Last Quarter, Warren Buffett Only Added to 1 Existing Position. In June, He's Bought Over $435 Million More of It.

Taking a look at what the smart money is doing on Wall Street can prove to be a useful exercise for investors. Following the end of each quarter, institutional investors such as hedge funds and wealth management firms are required by the Securities and Exchange Commission (SEC) to file a form called a 13F. It documents all the buying and selling activity from large, sophisticated investors, and provides a glimpse into where meaningful flows of capital are moving.

Last quarter, Warren Buffett's Berkshire Hathaway only added to one existing portfolio position: Occidental Petroleum (NYSE: OXY).

The Oracle of Omaha is following up his purchase from last quarter, as evidenced by new filings. According to Berkshire's latest Form 4, Buffett just scooped up another $435 million worth of Occidental Petroleum stock between June 13 and 17.

Let's explore why Buffett may be doubling down on this position in particular, and assess if you should follow his lead.

Understanding the mechanics of commodities

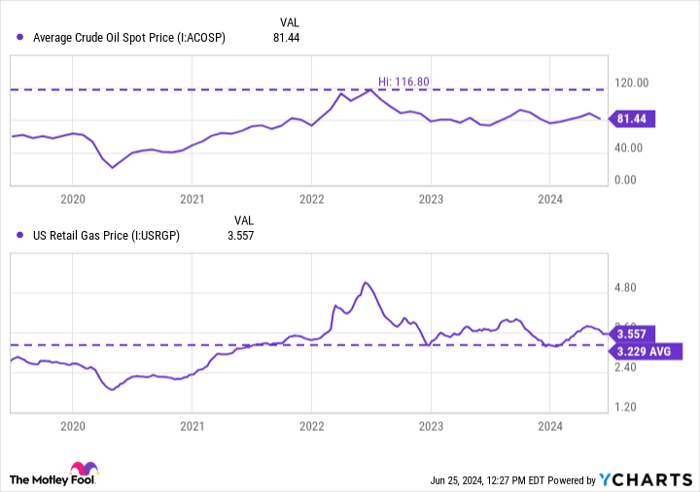

Occidental Petroleum specializes in the exploration and development of oil and natural gas. The chart illustrates the average spot price for crude oil over the last five years.

Average Crude Oil Spot Price

Clearly, the price of crude oil has come down considerably since peaking a couple of years ago. But that said, the current average spot price of roughly $81 remains notably higher than pre-pandemic levels.

One of the most important things to keep in mind is that oil and gas are commodities. Just like a stock price can fluctuate dramatically based on business results, commodity prices can be quite volatile.

Some reasons that commodities can ebb and flow relate to congressional policies or even developments in other parts of the world. One of the more obvious drivers of abnormal fluctuations in oil and gas in recent years can be tied to tensions in Eastern Europe between Russia and Ukraine.

Another key metric depicted in the chart is the price of gas in the U.S. As the average price for oil has normalized, so too has the price at the pump. However, at an average price of $3.56, gas prices are still higher than what consumers were used to not long ago.

Why Occidental Petroleum can benefit (in more ways than one)

While higher oil and gas prices may take a toll on the consumer, companies like Occidental Petroleum are benefiting greatly from them. It's important to keep in mind, however, that volatility in commodity prices goes both ways. Right now, higher prices are acting as a catalyst for Occidental Petroleum.

Another reason why Buffett might like Occidental is the company's new initiatives in carbon management. In recent years, governments and businesses around the world have made investment in green energy policies more of a priority. While traditional uses for oil and gas won't evaporate overnight, it's encouraging to see Occidental's management deploy its profits into future growth drivers outside its legacy business.

According to the company's first-quarter earnings report, management said that it expects its Low Carbon Ventures business "to generate cash flow detached from oil and gas price volatility and further strengthen Oxy's cash flow resiliency."

One of Buffett's investing commandments is taking positions in businesses that generate steady cash flow. Although Occidental Petroleum may experience some dramatic fluctuations in revenue and profits from time to time, the long-term thesis remains strong.

Oil and gas should continue to serve as a major business driver for the company. And with new opportunities in sustainable energy, Occidental Petroleum is quietly building an attractive, diversified business model.

An oil rig in a field.

Should you buy Occidental Petroleum stock right now?

Roughly halfway through the year, the S&P 500 has gained 14%, while the Nasdaq Composite has soared roughly 18%. Moreover, the energy sector has done particularly well -- gaining nearly 7%. Despite these performances, Occidental Petroleum stock's gain of 5% underperforms across the board.

My hunch is that investors are looking elsewhere for growth. It's no secret that the technology sector is having a moment right now. Furthermore, as the macroeconomy remains challenged by stubborn levels of inflation and a high-interest rate environment, some investors might be avoiding volatile opportunities in oil and gas.

However, the current conditions of the oil and gas market are actually contributing to Occidental's growth right now. Moreover, long-term investors understand that taking positions in any company based on current market trends is shortsighted.

I think Occidental Petroleum could be a good opportunity for investors right now. I suspect that the oil and gas business will continue to thrive over the long run. Even if commodity prices begin to normalize, I'm optimistic that the company's carbon capture business will quickly emerge as a new source of growth, thereby mitigating some of the volatility risk in Occidental's legacy operation.

Should you invest $1,000 in Occidental Petroleum right now?

Before you buy stock in Occidental Petroleum, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Occidental Petroleum wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.