Could This Artificial Intelligence (AI) Stock Be the Next Nvidia?

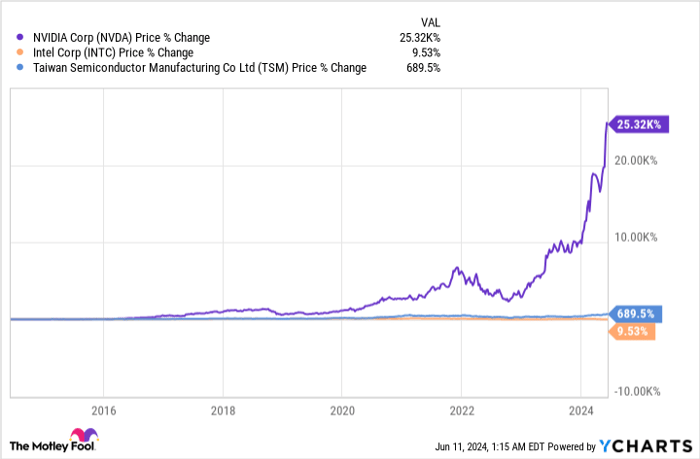

Over the past 10 years, the semiconductor sector has had a clear winner, Nvidia (NASDAQ: NVDA), and a clear loser, Intel (NASDAQ: INTC).

Intel ceded chip manufacturing leadership to Taiwan Semiconductor Manufacturing (NYSE: TSM) back in the 2010s. As AI computing on GPUs has emerged over the past two years, Intel saw share losses to Nvidia and other TSMC customers.

NVDA

However, CEO Pat Gelsinger, who was an Intel leader during its glory days, was brought in to turn "Chipzilla" around in 2021. Gelsinger embarked on an ambitious multiyear turnaround, and all of that money, time, and effort may be coming to fruition in 2025. If Intel executes, here's how it could reemerge as an industry leader.

Regaining technology leadership

The most important factor in Intel's comeback is whether or not it can leap ahead of TSMC in terms of manufacturing technology. Intel's failures to keep up in the 2010s allowed TSMC to surge ahead as a de facto monopoly on leading-edge chip manufacturing for the past several years.

However, not only has Gelsinger invested vast sums of money to retake TSMC by next year, but he's also attracted credible co-investors in the effort, including private equity firm Apollo (NYSE: APO), Brookfield Infrastructure (NYSE: BIP), and the U.S. government, which has doled out billions to Intel's effort via the 2022 CHIPS Act.

Gelsinger's ambitious plan to progress through "five nodes in four years" is on track per the company's recent commentary and will culminate in 2025, four years after Gelsinger took the helm, with the first production out of Intel's new 18A foundries. That's when Intel will allegedly produce semiconductors with transistors just 1.8nm apart. The 2025 releases of the Panther Lake PC chips and Clearwater Forest data center chips will be the first processors made on 18A and could be a turning point.

One very interesting news item is also that Intel purchased all five high-NA EUV machines produced by ASML (NASDAQ: ASML) this year, essentially boxing out TSMC and Samsung from purchasing these latest and greatest EUV machines for most of 2024. ASML is the only provider of this crucial chipmaking technology.

Previously, TSMC had said these advanced machines, which cost some $370 million a pop, wouldn't be economical to use until 2026 and that it would use double-patterning with low-NA EUV until then. However, it was recently disclosed that TSMC will now be receiving a high-NA machine at the end of this year. Perhaps this indicates that TSMC now sees the benefit of high-NA and is looking to catch up.

Meanwhile, Intel will already have five machines this year and will receive another at the end of this year to make six. Notably, Intel began testing high-NA wafers, or "first-light," on its first high-NA machine back in April.

If Intel's big bet on high-NA works out next year, it would amount to a massive shift in the balance of power in the tech world.

Letters A and I on an animated chip.

New Intel AI accelerators will also get a big makeover in 2026

While Intel is moving to process leadership, Nvidia CEO Jensen Huang has said that doesn't matter much anymore, because parallel computing via GPUs is leaving CPU-based computing in the past.

Intel disputes this, claiming CPUs will still have ample workloads in the future, especially for AI inference. But it's also seeking to compete with Nvidia in the AI GPU accelerator space, whose chips are needed for training.

This year, Intel forecasts over $500 million in revenue from the new Gaudi 3 accelerator. At the recent Computex conference, CEO Pat Gelsinger claimed Gaudi 3 offered 2.3 times the inferencing performance per dollar of Nvidia's H100 and two times the training performance per dollar.

Of course, that could be because Intel will be taking a lower price and margin than Nvidia and will not necessarily be making a more powerful chip. And Nvidia, which made $20 billion in data center chips last quarter alone, will already be moving onto its new Blackwell chip later this year. Furthermore, Gaudi also has some limitations due to its lack of open software programmability, plus the fact that the chip is actually made on TSMC's 5nm node, not in Intel's fabs.

However, in late 2025 or 2026, Intel will be combining Gaudi's technology with its own Xe GPU cores into a new GPU technology called Falcon Shores. This new chip will be programmable under Intel's OneAPI software platform, which Intel hopes to compete with Nvidia's CUDA. And Falcon Shores chip will reportedly consume 1500 watts of power, even more than the Nvidia B200's 1200 watts. Therefore, it's possible the upcoming chip may be more powerful than Nvidia's Blackwell.

Intel will also have brought back Falcon Shores production to its own fabs instead of using TSMC, so it could be not only more powerful but should also have a much higher margin.

OneAPI to break the CUDA moat?

The third leg of the stool in Intel's turnaround is its OneAPI software platform. Nvidia has a 15-year head start in developing its CUDA software to program GPUs, with a substantial installed base of developers who know CUDA very well and, therefore, likely opt for Nvidia GPUs because of it.

However, customers don't want to pay sky-high prices for Nvidia chips forever, and would likely prefer a platform that can program any kind of AI chip. So, Intel has decided to partner with seven other technology giants in expanding its oneAPI software, first introduced in 2018, which will be able to program virtually any kind of AI processor.

If successful, the openness would allow tech companies to opt for whichever hardware they wanted, breaking Nvidia's moat. While it's a big "if," having not one but seven giant tech companies teaming up to take on CUDA could eventually yield results.

If all three go right...

Intel no doubt put itself far behind in the AI races by falling behind on manufacturing technology and failing to anticipate the parallel computing capabilities of GPUs for AI. However, it's now far along in its plan to regain process leadership, introduce a competitive AI accelerator, and develop its new open-source AI software. If these efforts are successful, Intel may very well surprise investors next year.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Billy Duberstein and/or his clients have positions in ASML, Intel, and Taiwan Semiconductor Manufacturing and has the following options: short June 2024 $30 puts on Intel. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Brookfield Infrastructure Partners and Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.