Forget Starbucks. Is Dutch Bros. the New Coffee Stock to Own?

As shares of Starbucks (NASDAQ: SBUX) have struggled, trading down over 20% over the past year, a new coffee leader has started to emerge in Dutch Bros (NYSE: BROS), which is trading up over 35% in the past year.

Let's take a closer look at Dutch Bros and why its performance has been diverging from that of its rival Starbucks.

A small concept with big plans

I got to experience Dutch Bros for the first time on a recent trip to Oregon, where the company was founded. When you visit one of its legacy concepts, the first thing you notice is how small the locations are. These legacy stores are only about 500 square feet and have two drive-thru lanes on each side. You wait in your car as your drink is made. Newer concepts are a little bigger at between 800 square feet to 1,000 square feet, with multiple drive-thru lanes served by one window and a walk-up window. The company also has a few larger endcap configurations that are about 1,200 square feet and may include a lobby but no seating.

Given this setup, it's not surprising that over 90% of its business is done through the drive-thru window. The company says that about half its sales come from coffee-based drinks, while 25% come from its proprietary Blue Rebel energy drinks, and the other 25% from a mix of smoothies, lemonade, soda, and other drinks. I had a milkshake -- the company has several syrups with which to flavor them.

The concept appears to be resonating with customers, with Dutch Bros seeing its same-store sales climb 10% last quarter despite working to redirect sales from some existing locations to new locations. That is in stark contrast to Starbucks, which saw its first-quarter same-store sales drop 4%, including a 3% decline in the U.S.

Overall sales for Dutch Bros climbed nearly 40% year over year in the quarter to $275.1 million. Profitability metrics grew even faster, with adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) soaring 120% to $52.5 million, while adjusted earnings per share (EPS) came in at $0.09 versus $0.00 a year ago.

Iced coffee drink on table.

With only 876 coffee shops (582 are company-owned) at the end of March, Dutch Bros' biggest opportunity moving forward is expansion. Currently, the company operates in only 17 states, most of which are in the western and southwestern U.S. This gives the company a long runway to open up stores on the East Coast and in upper Midwestern markets.

Overall, the company sees the potential for over 4,000 locations to be open in the next 10 to 15 years. It opened a record 45 new shops in Q1.

Meanwhile, Dutch Bros just introduced a mobile ordering app that it is beta testing in Q1 of this year. It expects to have mobile ordering in most of its stores by the end of the year. Most restaurant chains have this type of technology already, so this is a big leap forward that the company is now just catching up on. For its part, mobile ordering has been a growth driver for Starbucks, but more recently it has become an issue, with the company seeing people cancel orders due to long wait times.

Is it time to buy the stock?

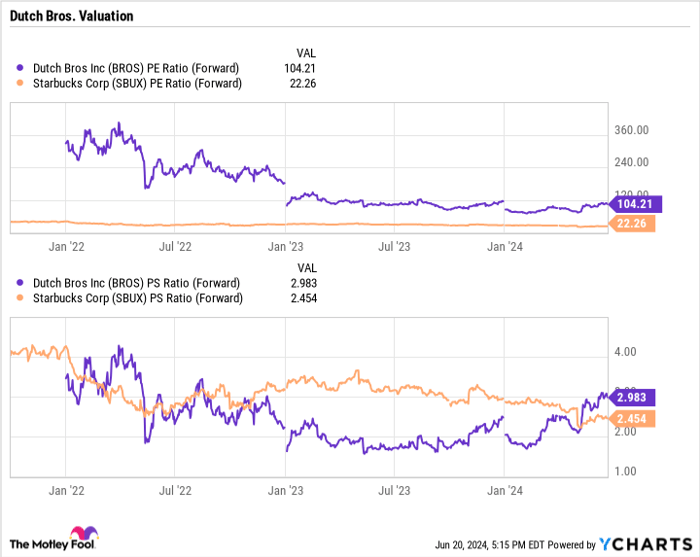

From a valuation perspective, Dutch Bros (not surprisingly) is more expensive than Starbucks, trading at a forward price-to-earnings (P/E) ratio of over 104 times compared to 22 times for its much larger rival. However, on a forward price-to-sales (P/S) ratio, the gap is much smaller, with Dutch Bros trading at only 3 times sales versus 2.5 times sales for Starbucks.

BROS PE Ratio (Forward)

Given that Dutch Bros is still very much in the early innings of building out its store base and expanding, it should see much higher earnings growth as its business scales. With the potential to increase its store base by nearly five times while also growing its same-store sales, the company has a lot of revenue and earnings growth in front of it. Meanwhile, given the format of its stores, its real estate buildout should not be as expensive as that of traditional restaurants, and its stores still do solid sales with a $2 million AUV (average unit volume) in Q1.

While not without risks, as the company has not been generating free cash flow given its expansion, this looks like a strong regional-to-national expansion story. As such, Dutch Bros looks like a solid investment option for the long term.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Starbucks. The Motley Fool has a disclosure policy.