Barclays boss says calls for bank to abandon oil and gas are unrealistic

CS Venkatakrishnan, Barclays chief executive, says global economy 'cannot go cold turkey on [oil and gas] tomorrow' - Barclays

The boss of Barclays said it is unrealistic for banks to abandon oil and gas, as he hit back at growing scrutiny of the ties between finance firms and the fossil fuel industry.

CS Venkatakrishnan said lenders “cannot go cold turkey” on the fossil fuel sector, despite its contribution to global warming.

His comments come after Barclays has come under repeated pressure from climate activists with the bank’s branches targeted by Just Stop Oil.

It also follows reports that Cambridge University is considering cutting ties with the bank over its climate change record.

Mr Venkatakrishnan insisted Barclays is “very much moving away from” coal and oil, but warned that fossil fuels will be around “for quite some time”.

The Barclays boss told the Bloomberg Sustainable Finance Forum in London that the bank has the “ambition to be a net zero company in financed emissions” by 2050.

He said: “We have aggressive targets on energy and power and other sectors to 2030. We are adding to that cement and aviation.

“The end has never been in question.

“The only thing that has been questioned is: how fast and are there some activities that you would not do?

“So, for instance, coal or Arctic oil sands are things we would not do.

“We are very much moving away from coal to oil, oil to gas, gas to clean energy and the reality is that for quite some time fossil fuels will be with us, especially natural gas.

“So that glide path is long and the world economy cannot go cold turkey on this tomorrow.

“That was the commitment that we made and we made a statement of how aggressively we were going to do it.”

In February Barclays announced it would stop directly financing new oil and gas projects after bowing to pressure from net zero activists.

Yet the move did little to stem pressure from campaigners.

Wimbledon organisers have put on extra security to prepare for the next wave of protestors who are planning to disrupt Britain’s Grand Slam which starts on July 1, where Barclays is a sponsor.

Read the latest updates below.

06:07 PM BST

Signing off...

Thanks for joining us today. We’ll be back blogging about the markets tomorrow morning, but I’ll leave you with the latest article by Ambrose Evans-Pritchard:

The director of the Bruegel think tank in Brussels once asked what would happen if a eurozone state ever attempted a variant of Trussonomics, without the protection of its own sovereign central bank and policy instruments. We may find out as soon as the first round of voting in the French elections this Sunday.

Jeromin Zettelmeyer said the Truss-Kwarteng accident was humiliating but was corrected quickly with no lasting damage.

“The UK’s political and economic institutions absorbed the shock. Now think of something like this in the eurozone with, say, a populist Right-wing party in France trying to pull a Liz Truss. The consequences would be disastrous,” he said.

Read the full piece...

Liz Truss at the Tory party conference last year - Paul Grover

05:44 PM BST

Nasdaq jumps by more than 1pc

The tech-heavy Nasdaq jumped by 1pc on Tuesday, buoyed by strength in Nvidia and other megacaps, while the Dow slipped as investors awaited a crucial inflation print this week for further cues on the US monetary policy path.

AI chip firm Nvidia soared 6pc, recovering some of the steep losses it had notched in three consecutive declining sessions. At current levels, the stock is still 12pc away from last week’s record high.

Brian Klimke, Cetera Investment Management’s chief market strategist, said:

The Nvidia story is currently more of a technical one, and not necessarily fundamental. It could be a great stock in the long run, but investors just need to be cautious.

Chip companies Arm, Broadcom and Applied Materials also gained 2pc to 4pc.

The recent pullback in tech and tech-adjacent stocks had prompted investors to lap up lagging sectors, with utilities and energy enjoying strong gains on Monday.

“We’ve been calling for broadening to other segments for a while. Indexes are really concentrated within a few top holdings, so even though you’ve been hurt recently by these names doing so well, it’s good to be diversified,” Mr Klimke added.

05:40 PM BST

Why politicians can’t have a ‘sensible conversation on tax’

Politicians are unable to have a ‘sensible conversation on tax’ because they have no plan to make public services less wasteful, a leading economist has said.

05:34 PM BST

LVMH’s Bernard Arnault buys stake in rival

Bernard Arnault, the billionaire founder of Moët owner LVMH, has bought shares in rival Richemont, according to a FT report.

