Boustead Holdings creditors uneasy with delay in Affin Bank stake sale

This article first appeared in The Edge Malaysia Weekly on June 10, 2024 - June 16, 2024

BOUSTEAD Holdings Bhd (KL:BSTEAD) is understood to be in talks with a number of financial institutions to seek their indulgence as lenders and allay fears of triggering a cross default, sources familiar with the matter tell The Edge.

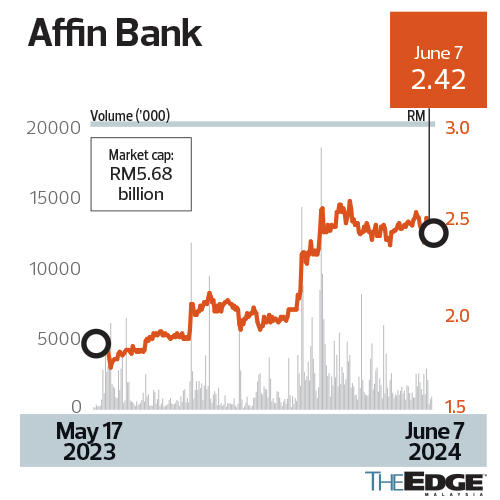

The conglomerate and its parent company Lembaga Tabung Angkatan Tentera (LTAT) are like ants on a hot pan as the sale of a 25% stake in Affin Bank Bhd (KL:AFFIN) — which should provide the cash-strapped group some breathing room — to State Financial Secretary Sarawak seems to be taking longer than anticipated. The stake sale is currently pending the requisite approvals from Bank Negara Malaysia.

In an emailed response to questions, Bank Negara says of the approval for the stake sale, “Bank Negara does not comment publicly on specific applications for licensing or acquisition of interest in shares in licensed institutions. The assessment for such applications is guided by the relevant provisions and factors listed under the Financial Services Act 2013 and the Islamic Financial Services Act 2013.”

In the meantime, Boustead Holdings is understood to be looking for a bridging loan and may end up paying high interest rates due to the uncertainty surrounding the stake sale, as well as its high debt level.

One source familiar with Boustead Holdings says, “The company recently needed to raise funds, and I hear that according to the terms, it needed to cough up a lot, taking a very expensive bridging loan ... All the direct lenders are uneasy, and all are on alert for cross defaults.”

Boustead Holdings creditors uneasy with delay in Affin Bank stake sale

LTAT declined to comment when contacted.

At present, State Financial Secretary Sarawak has 4.8% equity interest in Affin Bank, acquired for RM221.74 million or RM1.97 per share in April 2023. The state is looking to buy a 25% stake in the second-smallest, by assets, of the eight local banks.

LTAT is the largest shareholder in Affin Bank with a 28.78% stake and its wholly owned Boustead Holdings has a 20.02% direct shareholding.

In late January, Sarawak Premier Tan Sri Abang Johari Openg said in a press conference that the state government was “close” to concluding its negotiations with LTAT to raise its stake in Affin Bank. “Definitely, we are looking at Affin. [We are] more or less conclusive in terms of our discussions with LTAT,” he is reported to have said.

The 25% stake, which is equivalent to 586.6 million shares, is worth RM1.42 billion based on a share price of RM2.42. State Financial Secretary Sarawak is expected to pay a premium as it will have the controlling block in Affin Bank. In that case, LTAT and Boustead Holdings would rake in more, and will be able to settle more debts.

Affin Bank’s share price has gained 19% year to date.

A check with Suruhanjaya Syarikat Malaysia (SSM) reveals that in December 2022, Boustead Holdings had total liabilities of RM10.62 billion, out of which RM7.4 billion were current liabilities. The conglomerate’s total assets amounted to RM15.89 billion, of which more than 72% or RM11.48 billion were non-current assets, long-term investments, such as land, office buildings and manufacturing plants, which cannot be liquidated easily.

