Market digesting Creador’s stake acquisition in CCK’s Indonesian unit

This article first appeared in The Edge Malaysia Weekly on June 17, 2024 - June 23, 2024

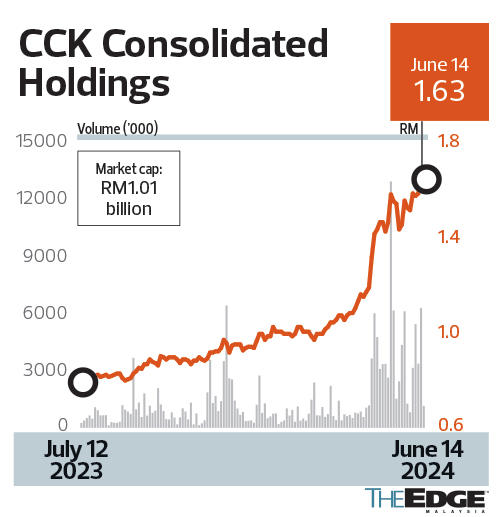

INVESTORS who bet on the growth story of CCK Consolidated Holdings Bhd (KL:CCK) a year ago would have been quite handsomely rewarded as the share price of the integrated poultry and retail player has more than doubled on the back of its robust expansion plans.

The icing on the cake may well be the group’s most generous dividend payout to date of 4.25 sen per share, to be paid come Wednesday.

However, CCK’s share price has been volatile of late. Year to date, the counter of the Sarawakian integrated food retail player has risen 79% to RM1.63 last Friday. Following news reports on May 28 of Creador’s proposed acquisition of a 40% stake in CCK’s Indonesian unit PT Adilmart for RM170.3 million, the counter surged to RM1.70 on the same day from RM1.20 the day before, only to slip to the RM1.35 level later in the week.

At the time, two of the three analysts on Bloomberg covering the stock had issued reports that suggested that the counter has run ahead of their recommended target prices. PublicInvest Research had recommended a target price upgrade to RM1.20 from RM1.12, and Apex Securities RM1.48 from RM1.11. The third analyst did not have a target price in his unrated report published on May 20.

Apex Securities tells The Edge that it has yet to factor in the impact of Creador’s recent investment in CCK’s subsidiary in its latest report dated June 4 as it deems it “still too early to gauge the potential synergistic effect towards CCK’s production of frozen food business segment as well as the prospects of potential expansion of (its) retail mart business into the Indonesian market.

Market digesting Creador’s stake acquisition in CCK’s Indonesian unit

“Nevertheless, we noted that Indonesia’s poultry meat consumption per capita is on the growing trend over the years that stood at 8.21/kg and is expected to reach 9.32/kg by 2029, based on an independent market research report,” says Apex Securities.

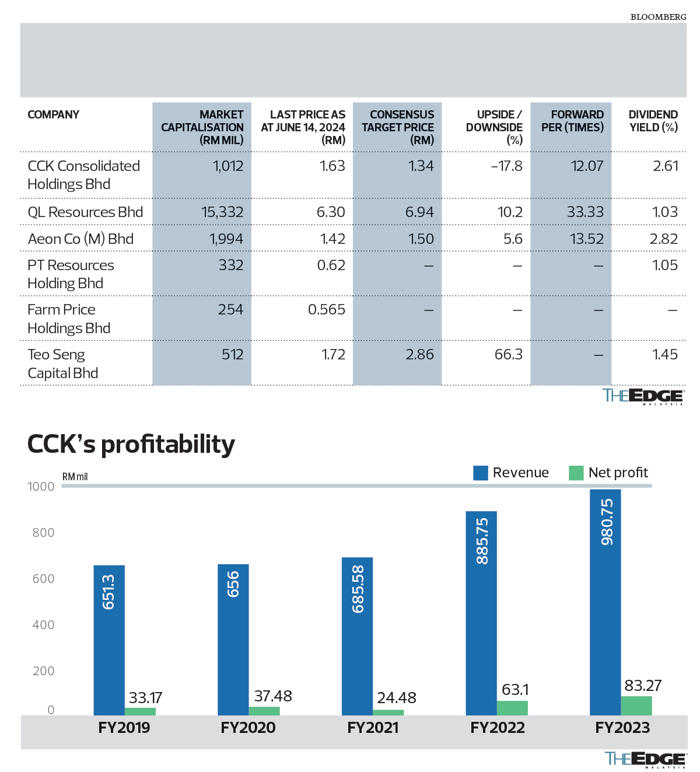

However, CIMB Securities noted in its report that CCK trades at 11.7 times CY2023 core price-earnings ratio (PER), “... a steep discount versus our Malaysia consumer sector average CY2023 PER of 32.8 times (64.4% discount) and our consumer staples subsector average CY2023 PER of 35.6 times (67.1% discount)”.

