New York Community Bancorp Stock: Buy, Sell, or Hold?

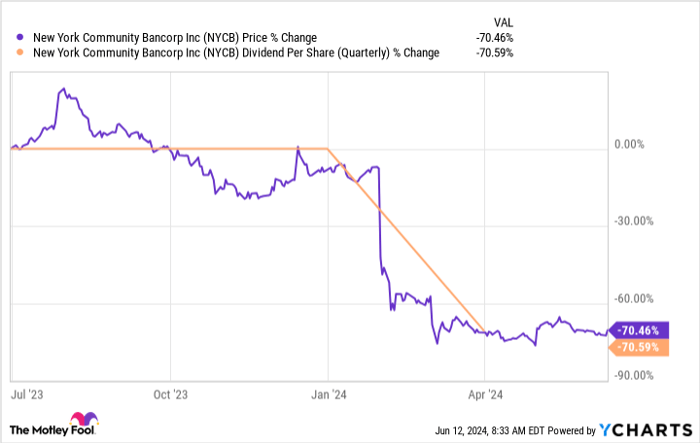

Share prices of New York Community Bancorp (NYSE: NYCB) have fallen roughly 70% over the past year. In the first-quarter 2024 earnings update, the first bullet point in management's comments was that the company is targeting "peer level profitability by fourth quarter 2026."

Given the huge stock decline, the below-peer performance, and a target date for improving financials, interested investors have a tough decision about what to do with this stock. Is it a buy, sell, or hold?

All signs point to NYCB being a turnaround stock. But potential investors should tread carefully. Here's what needs to be considered.

Buy New York Community Bancorp

Turnaround investing is something of a risky niche on Wall Street. It means buying a company with problems in the hope that it will be able to fix them. There are several challenges dogging New York Community Bancorp right now. Given the steep price decline, there is a potential upside here if management can get the bank back on track.

A person standing with a U-turn symbol on the ground in from of them.

There's a lot of work to be done before any turnaround can happen. The bank has grown via acquisition and is now larger than it was just a few years ago. Bigger banks are subject to more regulatory scrutiny than smaller banks. New York Community Bancorp wasn't ready for the added oversight and has had to quickly adjust. That required it to bring in employees with the needed expertise and rapidly shore up the bank's finances so it could meet regulatory requirements.

Bolstering the balance sheet led to a massive dividend cut, with the quarterly dividend falling from $0.17 per share to $0.01 in less than a year. This aggressive move was also necessitated by the fact that some large loans the company made ran into trouble. There were no easy answers, so management took drastic measures. The list of drastic measures included securing a $1 billion bailout from private investors.

The good news here is that the bailout should provide management with the means to get back on track, assuming there's little additional bad news on the horizon (like more large troubled loans). So if you have a strong stomach and like to track your investments closely, this turnaround story might be worth a look based on the steps the company has taken to right the ship.

Hold New York Community Bancorp

If you bought New York Community Bancorp before the big stock decline, then you are likely sitting on significant losses. There's probably no point selling now unless you want to harvest those losses to offset gains elsewhere in your portfolio. After all, the company appears to be past the worst of the bad news now that it has secured additional funding. It seems highly likely at this point that it will rebound eventually.

The timing of the turnaround is actually a part of the problem here. Right now, the company doesn't expect to return to peer-level financial performance until the fourth quarter of 2026 at the earliest. That's a long time from now, so you might have to sit with red ink in your portfolio for a year or two. That's asking a lot, and the huge dividend cut means you are no longer being paid well to stick around. Yes, the company's fortunes look like they are improving, but it could be a long road ahead. If you are OK with that, you should hold on. If you aren't, you might want to sell.

Sell New York Community Bancorp

There are no guarantees on Wall Street. Sometimes turnaround stocks -- even ones that seem to be well positioned for a reversal of their business fortunes -- sputter out and die. Are you willing to take on that risk? If not, and you own New York Community Bancorp, you should sell it. It can be hard to take a loss, but it's probably the appropriate decision to make if you are just a risk-averse investor by nature. It might also be the proper move if there are other stocks you like more than this one, since that would allow you to get out from under a troubled stock that needs close attention.

NYCB

If you don't own New York Community Bancorp, there are a number of reasons why you should avoid it. First off is the turnaround issue, which is an investment approach that only more aggressive investors should be pursuing. But the other issue is the dividend cut, which has left the stock offering a dividend yield that's less than half that of the average bank stock. Income investors would probably be better off buying a diversified bank exchange-traded fund (ETF) than buying New York Community Bancorp on the hopes that the dividend gets increased back to its prior levels.

Most investors should avoid New York Community Bancorp for now

At the end of the day, New York Community Bancorp is only at the beginning of its turnaround effort. While it appears to have a solid foundation from which to work, that doesn't mean it will be able to get the business back in shape quickly. Aggressive investors willing to bet on turnaround situations might be interested here, accepting that a recovery is still at least a year and a half away. But most others should probably wait for substantial proof that the bank is on the mend before considering it.

Should you invest $1,000 in New York Community Bancorp right now?

Before you buy stock in New York Community Bancorp, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and New York Community Bancorp wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.