Nvidia Is Now Worth More Than $3 Trillion. Here's How the Company Makes Money

Only six months into 2024, both the S&P 500 and Nasdaq Composite have posted double-digit gains and are each hovering around record levels.

One of the biggest beneficiaries of the bull market is semiconductor darling Nvidia (NASDAQ: NVDA). Shares of the chip giant are up a whopping 156% so far this year, and the company even briefly passed Microsoft as the most valuable company in the world after its market cap eclipsed $3.3 trillion.

Although Nvidia is mostly known for its semiconductor chips, there is far more to the business. Let's break down how Nvidia makes money and what it means for the longer-term thesis surrounding artificial intelligence (AI).

A close look at Nvidia's income statement

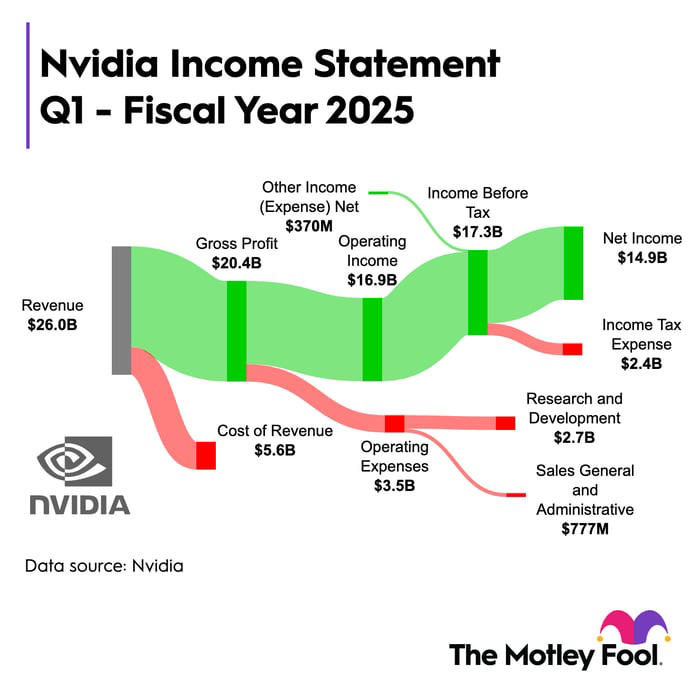

The illustration below is a visual representation of Nvidia's income statement for its first quarter of fiscal 2025 (ended April 30).

Nvidia Income Statement Sankey Chart

For the quarter that ended April 30, Nvidia generated total revenue of $26 billion. The table below breaks down Nvidia's revenue by reported category:

| Category | Revenue |

|---|---|

| Data Center-Compute | $19.4 billion |

| Data Center-Networking | $3.2 billion |

| Gaming | $2.6 billion |

| Professional Visualization | $0.4 billion |

| Automotive | $0.3 billion |

| OEM and Other | $0.1 billion |

Data source: Nvidia Investor Relations.

Clearly, Nvidia's largest source of revenue comes from its data-center services. Considering how high demand is for graphics processing units (GPUs) and their applications for generative AI development, it's not surprising to see Nvidia as a bellwether in compute and networking services.

Of course, looking at revenue alone won't help much when assessing the financial health of a business. Let's move down the income statement and assess Nvidia's expense profile and its profitability generation.

How do these results impact cash and liquidity?

During Q1, Nvidia reported $5.6 billion in cost of goods sold (COGS). This resulted in a gross profit of $20.4 billion, or a margin profile of 78.4%.

