Is Now the Time to Buy SoFi Technologies?

Fintech company and digital bank SoFi Technologies (NASDAQ: SOFI) can't catch a break. The stock has tumbled and is near a 52-week low and is a whopping 75% off its all-time high. Stocks can go up or down for whatever reason in the short term but tend to follow the direction of the underlying business over time.

So, do SoFi's business fundamentals indicate an eventual winner, or should investors avoid this troubled name?

I dug into the company, and what I found helped explain the stock's struggles and why things could soon get better. Here is what I found that makes SoFi a potential buy today.

Starting with the obvious

SoFi is primarily a digital bank, though it does operate a fintech unit that offers infrastructure services via Galileo and Technysis. The company began with student loans but has built a diversified banking platform that provides a range of financial products and services through its smartphone app. SoFi doesn't have brick-and-mortar branches. The app is convenient and offers a low-cost way to cross-sell to users.

The most obvious success of SoFi's business is how much it seems to resonate with users. SoFi has demonstrated consistently robust member growth, from just over 1 million members in early 2020 to over 8.1 million in just four years. Additionally, SoFi's app carries a 4.8-star rating (out of five) on the iOS store, based on nearly 350,000 reviews. Given the ratings and the growth, it seems clear that SoFi is delivering a great product to users.

Why has SoFi's stock struggled?

SoFi's multiple parts make evaluating the stock potentially tricky. However, it seems there is an explanation for the stock's poor performance to date. Simply put, the company's financials couldn't justify the valuation at the time it went public. SoFi was trading at between 4 and 6 times its book value back in the summer of 2021, a really expensive multiple for a bank stock (it was awarded its charter in January 2022).

As you might know, the growth stock bubble popped in early 2022. Valuations of speculative stocks plunged. Now, why hasn't SoFi gotten up off the floor, so to speak, especially given its tremendous growth?

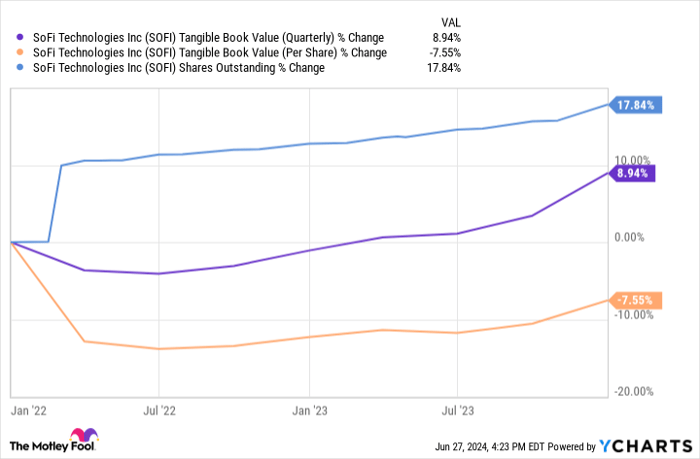

In short, SoFi did not meaningfully increase its book value per share for much of 2022 and 2023. In fact, it declined.

SoFi dramatically raised its share count in 2022 and 2023, which more than offset the company's gains in total book value:

SOFI Tangible Book Value (Quarterly)

SoFi may have been growing in more ways than one, but not its book value per share. For a bank, that's a cardinal sin that investors haven't overlooked.

Why now is the time to buy

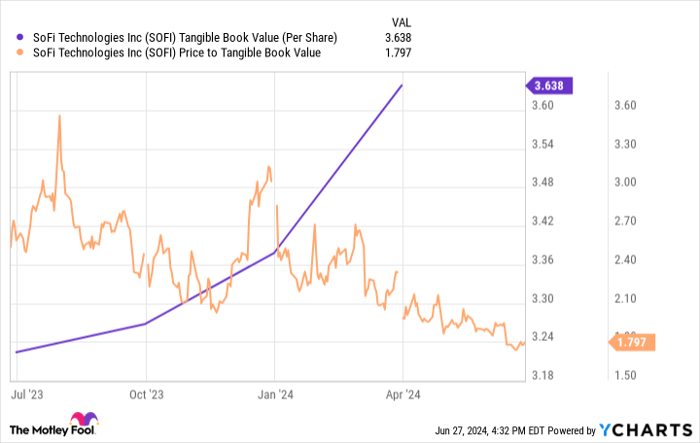

The excellent news for investors is that the tide is quickly shifting. Book value per share has begun growing meaningfully. This started in late 2023 and is picking up steam:

SOFI Tangible Book Value (Per Share)

Meanwhile, the rising book value and falling share price have finally made SoFi a less expensive stock than established blue chip banks like JPMorgan Chase, which currently trades at about 2.3 times its book value.

It seems fair for a less-proven bank to trade at a discount to arguably the world's most renowned financial institutions. Fortunately, SoFi shouldn't need a higher valuation to deliver stellar returns. Assuming SoFi's book value per share continues to ascend, investors could easily realize that growth as investment returns.

It's been a tough stretch for SoFi investors, but the stock didn't deserve the valuation it had for a few years. Now that the issue is corrected and SoFi is meaningfully increasing its book value per share, investors could enjoy future stock performance that reflects the good things SoFi's business has been doing for years.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $759,759!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.