Banks Press UK to Delay Basel Rules Again as US Process Drags On

(Bloomberg) -- Banks are pushing UK policymakers to join their European counterparts in delaying key parts of a package of new capital rules to ensure the country’s regulations are aligned with those in the US.

Domestic lenders including HSBC Holdings Plc have begun pressing the UK to postpone its mid-2025 adoption of the new requirements, which force banks to hold more capital and are known as Basel III, according to people familiar with the matter. International lenders including Citigroup Inc. have also made policymakers aware of the difficulty of adopting the new requirements on differing timelines.

The industry plans to intensify its efforts on the matter in the aftermath of the UK’s election in July, the people said, asking not to be named discussing private deliberations. Still, some executives acknowledged that delaying the timeline is unlikely to be high on the new government’s list of priorities for some time.

Representatives for the Bank of England, HSBC and Citigroup declined to comment. Barclays Plc, which also has a significant international business, declined to comment on whether it was involved in the initiative, as did lobbying body UK Finance.

The lenders’ moves come as the European Union announced it would delay implementing the rules until January 2026, with financial services commissioner Mairead McGuiness arguing that the reprieve would guarantee a “global level playing field” for European banks competing with rivals in the US. Switzerland on Tuesday said it would not delay its implementation, which begins in January 2025, despite pleadings from banks including UBS Group AG.

British banks are equally keen for a level playing field, while international banks with large trading operations in London do not want the practical headache of implementing the rules on a staggered basis across their global businesses, the people familiar with the situation said.

Willingness to Change

For now, officials in the US have not altered their plans to begin implementing their new requirements by July 1, 2025. A spokesperson for the Federal Reserve declined to comment on the likely timeframe or its level of coordination with international regulators as deliberations continue.

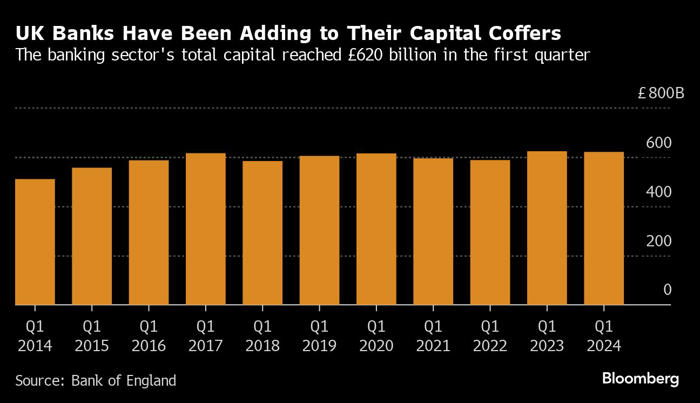

UK Banks Have Been Adding to Their Capital Coffers | The banking sector's total capital reached £620 billion in the first quarter

In May, Fed Chairman Jay Powell said the US was committed to implementing a regime “comparable to what the other large comparable jurisdictions are doing” but would not hesitate to re-propose its rules if that was “appropriate.” The Fed has shown other US regulators a three-page document of possible changes to their bank-capital overhaul that would significantly lighten the load on Wall Street lenders, Bloomberg News reported this week.

The giants of the banking industry have been engaged in a fierce lobbying campaign against the new rules, which would increase the amount of capital that the eight largest banks have to set aside by 19%. Ever since the Federal Reserve’s top banking watchdog said in March that there would likely be significant changes to their original Basel III proposal, industry executives have questioned how regulators would be able to pull off implementing the new rules by that original deadline and there’s widespread belief that the US will have to delay.

UK regulators had hoped to announce their final package earlier in the summer, but were forced into a so-called quiet period when a general election was called on May 22.

The UK has already shown its willing to align with the US when it comes to adopting the new rules. British regulators had at one point been due to implement the package on January 1 but pushed that timetable back by six months to align with the July 2025 deadline announced by their counterparts in America.

But any further delays by the UK would be the latest blow to a landmark package that was already running years behind schedule, prompted by the pandemic and demands by banks for an additional year of preparations. Some regulators now fear that the ongoing political backlash to the new rules in the US, coupled with a European agenda that’s focused more on growth, could lead to a wider rowing back of the measures.

In the UK, the PRA now has a new secondary mandate to promote the competitiveness of the UK industry. That lends itself to banks’ arguments, the people familiar with the matter said, as does the UK’s goal of retaining as much business as it can in the City after Brexit’s losses.

At the same time, the UK’s proposals have been less controversial. The PRA itself has predicted under its new regime that capital requirements would increase just 3%.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.