Confession Time: I Own 5 Industry-Leading Artificial Intelligence (AI) Stocks, but Not for the Reason You Might Think

Roughly three decades ago, the proliferation of the internet changed the growth trajectory of corporate America forever. Though numerous new innovations, technologies, and popular trends have come and gone since the internet became mainstream, nothing has come close to changing the growth arc for businesses... until now.

The rise of artificial intelligence (AI) has absolutely lit a fire under Wall Street. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite have all recently galloped to record-closing highs, with the AI revolution doing a lot of the heavy lifting.

A hologram of a rapidly rising candlestick stock chart coming from the right palm of a humanoid robot.

Artificial intelligence (AI) stocks take Wall Street by storm

With AI, software and systems are given responsibilities that would normally be assigned to humans. The key being that these systems have the capacity to learn and evolve over time without human intervention. The ability to become more proficient at tasks over time, or perhaps even learn new skills, is what gives AI broad-reaching utility and has investors seeing big dollar signs.

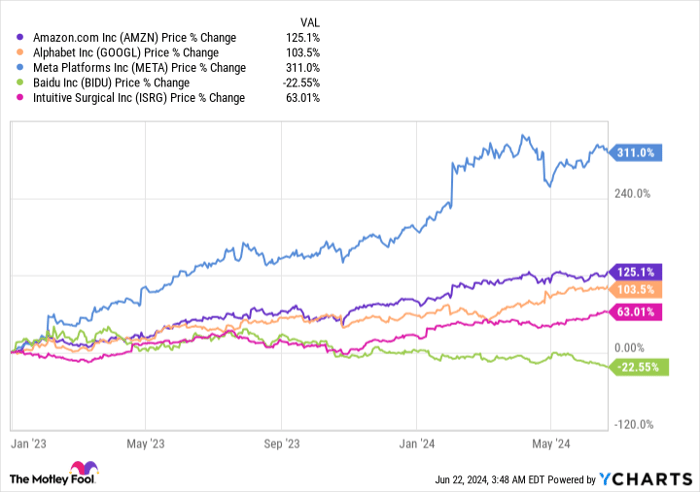

As of the closing bell on June 21, five of my 42 stock holdings were highly innovative, industry-leading artificial intelligence stocks (listed in no particular order): Amazon (NASDAQ: AMZN), Alphabet (NASDAQ: GOOGL)(NASDAQ: GOOG), Meta Platforms (NASDAQ: META), Baidu (NASDAQ: BIDU), and Intuitive Surgical (NASDAQ: ISRG).

- Amazon is deploying AI in virtually all facets of its operating segments. In particular, it's allowing its Amazon Web Services (AWS) customers to lean on generative AI solutions to train large language models (LLMs) and deploy virtual chatbots for their businesses.

- Alphabet, like Amazon, is leaning on AI in multiple arenas, including the training of LLMs and the processing of text, audio, and video via its Gemini AI model.

- Social media juggernaut Meta Platforms trusts AI solutions to moderate noncompliant content on its platforms, as well as help advertisers tailor their message(s) to Meta's users.

- Baidu, like Amazon and Alphabet, is relying on generative AI solutions to improve its AI Cloud platform. It also introduced its own chatbot service, known as Ernie Bot, in 2023.

- Robotic-assisted surgical systems developer Intuitive Surgical is using AI as a tool to help surgeons predict complications and study surgical data to improve patient outcomes.

While the buzz surrounding AI has pushed all but Baidu higher, I have a rather blunt confession to make. My investment thesis for all five of these top-tier companies has absolutely nothing to do with artificial intelligence.

AMZN

Confession time: I didn't buy these industry leaders because of their AI ties

If artificial intelligence turns into a key cash-flow driver for Amazon, Alphabet, Meta Platforms, Baidu, and Intuitive Surgical, it would be fantastic. However, the primary reason I bought into each and every one of these businesses is because they possess seemingly impenetrable moats in one or more respective industries.

- Amazon is a leader in two industries. It's the undisputed No. 1 e-commerce marketplace in the U.S., as well as the top dog among global cloud infrastructure service providers, with regard to enterprise spending. AWS surpassed $100 billion in annualized run-rate sales during the March-ended quarter, which is great news considering that cloud-service margins run circles around the razor-thin margins provided by online retail sales.