The purchase of stake in the owner of Cartier jewellery is understood not to signal a takeover approach, with sources suggesting to the FT that it was just one of many investments made by Mr Arnault.

LVMH and Richemont have been approached for comment.

Bernard Arnault, chief executive of LVMH, in January - Stephanie Lecocq/Reuters

05:14 PM BST

FTSE 100 slides as investors wary ahead of data and election

The FTSE 100 closed lower on Tuesday as investors stayed cautious ahead of economic data that could sway expectations on the path of US and UK interest rates, and Burberry’s losses weighed on the market.

The blue-chip FTSE 100 was down 0.4pc at 8,247.79 points.

UK gross domestic product (GDP) is due this week and could potentially add to Bank of England (BoE) policymakers’ confidence of an interest rate cut in August.

UK parliamentary elections on July 4 are adding to general caution and investors also expect the BoE to refrain from releasing minutes of its meeting ahead of the polls.

Melrose shares fell after plane making giant Airbus, a key client, announced a profit warning, citing a shortage of plane parts for pushing expected deliveries down.

Dan Coatsworth, investment analyst at AJ Bell, said:

It is tempting to think that life will be simpler if your biggest rival is a terrible mess and Boeing’s woes are a potential boon for Airbus.

However, the European firm is encountering some turbulence of its own and that is having a knock-on effect upon the companies that form part of its supply chain.

Shares in engineers Melrose, Rolls-Royce and Bodycote slid lower, alongside those of European manufacturers MTU Aero Engines and Safran, as Airbus tumbled to a seven-month low.

05:03 PM BST

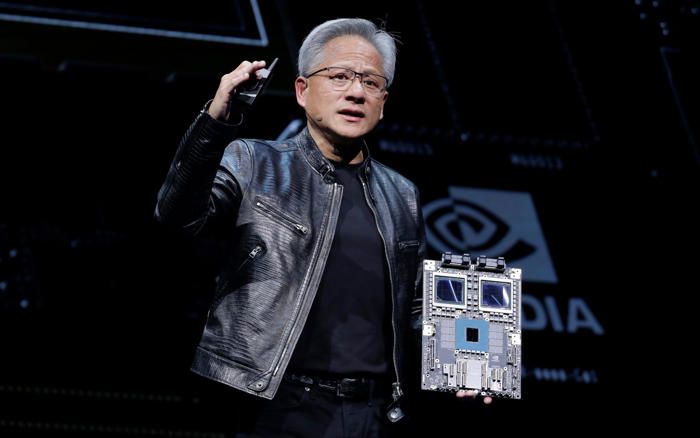

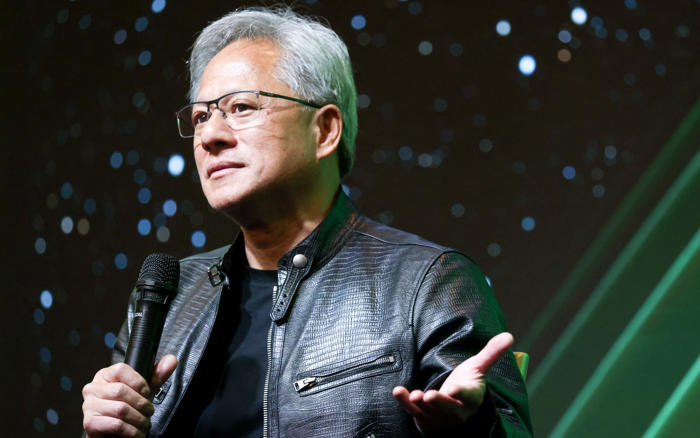

Nvidia sell-off unrelated to to ability to generate ‘epic profits’, says analyst

Nvidia was back in the green today Tuesday after diving by 15pc from its high on Thursday over concerns that the tech sector’s rally had gone too far.

The US company had briefly become the world’s biggest publicly listed firm last week, with a market capitalisation of more than $3.3 trillion (£2.6 trillion).

The Nvidia sell-off “was not driven by fundamental factors”, said Kathleen Brooks, research director at XTB trading platform. “The company is still expected to generate epic profits for this quarter.”

