Better Artificial Intelligence (AI) Stock: Oracle vs. Dell Technologies

The proliferation of artificial intelligence (AI) turned out to also be a boon for some legacy tech companies looking for their next big growth driver. Stalwarts like Oracle (NYSE: ORCL) and Dell Technologies (NYSE: DELL) have gained impressive momentum on the stock market of late.

Share prices of Oracle, which made its name selling database software, are up 34% so far in 2024. Dell Technologies, which is in the unfashionable business of selling computers and servers, has delivered stunning stock price gains of nearly 90% so far this year.

How did AI help reignite investor interest in these stocks? More importantly, which one of these tech giants should you consider buying right now to capitalize on the AI boom? Let's try and find some answers.

The case for Oracle

Enterprise software and database solutions provider Oracle has struggled to accelerate its growth lately. In the recently concluded fiscal 2024 (which ended on May 31), Oracle's annual revenue increased just 6% to $53 billion. That was a step down from the 22% revenue growth to $50 billion it reported in fiscal 2023, though $5.9 billion of that came from the acquisition of healthcare information technology company Cerner, which Oracle acquired at the beginning of the fiscal year.

Excluding that acquisition, Oracle's top line would have increased in the low single digits in fiscal 2023. The good news is that the accelerated interest in AI opened a whole new growth opportunity for Oracle. Even better, the company is already capitalizing on it. This is evident from the fact that Oracle's remaining performance obligations (RPO), which refers to the total value of a company's future contracts that it is yet to fulfill, jumped a solid 44% year over year in the fourth quarter of fiscal 2024 to $98 billion.

AI played a central role in this massive improvement in Oracle's revenue pipeline. That's because the demand for Oracle's generative AI cloud infrastructure is so strong that the company is rapidly building more of it to meet the same. More specifically, the robust demand for cloud AI services is now moving the needle in a significant way for Oracle. This was evident from CEO Safra Catz's comments on the latest earnings conference call:

Infrastructure cloud services revenue was up 42%. Excluding legacy hosting, OCI Gen 2 Infrastructure cloud services grew 44%, with an annualized revenue of $7.4 billion. OCI consumption revenue was up 53%. Were it not for continuing supply constraints, consumption growth would have been even higher.

It is worth noting that Oracle is looking to aggressively add more cloud capacity "given the enormity of our backlog and pipeline." More importantly, the cloud AI market represents a lucrative and secular long-term growth opportunity for Oracle. Mordor Intelligence estimates that the cloud AI market could grow from an estimated revenue of $67 billion this year to $275 billion in 2029.

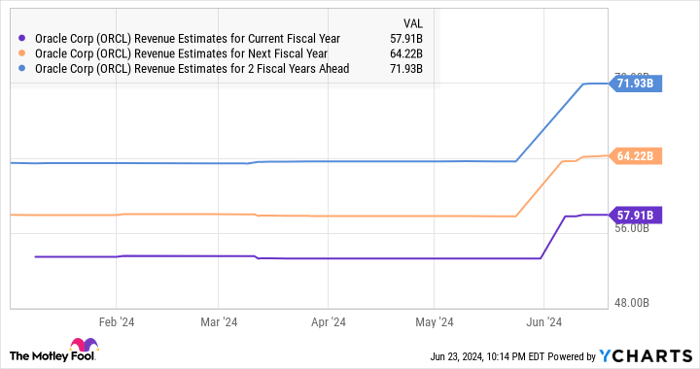

Oracle management forecasts double-digit revenue growth in the current fiscal year, which would be an improvement over its fiscal 2024 performance. Even better, as the following chart tells us, its top-line growth is expected to get better over the next couple of fiscal years as well.

ORCL Revenue Estimates for Current Fiscal Year

All this indicates that Oracle could continue to remain a top AI stock in the future thanks to its enormous backlog and the growing adoption of AI-focused cloud services.

The case for Dell Technologies

Dell had a forgettable time in fiscal 2024 (which ended in February this year) as its top line dropped 14% to $88.4 billion. The company was hit hard by the weak demand for personal computers (PCs) last year, but things have started changing for the better in the new fiscal year.

Dell's fiscal 2025 Q1 revenue increased 6% year over year to $22.2 billion. The company's client solutions group (CSG) segment, which struggled last year on account of the weak PC market, delivered a flat revenue performance as compared to the prior-year period. This segment's performance could improve in the future thanks to the growing adoption of AI-enabled PCs.