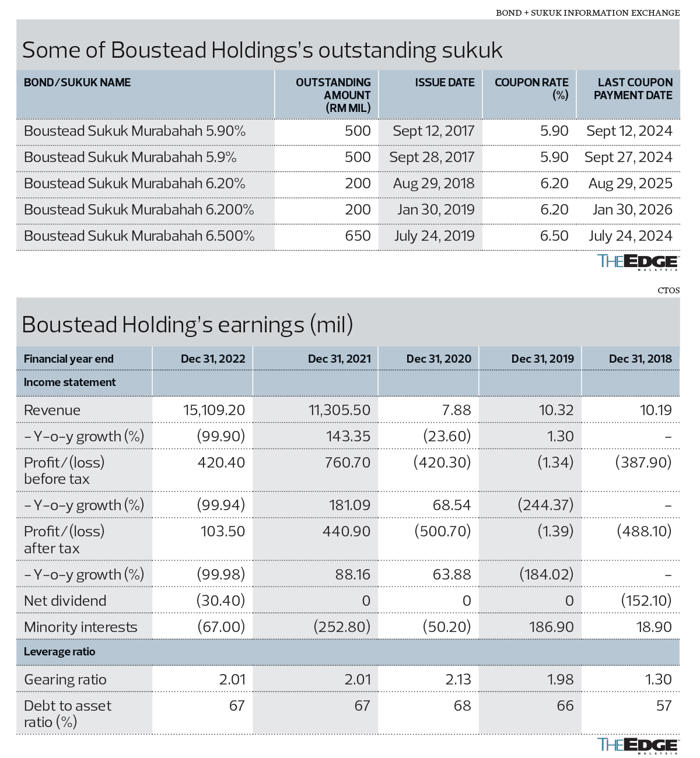

The diversified conglomerate’s short-term borrowings amounted to RM3.986 billion while long-term debts stood at RM2.77 billion as at end-March 2023, according to the last set of unaudited quarterly financial statements filed with Bursa Malaysia in late May last year, prior to the privatisation exercise.

For its financial year ended Dec 31, 2022 (FY2022), Boustead Holdings posted a net profit attributed to shareholders of RM62 million on the back of RM15.11 billion in revenue. The annual net profit took into account of a large divestment gain of RM465.5 million and finance costs of RM336.6 million.

Besides Boustead Holdings and Affin Bank, LTAT has a 72.38% stake in ailing Boustead Heavy Industries Corp Bhd (KL:BHIC) and 54.9% in cash-strapped Practice Note 17 pharmaceutical outfit Pharmaniaga Bhd (KL:PHARMA). It wholly owns Boustead Plantations Bhd (BPlant).

In June last year, LTAT took Boustead Holdings private at an offer price of 85.5 sen per share. The exercise cost LTAT RM703.25 million to buy out the 40.58% stake it did not own.

Roughly two months later, LTAT launched another takeover bid, wanting to take Boustead BPlant private at RM1.55 per share or RM1.11 billion in total. This came about after Boustead Holdings and LTAT firmed up a plan to hive off 33% of BPlant for RM1.15 billion to plantation giant Kuala Lumpur Kepong Bhd (KL:KLK) (KLK), which would be followed by a privatisation offer to minority shareholders. The plan was for KLK to control 65% of BPlant and for Boustead Holdings to maintain a 35% stake.

However, politicians poured cold water on the deal as it involved the sale of bumiputera assets to a non-bumiputera entity. This was despite the fact that LTAT was slated to retain a 35% stake in BPlant, which would have a value of RM3.47 billion at RM1.55 per share.

In a nutshell, instead of getting RM1.15 billion cash from the sale of 35% of BPlant to KLK, Boustead Holdings ended up forking out RM1.11 billion to privatise and acquire the 32% in BPlant it did not own. This resulted in Boustead Holdings being stretched financially. In October last year, former defence minister Datuk Seri Mohamad Hasan indicated that the government would provide a financial guarantee of RM2 billion to LTAT to buy out BPlant, over and above an allocation of RM300 million to assist Boustead Holdings in addressing its liquidity issues.

In March, The Edge reported that BPlant was in talks to sell 1,200 acres of plantation land in Kulim, Kedah, to Kulim Technology Park Corp Sdn Bhd for about RM400 million. It is understood that the talks are still ongoing.

To recap, LTAT was established in August 1972 under the Armed Forces Fund Act or Act 101, and is a statutory body that manages the pension fund for officers and members of the Malaysian Armed Forces and veterans.

LTAT’s main objective is to protect the pension fund that manages the savings of the more than 140,000 veteran armed forces members who are on the pension roll, as well as the 115,456 members currently serving in the armed forces. To do this, it is imperative for LTAT to restructure the ailing Boustead Holdings since it makes up about 50% of its investment portfolio.

As at end-December 2023, LTAT had assets under management of close to RM11.54 billion.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.