Nvidia boss Jensen Huang delivers a speech during the Computex 2024 exhibition in Taipei earlier this month - Chiang Ying-ying/AP

04:53 PM BST

Footsie closes down

The FTSE 100 closed down 0.4pc. The biggest riser was insuer Admiral, up 2.3pc, followed by easyJet, up 1.9pc. The biggest faller was Burberry, down 4.5pc, followed by medical products business ConvaTech, down 4.1pc.

Meanwhile, the mid-cap FTSE 250 fell 1pc. The top riser was cruise operator Carnival, up 9.4pc, followed by Sdcl Energy Efficiency Income Trust, up 5.9pc. The biggest faller was Ocado, down 7pc, followed by heat treatment services company Bodycote, down 5.6pc.

04:47 PM BST

US dollar gains after hawkish Fed comment

The US dollar rose against most major currencies on Tuesday, bolstered by hawkish comments from a Federal Reserve official as well as better-than-expected economic data in the world’s largest economy that suggested the central bank will not be in a rush to kickstart its rate-cutting cycle.

The dollar firmed against sterling, the euro and the yen.

Fed Governor Michelle Bowman started the ball rolling for the dollar, repeating her view on Tuesday that holding the policy rate steady “for some time” will likely be enough to bring inflation under control. She also reiterated that she “remains willing” to raise borrowing costs if needed.

Further boosting the dollar was a report showing US single-family home prices increased at a steady pace in April, rising 0.2pc on the month after being unchanged in March. In the 12 months through to April, house prices increased 6.3pc after advancing 6.7pc in March.

US consumer confidence slightly eased in June, with the index at 100.4 from a downwardly revised 101.3 in May, according to business group the Conference Board. The June number, however, was marginally higher than the market forecast of 100.

The dollar actually extended its gains after the consumer confidence data.

Thierry Wizman, of Macquarie in New York, said:

The weakness in some of the previous data such as retail sales and jobless claims is not really enough to spark an FX [foreign exchange] rally or dollar weakness.

04:35 PM BST

China hopes EU will pursue a ‘rational, pragmatic’ policy towards the country, foreign minister says

China hopes the EU will pursue a “rational and pragmatic” policy towards the country, its foreign minister Wang Yi said in a phone call with Hungarian foreign minister Peter Szijjarto today.

China hoped the EU would uphold an open stance, and move in the same direction as China to ensure the healthy and stable development of Sino-European relations, the foreign ministry quoted Mr Wang as saying.

China believed Hungary would play a positive and constructive role in the benign interaction between China and Europe, Mr Wang added.

China's foreign minister Wang Yi attends a meeting of foreign ministers of the Brics group of nations in Nizhny Novgorod, Russia, on June 10 - Maxim Shemetov/Reuters

04:24 PM BST

Swiss hope to secure new deal with EU this year, president says

Switzerland is looking to wrap up a deal to update its relationship with the European Union this year, its president said on Tuesday, after previous attempts spanning years foundered over concerns about Swiss sovereignty.

Unrestricted access to the EU market is the cornerstone of the plan, which aims to update existing accords and conclude new sectoral agreements in areas including electricity and food safety, the Swiss government has said.

Viola Amherd, the Swiss president, said:

The political goal is to conclude the negotiations this year. Our motto is as fast as possible, as slow as necessary.

Wealthy, neutral Switzerland has long had powerful internal resistance to closer integration with the EU, even as supporters of closer ties warn that the country cannot expect to benefit from the bloc without making concessions.

Ms Amherd said finding a deal quickly was in the interests of Switzerland, its economy, its industry and its research.

04:13 PM BST

Shein’s float to be a ‘badge of shame’ for the London Stock Exchange, claims charity

Amnesty International has claimed that Shein’s potential London initial public offering would be a “badge of shame” for the London Stock Exchange because of the fast-fashion firm’s “questionable” labour and human rights standards.

Shein confidentially filed papers with Britain’s markets regulator in June, two sources told Reuters on Monday, kicking off the process for a potential London listing later this year.

Dominique Muller, an Amnesty International researcher specialising in the garment industry, said: “Rewarding Shein’s current methods via a flotation would be a badge of shame for the London Stock Exchange.”

