Why world's biggest bond investors are set to bet big on India

This week is set to see a much-anticipated development for the Indian bond market. On 28 June, JPMorgan is set to include India in its largest emerging-market bond index. This move is expected to drive global investment in Indian debt up by $40 billion, according to Goldman Sachs.

Along that tangent, Bloomberg Index Services will start including India's bonds in its offerings from January 2025. That, too, is expected to up the inflow of money into India as bond investors flock to the Asian nation.

But what factors are pushing bond investors from the world over to invest in the Indian government's debt? We explain.

But before that, it's important to understand how the Indian bond market actually works.

How the Indian bond market works

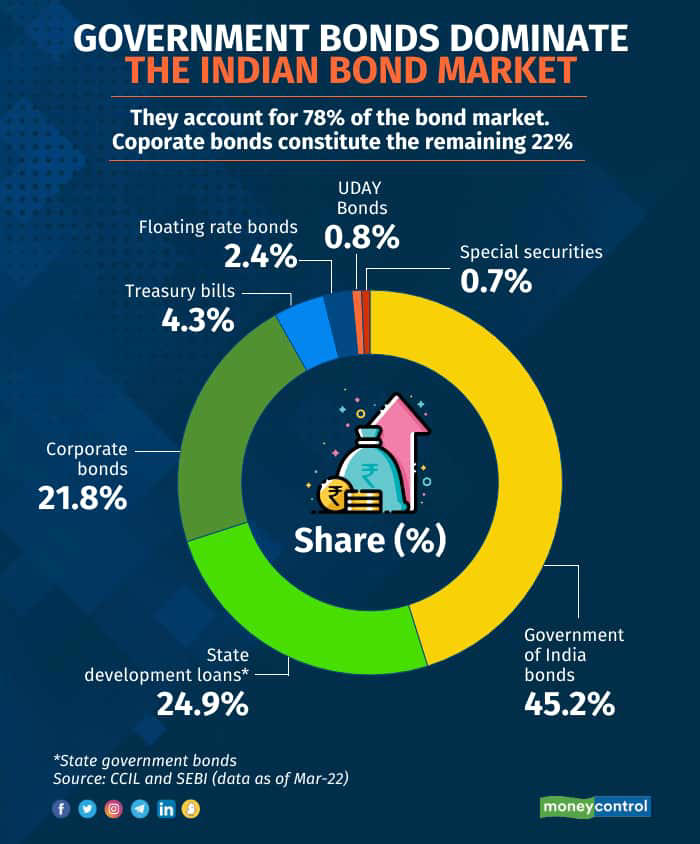

The Indian bond market is divided into government bonds (G-secs) and corporate bonds. Here, we focus on government bonds.

Government bonds, also known as government securities or G-secs, are debt instruments issued by a government to finance its expenditures and manage the country's debt. Like loans, these bonds are a way for the government to borrow money from investors with a promise to pay back the principal amount along with interest at a later date.

The bonds are issued by the Reserve Bank of India (RBI) on behalf of the government. There are two types of these bonds: Treasury Bills, or T-bills, which have a short-term maturity, and Government Bonds, which have long-term maturity.

These bonds are sold through auctions where investors bid, and the highest bidders are allocated the bonds. Participants include banks, financial institutions, mutual funds, insurance companies, and retail investors.

G-secs are traded on the secondary market, ensuring liquidity.

Government bonds in India

Source: Moneycontrol

Factors driving investors to Indian government debt

Inclusion in major global indices

The most significant catalyst for Indian bonds is their inclusion in JP Morgan's Government Bond Index-Emerging Markets Global Index, starting on 28 June. This inclusion, spanning until March 31, 2025, is important as global bond indices help investors, including mutual funds, pension funds, and passive investors, to track bond movements across multiple jurisdictions, guiding their investments.

This inclusion signals a broad consensus among foreign investors that India has achieved sufficient financial stability and that there is a substantial appetite for Indian G-Secs in global investment portfolios. Consequently, inclusion in indices like those of JP Morgan, Bloomberg, and potentially FTSE would open the Indian bond market to a larger pool of investors.

Since the announcement of the index inclusion, foreign portfolio investors have purchased $14.6 billion worth of bonds, equivalent to Rs 1.2 lakh crore at current exchange rates, according to Moneycontrol.

JPMorgan India bond market

JPMorgan will add India to its emerging market bond index from 28 June onwards. Reuters

Economic stability and growth prospects

India's economic prospects, marked by lower inflation (around 4-6 per cent), a stable currency, and ongoing reforms, remain favourable and reflect optimism towards the country's growth potential. This optimism serves as a strong backdrop for potential investors, opening new sources of investment avenues for domestic capital due to the availability of funds.

Higher bond yield

Currently, India's 10-year government bonds yield is hovering around 7 per cent, providing a significant 3-4 per cent premium over similar bonds in developed markets. Additionally, Indian bonds offer higher yields compared to many other emerging markets.

India's sovereign credit rating, generally lower than that of developed nations, implies higher risk, leading investors to seek higher yields as compensation. The government's substantial borrowing requirements to finance its fiscal deficit result in a higher supply of government bonds in the market. When the supply of bonds increases, yields rise to attract buyers, making Indian bonds an attractive investment.

Diversification benefits

Indian bonds serve as a diversification tool. According to HSBC, over the past decade, Indian bonds have shown a low correlation with global bonds. this can be attributed to the country's unique growth dynamics, which distinguish it from other markets. Those looking to truly diversify their portfolios to shield from shocks delivered by unexpected events are, thus, attracted to Indian bonds.

Russia's invasion of Ukraine led to its exclusion from indexes, and China's worsening economic conditions have diminished the attractiveness of its sovereign debt. Amid this turmoil, India has appeared as an appealing option.

Policy reforms and investor-friendly measures

The Indian government has been firm in maintaining tax policies that facilitate the inclusion of its securities in global indexes. This uncompromising stance, along with other market-friendly reforms (such as FAR 2020), has created a conducive environment for foreign investment.

Fully Accessible Route (FAR) initiative

The Reserve Bank of India (RBI) introduced the Fully Accessible Route (FAR) in April 2020, allowing non-residents to invest in certain government securities without restrictions. The FAR enables foreign portfolio investors (FPIs) to invest in specified G-secs without macroprudential limits.

Following the government's introduction of the FAR program in 2020 and significant market reforms to facilitate foreign portfolio investment, foreign investment in Indian government bonds has increased further.

RBI

The Reserve Bank of India has enacted investor-friendly reformes, including the Fully Accessible Route (FAR) initiative. File image/Reuters

Ample scope for investment

India's local debt stock is among the largest in emerging markets, with total outstanding bonds included in the index standing over $400 billion, second only to China.

JPMorgan, in a note, said that "Structurally, we see ample scope for non-resident participation in the local bond market to increase, given it currently sits at one of the lowest levels in EM."

In a nutshell

The inclusion of Indian government bonds in major global indices, coupled with favorable economic conditions, policy reforms, and attractive yields, is driving a surge of interest from global investors. As India opens its bond market to the world, it stands poised to attract substantial foreign investment, marking a significant milestone in its financial journey.