Counterpoint Research points out that roughly 75% of laptop PCs shipped in 2027 are going to be AI-enabled, which would be a big jump when compared to last year when only 13% of the laptop PCs were capable of running AI applications locally. The overall demand for AI-capable PCs is forecast to increase at an annual rate of 44% through 2028.

Dell management acknowledged this potential growth opportunity on its recent earnings conference call, with COO Jeff Clarke pointing out, "The PC installed base continues to age. Windows 10 will reach end-of-life later next year, and the industry is making significant advances in AI-enabled architectures in applications."

So, there is a good chance that this segment, where Dell has found growth difficult to come by, is set for a solid turnaround. At the same time, the company's infrastructure solutions business saw robust growth on the back of healthy demand for AI servers. Its revenue increased 22% year over year to $9.2 billion in the previous quarter, and the trend is here to stay as customers line up to purchase Dell's AI-optimized servers.

The company ended fiscal Q1 with an increase of more than 100% in shipments of AI-optimized servers on a quarter-over-quarter basis to $1.7 billion. More importantly, it received $2.6 billion worth of AI server orders last quarter and currently has a backlog of $3.8 billion that it is yet to fulfill. This is another red-hot growth opportunity for Dell as the market for AI servers is expected to generate a whopping $430 billion in annual revenue in 2033, up from just $31 billion last year.

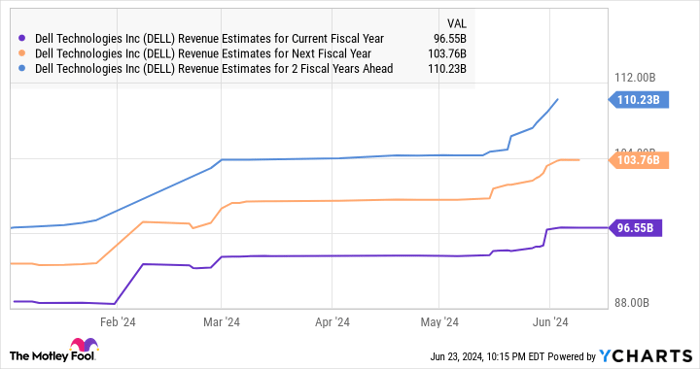

So, just like Oracle, even Dell is sitting on lucrative AI-related catalysts, which is the reason why analysts have been raising their growth expectations from the company.

DELL Revenue Estimates for Current Fiscal Year

The verdict

If you're on the hunt to add an AI stock to your portfolio, which one of these two tech giants is a better bet right now?

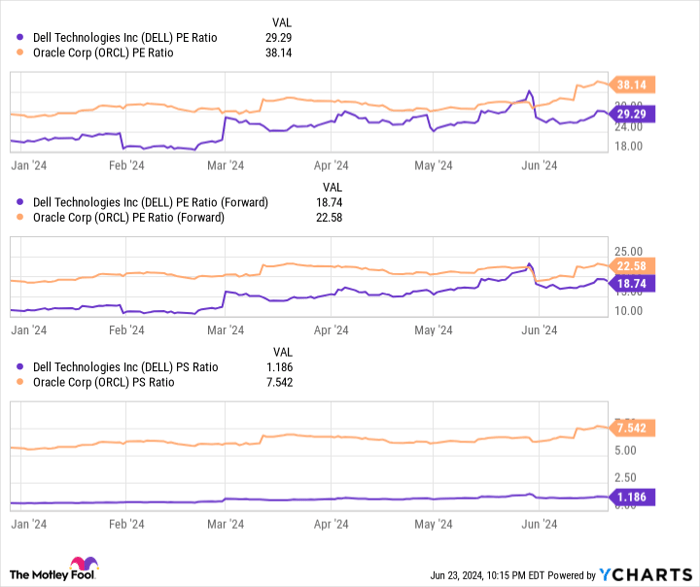

Even though Dell stock jumped impressively in 2024 and outperformed Oracle by a wide margin on the market, it still trades at a significantly cheaper valuation (see chart below). It is also worth noting that Dell seems like a more diversified AI investment as it is set to capitalize on the demand for AI-enabled PCs and servers.

DELL PE Ratio

However, Oracle has a much bigger backlog that could help accelerate its growth in the long run. Also, its revenue pipeline could continue to improve thanks to the massive revenue opportunity in the cloud AI space.

So the better stock to pick depends on the person buying. Investors considering these two AI stocks will need to choose based on their personal risk profiles and the valuation they are comfortable with. Depending on the individual's situation, either Dell or Oracle could be the better bet to benefit from the proliferation of AI.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Oracle. The Motley Fool has a disclosure policy.