Go Digit IPO last bidding date today: Should you subscribe or not? Check GMP, subscription status, other details

Go Digit IPO: The Go Digit General Insurance IPO, which opened for subscription on Wednesday, May 15, ends today (Friday, May 17). Although the issue struggled to get completely booked, retail investors showed a good deal of interest in it during the previous two days. The non-institutional investor portion fetched decent subscription numbers. Go Digit General Insurance IPO has been subscribed 79% on the second day of bidding on Thursday, as per BSE data.

A total of 2.54 times were subscriptions made from the retail individual investors (RIIs) component, and 73% were made fromthe non-institutional investors portion. The qualified institutional buyers (QIBs) fetched 24% subscription, as per BSE data.

Go Digit IPO, backed by the Fairfax Group in Canada, raised little over Rs. 1,176 crore from anchor investors. 56 funds have been granted 4.32 crore equity shares, which are valued at the top of the price range, by the company, according to a circular that was published late on Tuesday.

In the public offering, Go Digit IPO has set aside75% of the shares for qualified institutional buyers (QIB), 15% for non-institutional institutional investors (NII), and 10% for retail investors.

Go Digit General Insurance Limited is an insurance provider offering a range of insurance products, including customisable health, liability, property, marine, travel, and vehicle insurance coverage. The company has published 74 active items within its current business divisions.

The company's 2.67 lakh shares were purchased by cricket player Virat Kohli for ₹2 crore in 2020, while his wife, actress Anushka Sharma, invested 50 lakh in a private placement.

The listed peers of the firm are ICICI Lombard General Insurance firm Ltd. (P/E of 48.14x), Star Health and Allied Insurance Company Ltd. (P/E of 53.79x), and New India Assurance Company Ltd. (with a P/E of 38.47x).

Go Digit General Insurance IPO details.

Go Digit IPO details

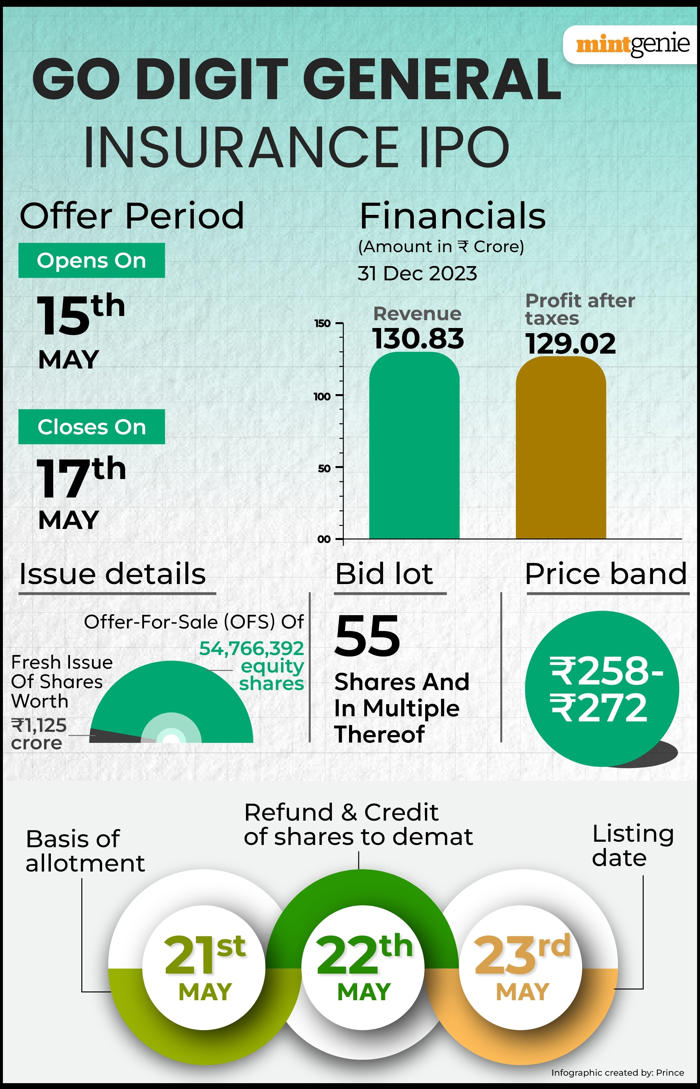

The Go Digit General Insurance IPO consists of an offer-for-sale (OFS) of 54,766,392 equity shares by the promoters and other selling shareholders, together with a fresh issue of ₹1,125 crore.

The company will use the net proceeds to support both the company's regular commercial operations and the projects that are suggested to be funded by the net profits. The firm anticipates benefits from the equity share listing on stock exchanges as well, believing that this would improve its brand awareness and reputation among current and future consumers.

The book running lead managers of the Go Digit IPO are ICICI Securities Limited, Morgan Stanley India Company Pvt Ltd, Axis Capital Limited, HDFC Bank Limited, Iifl Securities Ltd, and Nuvama Wealth Management Limited, with Link Intime India Private Ltd serving as the issue's registrar.

Go Digit IPO Review

Hem Securities

The brokerage claims that the company haslaunchedthe offering at a price range of ₹258–272 a share, with a P/GWP multiple of 3.44x based on annualised post-issue data from FY24 that ends in September. With cutting-edge technology and predictive underwriting algorithms, the company has reliable distribution partners. The company has good long-term prospects because of its size, number of policies, profitability, and age—six years old. In light of everything said above, the brokerage advises "Long Term Subscribe" on this issue.

Hensex Securities

Go Digit is one of the top providers of digital full stack insurance, according to the brokerage. The organisation has implemented cutting-edge technology in order to streamline its insurance documents. In terms of total GWP, the business raised its market share among general insurers from 2.3% in FY 2022 to 2.7% in FY 2023. In an effort to reach more customers, the corporation intends to establish new distribution alliances. As of December 31, 2023, the firm operated distribution networks in 24 of the 36 states and union territories that make up India. Investors with a long-term investment perspective are advised by the brokerage to subscribe to the issue.

Go Digit General Insurance IPO GMP today

Go Digit IPO GMP today is +14. This indicates Go Digit share price were trading at a premium of ₹14 in the grey market, according to investorgain.com.

Once the top end of the IPO pricing range and the existing premium on the grey market are taken into consideration, shares of Go Digit are anticipated to list at a price of ₹286 per share, which is 5.15% more than the IPO price of ₹272.

Based on last 9 sessions grey market activities, today IPO GMP points downward and expects to drop more. The lowest GMP is ₹14, while the highest GMP is ₹70, according to investorgain.com analysts.

'Grey market premium' indicates investors' readiness to pay more than the issue price.

Disclaimer: The views and recommendations above are those of individual analysts, experts and broking companies, not of Mint. We advise investors to check with certified experts before making any investment decisions.