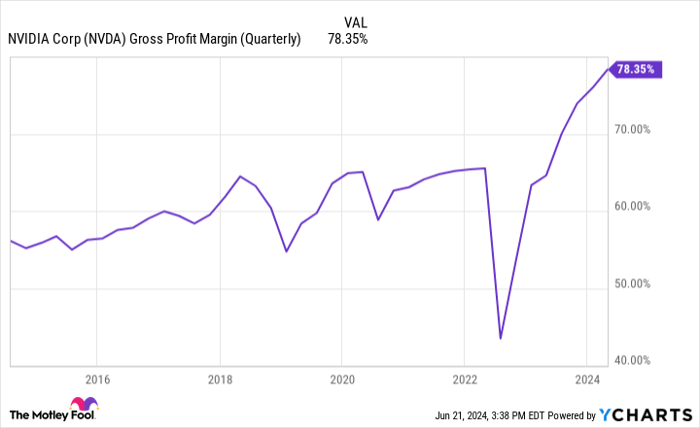

To put this into context, check out the chart below. Over the last couple of years, Nvidia has dramatically expanded its gross margin. One of the reasons for this is the high demand for AI chips. However, that's only part of the story.

A bigger contribution to Nvidia's rising profit margins is due to the company's pricing power. Despite intense competition, Nvidia's H100, A100, and new Blackwell chips are considered superior to alternatives on the market from the likes of Intel and Advanced Micro Devices.

Industry research suggests that Nvidia could have up to 95% of the AI chip market right now. Given its commanding position, Nvidia is in a lucrative spot to fetch peculiarly high prices for its chips compared to the competition.

NVDA Gross Profit Margin (Quarterly)

During Q1, Nvidia's operating expenses rose 39% year over year to $3.5 billion. While this is a non-trivial increase in expenses, it pales in comparison to the rate at which Nvidia's revenue and profits are accelerating.

For this reason, Nvidia has more than adequate financial resources to spend on research and development and acquire top engineering talent.

To me, this most important and impressive financial statistic from the graphic above is Nvidia's net income of $14.9 billion. While the company's revenue soared 262% year over year in Q1, net income grew by 628%.

This dynamic should not be overlooked or underappreciated. Given the rate at which Nvidia is accelerating both its top and bottom lines, the company is able to stockpile heaps of cash.

At the end of Q1, Nvidia boasted $31.4 billion of cash and equivalents on the balance sheet. This is more than triple Nvidia's outstanding debt, signaling that the company has enough liquidity to pay down its liabilities while simultaneously doubling down on its aggressive spending on innovation in product development and headcount.

An AI chip on a circuit board.

Is Nvidia stock a buy right now?

As of the time of this writing, Nvidia's market cap is about $3.1 trillion -- more than double what it was in January. Indeed, Nvidia has been on a roll, and its share price has soared to record levels in a short time period.

Despite its rapid ascent and newly acquired admission to the $3 trillion club, I think Nvidia stock is still a good buy.

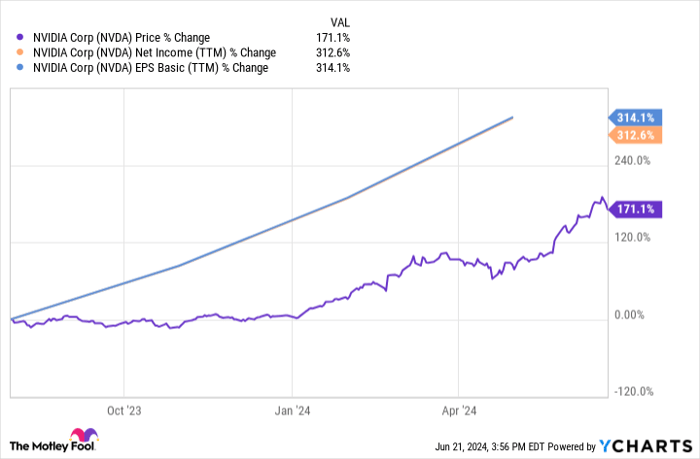

Take a look at the chart below. While shares of Nvidia are up 171% over the last year, profits and earnings per share are up by more than 300%.

NVDA

In other words, Nvidia's earnings power is accelerating at a higher rate compared to the stock-price movement. As a result, the company's price-to-earnings (P/E) multiple of 73.9 is actually far lower than it was this time last year when it was hovering around 240.

So even though Nvidia stock is having a moment right now, it's actually more reasonably valued today than it was a year ago. Considering the company's impressive lead over the competition, coupled with its strengthening financial profile and attractive valuation, I'd be a buyer of Nvidia stock right now.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Adam Spatacco has positions in Microsoft and Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.