Global Investors Turn Cautious on Once Favorite Japanese Stocks

(Bloomberg) -- Japan’s record share market rally earlier this year is looking like a distant memory as foreign investors sell off stocks in a sluggish economy.

Citigroup Inc. and abrdn Plc are among banks that have turned more pessimistic toward the nation’s equities as the outlook for corporate governance reform and the Bank of Japan’s monetary policy remains uncertain. A fund manager survey by Bank of America Corp. showed about a third of respondents believe the market has peaked.

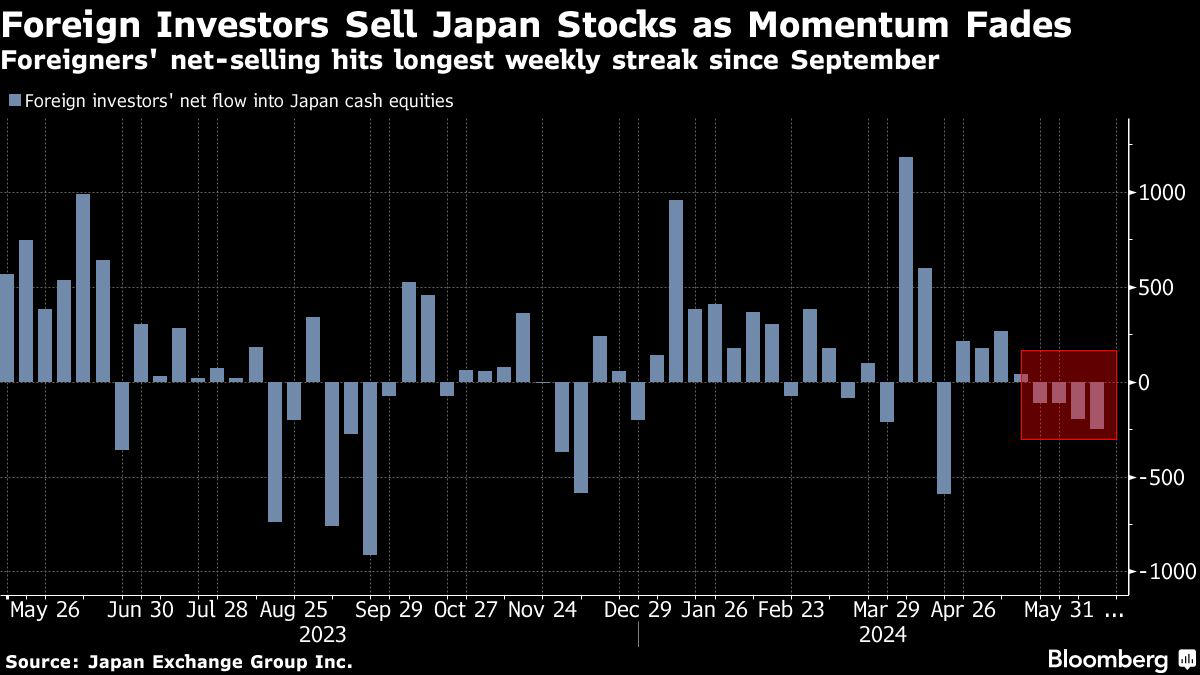

Foreign investors, who helped push up Japanese shares to a record high just a few months ago and beat overseas peers, became net sellers for a fourth straight week through June 14. That was the longest streak since September, according to Tokyo Stock Exchange data.

Japan’s blue-chip Nikkei 225 index has stalled since reaching an all-time high on March 22. It’s dropped 5.6% since then, compared with a 1% gain during the period for the MSCI AC Asia Pacific Index, and a 4.4% advance in the US’s surging S&P 500 Index.

Nikkei Lags Global Peers After Hitting Record in March

“The early optimism for Japanese stocks this year is clearly hitting a speed bump,” said Hebe Chen, an analyst at IG Markets Ltd. “Investors face the soul-searching question of whether the drivers for Japanese stocks are sustainable.”

Foreigners Sell

Factors that supported Japanese shares earlier are starting to drag on the market. Foreign investors that flooded in, attracted by Japan’s unprecedented push to improve shareholder value, are now selling, unloading a net ¥250 billion ($1.6 billion) worth of Japanese stocks in the week ended June 14, according to TSE data.

Japanese equities are facing “a material risk of correction,” and it’s likely to take a while before positive factors emerge, according to Citigroup analysts including Ryota Sakagami.

Yen Trades at Around Half The Value It Was in 2012

Weak Yen

Investors are becoming wary about the yen’s relentless slide. In the past they welcomed the weak currency as a boon for exporters, but the degree of the yen’s recent drop has put the focus on how it may harm Japan’s economy, including by boosting inflationary pressure.

See also: Japan’s Retail Investors Eye Risky Wagers on Yen Intervention

The yen depreciated on Friday to approach 160 per dollar, a level it hasn’t touched since April, prompting Japanese currency officials to warn against excessive foreign exchange moves.

“We would like to see some floor in terms of the weakening trend” of the yen, and that may benefit the domestic economy, JPMorgan Asset Management’s Aisa Ogoshi told Bloomberg TV.

Foreign Investors Sell Japan Stocks as Momentum Fades | Foreigners' net-selling hits longest weekly streak since September

Despite the recent sluggishness of shares though, several strategists including those at BlackRock Inc. and Morgan Stanley remain positive on Japan’s long-term outlook, citing structural changes including corporate reforms, domestic investments and wage growth.

BOJ Outlook

Investors will be closely watching whether the BOJ pushes ahead with its second interest-rate hike in July after lifting rates for the first time since 2007 in March. The Topix index for banks has climbed 30% this year, about double the gains of the overall Topix gauge, on expectations rising borrowing costs will help financial firms improve their lending margins.

But bets that the BOJ may go slow in raising rates has weighed on lenders more recently, with the bank index dropping 5.2% this month compared with a 1.7% decline in the Topix. The monetary authority surprised market players earlier this month by putting off until July the release of a plan to reducing bond buying. Swap rates are signaling that the odds of a rate hike in July have dropped to about 28% from around 66% at the start of the month.

Edinburgh-based abrdn Plc prefers Chinese and Indian stocks over their Japanese peers in the next three to six months, according to David Zhou, investment director of multi-asset and investment.

The firm is predicting that the right policy moves would help the two emerging markets attract fund inflows, Zhou said in an interview. As for Japan, foreign investors will probably need to see more progress on corporate governance reform before adding much there, he said.

--With assistance from Masaki Kondo.

Most Read from Bloomberg

©2024 Bloomberg L.P.