Will Walmart Reach a Trillion-Dollar Market Cap by 2030?

When Apple (NASDAQ: AAPL) become the world's first $1 trillion company back in 2018, investors cheered while they simultaneously wondered which company would be the next to achieve the feat. As it turns out, it would be Microsoft (NASDAQ: MSFT) the following year.

Much has changed since then. Namely, getting to the 13-figure mark is no longer a head-turning event. Four other companies have joined Microsoft and Apple in the trillion-dollar club ... five if you still count Tesla (NASDAQ: TSLA), which briefly got there in early 2022 before shares of the electric vehicle (EV) maker began struggling. Both Apple and Microsoft are each worth more than $3 trillion now. Investors just aren't as easily impressed by the metric anymore.

They might be impressed by the first seemingly unlikely name to do so though. That's brick-and-mortar retailer Walmart (NYSE: WMT), which is quietly inching closer to the trillion-dollar finish line than most investors might believe.

Just being there is half the battle

Sure, there are companies out there already closer than Walmart is to a $1 trillion market capitalization. Pharmaceutical outfit Eli Lilly (NYSE: LLY) sports a market cap of more than $800 billion. Given the potential of its weight loss drug Zepbound, a trillion-dollar market cap is hardly out of the question. If Tesla plays its cards right it could rejoin the trillion-dollar club as well.

For a retailer to become the world's first to eclipse the $1 trillion mark, however, would be exciting, to say the least.

The thing is, Walmart's already got all the tools and tailwinds it needs to generate the kind of revenue growth that would get it there within the foreseeable future.

The first of these is also the most obvious one. That's reach.

Walmart is the world's biggest retailer, operating more than 10,500 stores all over the world, with over 4,600 of them located within the United States alone. And that doesn't count any of its 600 Sam's Club membership-based shopping warehouses. Although it's difficult to get a bead on its global market share, the discounter clearly dominates the U.S. retail landscape.

Sheer size doesn't always matter, of course. But this is a case where it does.

See, being the name with the biggest existing footprint not only keeps would-be competing stores from setting up shop, but also means most of the nation's consumers are already at least semi-regular Walmart shoppers who (on average) visit one of its stores are least once per week, where they typically spend several thousand dollars every year.

Walmart is stepping up every aspect of its game

The advantage of scale goes beyond just "being there," however. Being most suppliers' and vendors' most important distributor/retail partner also means the retailer is in a position to negotiate the best prices. Being able to pass these savings along to consumers is never a small matter, but it's been particularly helpful since 2022 when inflation began soaring. Even relatively affluent households earning in excess of $100,000 were feeling pinched then. Many of them began shopping at Walmart on a regular basis. Given Walmart's current efforts to look and feel more like a typical mall-based store (with a growing number of luxury and high-end brands being offered), most of them should stick around even once price increases abate.

In the meantime, the brick-and-mortar retailer continues investing in e-commerce.

Although well behind Amazon (NASDAQ: AMZN) once it finally decided to turn up the heat on online shopping, it's making waves on this front. Last quarter's online sales were up 21% year over year, easily outpacing Amazon's North American e-commerce sales growth of 12%. Major investments in robotics and automation -- investments that most smaller rival retailers can't afford to make -- have a great deal to do with Walmart's persistently impressive e-commerce growth.

That's still not the full extent of Walmart's self-driven evolution of its shopping website though. The company increasingly recognizes that Walmart.com is in and of itself an advertising platform its suppliers can use to promote their products. This ad business's revenue grew 24% on a worldwide basis during the three-month stretch ending in April.

And that's without the benefit of the acquisition of smart-TV maker Vizio (NYSE: VZIO), which is doing just a little less than $2 billion worth of annual business on its own, nearly half of which is advertising revenue generated by its smart-TV operating system and platform. Once Walmart melds this tech with its existing digital ad business, look for the retailer to become a surprisingly important advertising player.

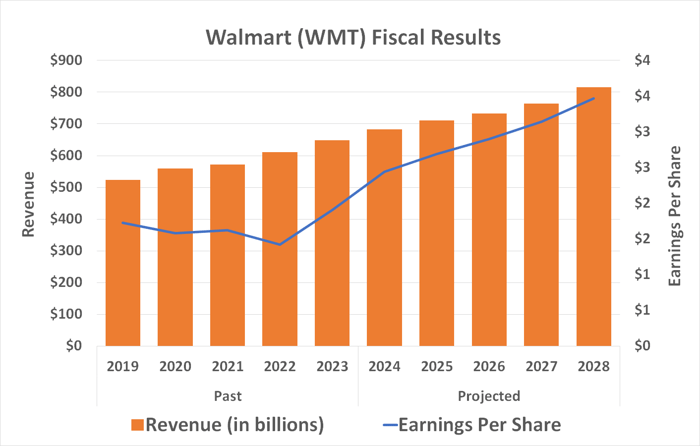

In light of all the new efforts the brick-and-mortar retailer is making to expand its existing business though, the analyst community is calling for a calendar 2028 top line of a little over $800 billion. That's nearly 20% better than this year's projected sales.

Data source: StockAnalysis.com.

Extending this growth rate through the end of 2030 would push its annual revenue up and over the $900 billion mark, with per-share earnings nearing $4 by that point.

When will it reach $1 trillion?

But will all of this be enough to push Walmart's current market cap of $535 billion up to $1 trillion by 2030?

Nobody owns a working crystal ball. To the extent these things can be predicted though, given the stock's presently stretched valuation of a little more than 0.8 times its revenue and a trailing price-to-earnings ratio of 28.5, even this degree of growth still probably wouldn't be enough to get the company to a $1 trillion market cap by 2030.

Getting there by 2032, however, is not only possible, but likely. Doing so by then would also be impressive if only because Walmart will be one of the first non-tech names to become a trillion-dollar company.

Either way, Walmart stock is still a great investment prospect in the meantime even if it's not apt to reach the big milestone within the next six years. Growth is still growth, after all.

Should you invest $1,000 in Walmart right now?

Before you buy stock in Walmart, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Walmart wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, Tesla, and Walmart. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.