3 Unstoppable Tech Stocks to Buy Without Any Hesitation

Tech stocks are hot right now. The S&P 500 is near its all-time high and megacap tech stocks dominate the index. Additionally, the Nasdaq-100 Technology Sector Index is just days away from its all-time high. Any way you look at it, it's a good time to be a tech investor.

This party won't last forever, though, and a pullback in tech stocks is inevitable at some point. This is why it's a smart strategy to identify the strongest businesses in the sector and put some investment dollars into them. Every stock slides at some point, but the stronger the underlying business, the quicker the recovery should be. With that in mind, here are three tech stocks you can buy without hesitation.

ASML

Dutch manufacturer ASML (NASDAQ: ASML) builds the lithography machines that are necessary to manufacture semiconductor chips. These machines cost hundreds of millions of dollars apiece and are the size of large shipping containers. For the most cutting-edge chip manufacturing, extreme ultraviolet lithography machines are necessary, and ASML is the only company in the world capable of supplying them.

In Q1, ASML's revenue fell by 22% year over year to 5.3 billion euros. For some companies, that sort of slide in revenue might be concerning, but the semiconductor industry is still in a cyclical downturn (despite all the artificial intelligence headlines), and this revenue result was expected by ASML.

What's important is that ASML is continuing to invest heavily during this industry down cycle so it can be ready when the cycle swings back upward. Management views 2024 as a transition year, and expects to see a return to growth in 2025.

Datadog

Business software company Datadog (NASDAQ: DDOG) helps businesses keep track of their computer systems, applications, and cloud services to ensure they're running smoothly. It does this through an integrated platform that removes the traditional silos that keep various aspects of monitoring separate from one another.

For investors who may not work in a field where this kind of software is necessary, the importance of this kind of software might not be immediately obvious. However, Datadog's results tell a clear story. In Q1, its revenue grew by 27% year over year, its bottom line improved from a loss of $0.08 per share to earnings of $0.12 per share, and the company generated $187 million in free cash flow.

Investors should keep an eye on Datadog's customer metrics. The number of customers contributing $100,000 or more in annual recurring revenue (ARR) increased by 15% in the quarter, and almost half of its customers now use four or more of its products. It takes less money to get current customers to spend more than it does to attract new customers, so as these metrics grow, its profitability should follow.

ServiceNow

ServiceNow (NYSE: NOW) sells software to enterprise customers that helps manage things like information technology, human resources, and customer service management. As with Datadog, because these products are not consumer-facing, their value and importance can be overlooked. But here too, the company's results should help investors understand just how critical these products can be.

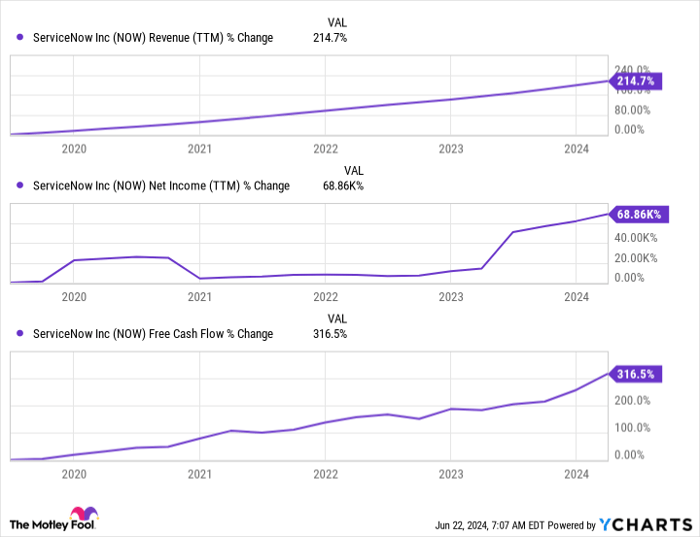

What sticks out about ServiceNow is how impressive its results have been over long periods. Consider revenue, net income, and free cash flow over the last five years.

NOW Revenue (TTM)

Management expects this type of growth to continue. In its Q1 earnings report, the company raised the low end of its full-year revenue guidance and expects growth to be approximately 22%. It is guiding for a free cash flow margin of 31%. Consistency is what has made ServiceNow one of the best tech stocks to own over the past decade, and there's no evidence that it's poised to slow down in the near term.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $723,729!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Jeff Santoro has positions in ASML, Datadog, and ServiceNow. The Motley Fool has positions in and recommends ASML, Datadog, and ServiceNow. The Motley Fool has a disclosure policy.