Whether the stock is undervalued in spite of its steady earnings growth (see table) and scalability of the business, Apex Securities points out that Bloomberg’s average two-year PER band for CCK stands at 7.8 times, whereas the PER the research house assigned it was 10.6 times, indicating a slight premium over the two-year historical average.

“This premium reflects CCK’s integrated end-to-end upstream to downstream business model, potential improved performance from the retail segment in [Sabah and Sarawak], which is currently thriving, as well as rising consumption of poultry meat in the Asean region.”

Meanwhile, PublicInvest Research says the counter is already trading at a premium to its valuation, that is one standard deviation of its five-year average forward PER.

“While we are positive that the proposed investment would drive further growth in CCK’s Indonesia operations, but given the limited upside potential, we downgrade our call to ‘underperform’ with a revised TP of RM1.20,” PublicInvest Research said in its May 28 report.

Pending further clarity on the deal, institutional analysts are keeping their earnings forecasts unchanged for now.

Potential beneficiary of developments in Sabah and Sarawak, Indonesia

CCK has four business segments: retail, poultry, prawn (frozen seafood production) and food service, with retail contributing the lion’s share of some 78% to group revenue. Since opening its first retail store in Sibu in 1970, the segment now operates more than 80 retail stores, supermarkets and wholesale stores across Sabah and Sarawak as well as Jakarta, Pontianak and Tarakan in Indonesia.

Retail stores come under the CCK Fresh Mart brand and supermarkets under the CCKLocal brand.

For lack of a closer peer comparison on Bursa Malaysia, analysts tend to liken CCK to integrated poultry player QL Resources Bhd (KL:QL) since both players have exposure to the poultry business, marine produce and retail segment.

However, the business models for both consumer companies differ significantly, with CCK predominantly being a retailer that is supported by its poultry operations (11.2% of FY2023 revenue), prawn (9.4%) and food service (2.4%), whereas QL is an agriculture-based group that produces products from resources in integrated livestock farming (poultry), marine products manufacturing and palm oil activities. QL has said that its foray into the convenience store segment via FamilyMart, which contributes about 16.3% to group revenue, is a natural extension of its value chain. QL’s mainstay is its integrated livestock farming business, which makes up more than half of the group’s revenue.

For the first quarter ended March 31, 2024, CCK posted a 32% higher net profit of RM21.37 million from RM16.16 million during the same period last year on improved revenue of RM260.7 million, compared with RM240.6 million the year before.

In a filing with Bursa Malaysia, the group attributed the revenue growth to an outperformance from its retail segment as well as improvement in its poultry segment, which collectively offset the decline in its prawn and food service segments.

”The retail segment grew 10.1% during the quarter, largely due to matured contributions from our established retail network-driven and robust consumer demand,” CCK said.

Consumer analysts who are bullish about CCK believe that it plays an important role in Sabah and Sarawak’s food security ecosystem while also standing to benefit from rising economic developments in Borneo, namely Sarawak.

“All goods from its integrated poultry supply chain are sold via its retail network. A key strength of CCK lies in its vertically cohesive retail supply chain, supported by its fully integrated poultry operations. Note that CCK is also Sarawak’s largest poultry goods producer. CCK sells all its poultry goods through its retail outlets, allowing the company to price its products competitively. This advantage is derived from controlling the poultry sales mix, managing supply-demand dynamics, and benefiting from higher economies of scale due to the vertical integration of its business,” CIMB Securities said in a report on May 20.

The research house points out that CCK is also poised to benefit from the development of Indonesia’s new capital, Nusantara, as its Indonesian operations are primarily located in West Kalimantan. CCK entered the Indonesian market in 2022 by acquiring Tarakan, North Kalimantan-based shrimp processing company PT Bonanza Pratama Abadi for US$8 million. The move grew CCK’s prawn segment by 430% in the second half of FY2022 to RM48.8 million from RM9.2 million in the first half, contributing 6.5% to group revenue in that year compared with 3% in FY2021.

Analysts highlight that CCK’s revenue contribution from Indonesia has risen steadily, with a five-year top line compound annual growth rate of 14.5% from FY2018 to FY2023, and has put the Sarawakian group’s foot in the door to tap the rest of the populous Indonesian market.

“Who knows what the deal with Creador’s investment is all about and how it will pan out for CCK? Looking at the group’s robust expansion plans and positioning in the Sabah and Sarawak and Indonesian markets, this little known stock has been undervalued for some time,” says another analyst who did not want to be named. “But that seems to be changing with the private equity firm’s involvement and investors are coming to be aware of the group’s growth potential. It will be a matter of time that the company will be due a rerating.”

The coming months will be important for CCK as it navigates the additions to its overall business across Sabah and Sarawak as well as Indonesia. For now, the market will have to decide whether the integrated retail player is worth its current share price.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.