream space, this tends to be one of the most common metrics by which to value these stocks.

EPD EV to EBITDA (Forward)

From a historical perspective, the midstream sector traded at an average EV/EBITDA multiple of over 13.5 times from 2011 through 2016 before the oil crash, while Enterprise often traded at a premium multiple of over 15 times. This is despite the company and sector as a whole being in better financial shape today versus a decade ago.

Trading at a low historical valuation, combined with a strong balance sheet, high yield, and strong growth prospects ahead, Enterprise Products Partners is a pipeline stock I'd be buying like there is no tomorrow.

Should you invest $1,000 in Enterprise Products Partners right now?

Before you buy stock in Enterprise Products Partners, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Enterprise Products Partners wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Geoffrey Seiler has positions in Enterprise Products Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.