- Alphabet's Google has accounted for at least a 90% monthly share of worldwide internet search dating back more than nine years. This makes it the logical go-to for advertisers, as well as generates sustainable cash flow. Further, Google Cloud turned profitable on a recurring basis in 2023, which should lead to a big uptick in operating cash flow in the years to come.

- Meta Platforms owns the top social media real estate globally, including Facebook (the most-popular social site), WhatsApp, Instagram, Facebook Messenger, and Threads. The company attracted 3.24 billion daily active users in the first quarter, and advertisers are well-aware that they aren't going to find broader access to consumer eyeballs anywhere else.

- Baidu has been China's version of Google over the last decade. With few exceptions, it's accounted for a 50% to 85% share of internet search in China. Baidu also closed out the March quarter with roughly $26 billion in cash, cash equivalents, and various investments.

- Intuitive Surgical ended March with 8,887 of its da Vinci surgical systems installed worldwide. It holds the lion's share of robotic-assisted surgical system market share and should see its operating margin improve as higher-margin segments (instruments and accessories sold with each procedure, as well as servicing) grow into a larger percentage of net sales.

While it's fair to say that I bought into each of these businesses before AI was the buzzy innovation is it today, it's not the catalyst that keeps me holding onto shares of Amazon, Alphabet, Meta, Baidu, and Intuitive Surgical.

A visibly concerned person looking at a rapidly rising then plunging stock chart displayed on a tablet.

History suggests the AI bubble is going to burst sooner than later

Truth be told, I'm a big believer that history tends to rhyme on Wall Street. We might not see things happen precisely the same way or within the same time frame, but history can absolutely act as a teacher for investors.

For instance, history tells us that long-term-minded investors tend to be successful on Wall Street. There hasn't been a single rolling 20-year period in the S&P 500 for more than a century (when back-tested) that didn't generate a positive total return, including dividends, for investors.

On the other hand, history hasn't been all too kind to next-big-thing innovations, technologies, and trends. Although it's impossible to predict when the hottest thing on Wall Street will run out of steam, there hasn't been a next-big-thing trend in 30 years that's avoided an early stage bubble-bursting event. All innovations need time to mature, just as businesses need a game plan for how to use these new technologies to grow their sales and profits. As of now, artificial intelligence isn't close to being a mature technology.

AI leader Nvidia (NASDAQ: NVDA) is providing all the evidence I need that history appears poised to rhyme, once more.

On the surface, Nvidia has been kicking tail and taking names. Its H100 graphics processing unit (GPU) has quickly become the most sought-after GPU for businesses operating AI-accelerated data centers. According to analysis firm TechInsights, Nvidia was responsible for 98% of the 3.85 million AI-GPUs shipped in 2023. Thanks to its first-mover advantages in AI, Nvidia's stock gained up to $3 trillion in market value in less than 18 months and briefly surpassed Microsoft and Apple to become the largest publicly traded company by market cap.

The problem is that we've never witnessed a company of Nvidia's size scale this quickly. The last time a market-leading business traded at close to 40 times trailing-12-month sales happened prior to the dot-com bubble bursting with Cisco Systems and Amazon. Both companies eventually pulled back by 90% from their respective dot-com bubble highs.

Additionally, Nvidia can lose even if its GPUs hold onto their computing advantages. A lack of available AI-GPU supply means businesses are more likely to turn to Nvidia's rivals to fulfill their needs. Likewise, Nvidia's top customers, which include Amazon, Alphabet, Meta, and Microsoft (not in this order), are developing their own AI-GPUs. This suggests a clear desire to lessen their reliance on Nvidia's technology.

All signs point to an AI bubble that's eventually going to burst. While AI can absolutely be a long-term game-changer, businesses first have to figure out how they're going to utilize the technology. Until this maturation process takes place, AI isn't going to play much of a role in my investment theses.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Sean Williams has positions in Alphabet, Amazon, Baidu, Intuitive Surgical, and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Baidu, Cisco Systems, Intuitive Surgical, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.