Nvidia Was Briefly the World's Most Valuable Company. Is It Too Late to Buy the Stock?

Earlier this month, Nvidia (NASDAQ: NVDA) briefly surpassed Microsoft to become the most valuable company in the world. It's one good day of trading away from rejoining Microsoft and Apple as the only three companies to obtain a market cap of $3 trillion or more.

With Nvidia briefly becoming the largest company on the planet, the question is: Has the stock topped out? Let's look at why it may still have plenty of room to climb.

The world's largest company

Becoming the world's largest company or reaching a market-cap milestone doesn't mean the gains on a stock are necessarily capped. For example, it was pretty astounding when Apple became the world's first trillion-dollar company back in August 2018. At the time, it certainly seemed that the gains would slow from there. After all, it took the company 42 years to reach a trillion-dollar market cap.

However, two years later in August 2020, the company crossed the $2 trillion market-cap level, and it hit a $3 trillion valuation in June 2023. If investors thought that a $1 trillion market cap was the near-term top on Apple, they would have missed out on the stock tripling over the next five years.

As such, there is certainly a recent historical precedent for Nvidia's stock to continue to soar to new heights if the company can continue to perform.

Riding the AI wave

Nvidia has undoubtedly been the biggest early winner of the current artificial intelligence (AI) revolution that is taking place as companies race to add AI functionality. Its graphic processing unit (GPU) designs have become the foundation of powering AI in the data center, where its GPU clusters are used to help with large language model (LLM) training and AI inference.

Given Nvidia's success, both rivals and customers have tried to make inroads into AI chips. However, Nvidia continues to hold an estimated 80% plus market share in large part due to its Compute Unified Device Architecture (CUDA) software platform. Long before AI was the next big thing, developers were taught to program GPUs using Nvidia's CUDA software, which helped make it the industry standard. In turn, this has created a large moat for the company.

With AI in the early innings, demand for Nvidia's offerings has been insatiable. This can be seen in the company's extraordinary revenue growth, with its most-recent quarterly revenue surging 262% to $26 billion. Sales into the data center have been its biggest growth driver with revenue soaring 427% last quarter to $22.6 billion.

At this point, the only thing keeping Nvidia from generating even more revenue is keeping up with demand, with the company noting that demand for its latest chips outstripped supply.

The company is also pushing the innovation envelope by looking to develop new GPU architecture platforms nearly every year. The company's Hopper GPU architecture platform led the way in Q1, but it has already introduced its next-generation Blackwell platform and plans to introduce its Rubin architecture in 2026. All platforms are backward compatible so customers don't have to worry about their prior investments becoming obsolete, while at the same time this innovation will push customers to get the latest and greatest technology to keep up in the AI race.

Artist rendition of AI chip.

Where the stock could be headed

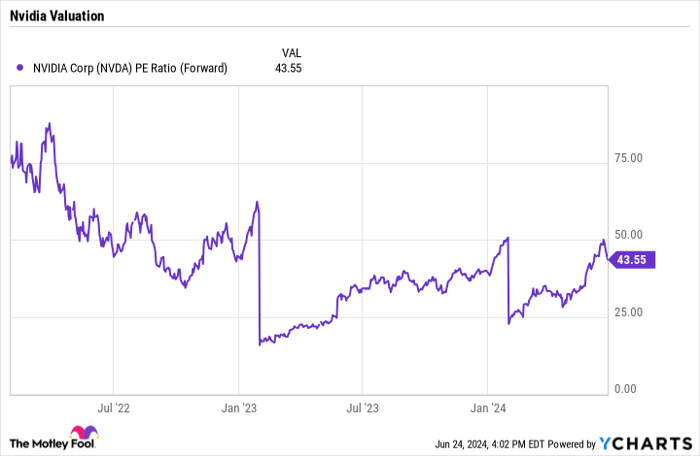

Despite its extraordinary growth, Nvidia's stock is valued quite reasonably given its continued prospects. A forward price-to-earnings (P/E) ratio of 44 times the next 12 months' earnings estimates is not expensive for a company that just saw its revenue increase 262%.

NVDA PE Ratio (Forward) Chart

NVDA PE Ratio (Forward) data by YCharts

Revenue growth will ultimately slow, as it's not possible for Nvidia to continue to grow at the pace it has the past few quarters. However, it's not out of the question given that the AI build-out appears to be in its early days, and the company's continued innovation could grow its revenue by 50% in 2025, 40% in 2026, and 30% in 2027. It's currently projected by analysts to generate revenue of $120 billion this fiscal year, so that growth would put it at about $328 billion in revenue in 2027.

If the company's adjusted operating expenses increased an average of 13% quarter over quarter through 2030 (similar to last quarter's sequential growth), and then a 20% tax rate is applied on its operating income, Nvidia could be close to generating $165 billion in adjusted earnings by 2027. Place a 30 times P/E multiple on that and Nvidia is a $5 trillion stock in 2027.

Of course, Nvidia could grow more or less than any projections, and its P/E multiple could fluctuate over time as well. However, while its biggest growth may be in the past, it still looks like the company has strong potential upside ahead. As such, it is not too late to buy the stock.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.