A Shein spokesman said:

Shein is investing millions of pounds in strengthening governance and compliance across our supply chain.

Our regular supplier audits are showing a consistent improvement in performance and compliance by our supplier partners. This includes improvements in ensuring that workers are compensated fairly for what they do.

As a result of our efforts, research conducted by our third-party auditors across more than 4,000 workers at Shein supplier facilities in China has found that they earn basic salaries (before overtime) that are, on average, two times higher than the local minimum wage, and more than 50pc higher than the Global Living Wage Coalition’s 2022 living wage for Shenzhen.

Shein’s listing plans had run into political opposition in the United States over labour concerns.

The China Securities Regulatory Commission (CSRC) earlier this year informed Shein the regulator would not recommend a US IPO due to the company’s supply chain issues, according to reports.

Shein executives recently met with Amnesty representatives and subsequently responded in writing to a series of human rights related questions, Amnesty International said.

The London Stock Exchange Group has been approached for comment.

Workers producing garments at a factory that supplies clothes to fast fashion e-commerce company Shein in Guangzhou, China - Jade Gao/AFP

04:10 PM BST

Wealth tax needed on ‘undertaxed billionaires’, claims French academic hired by G20 presidency

An annual 2pc levy on fortunes exceeding $1bn (£790m) is the starting point for a global proposal to increase the burden on undertaxed billionaires, French economist Gabriel Zucman said on Tuesday.

Prof Zucman was commissioned by the Brazilian G20 presidency to present a report on the issue for discussion by the finance ministers of the world’s 20 largest economies at a meeting in July.

He said:

The goal of this blueprint is to offer a basis for political discussions - to start a conversation, not to end it. It is for citizens to decide, through democratic deliberation and the vote, how taxation should be carried out.

Prof Zucman, an academic at the Paris School of Economics and the University of California, Berkeley, stressed that enhanced transparency on company ownership would aid tax authorities in its potential implementation.

According to the economist, implementing the rule would raise $200bn to $250bn annually in tax revenue from about 3,000 individuals.

Extending the tax to those with over $100m would generate an additional $100bn to $140bn , he said.

04:03 PM BST

Europe stocks drop on renewed French vote fears

European stock markets has slid today as jitters resurfaced over impending French elections.

In Europe, Paris, London and Frankfurt were all in the red in afternoon trading.

The focus was on the upcoming elections in France on Sunday, which will be followed by a second round on July 7.

President Emmanuel Macron called the snap legislative polls after his centrist party was trounced by the populist National Rally (RN) in European Parliament elections two weeks ago.

The euro remains supported even as some opinion polls show the RN leading, with a Left-wing alliance in second and Macron’s centrists third.

03:54 PM BST

Oil price rises to near two-month high before stalling

Oil prices are down today, with Brent crude currently down 0.2pc, although the red ink was rather more severe just before 1pm.

Prices are up 11.4pc since the start of the year.

Axel Rudolph, senior market analyst at online trading platform IG, said:

The recent oil price rise on the back of heightened geopolitical tensions and higher anticipated summer demand stalled on Tuesday below its near two-month high ahead of US API [American Petroleum Institute] crude oil inventories.

03:48 PM BST

Lufthansa to add environmental charge to UK fares

German airline giant Lufthansa said Tuesday it would add an environmental charge of up to €72 (£61) to fares in Europe - including the UK - to cover the cost of increasing EU climate regulations.

The extra cost will be added to all flights sold and operated by the group departing from EU countries as well as Britain, Norway and Switzerland, it said in a statement.

It will apply to flights from January next year and, depending on the route and fare, will vary from one to €72.

The group - whose airlines include Lufthansa, Eurowings, Austrian, Swiss and Brussels Airlines - said it is facing extra costs from EU regulations related to sustainable aviation fuel.

The EU legislation requires airlines to gradually increase use of the fuel on routes departing EU airports.

Carriers will need to include two per cent of SAF in their fuel mix from next year, rising to six per cent in 2030 and then soaring to 70 per cent from 2050.

An Lufthansa Airbus A380 at Frankfurt, Germany, 2019 - Kai Pfaffenbach/Reuters

03:44 PM BST

Microsoft breached competition rules with Teams, claims European Commission

Microsoft violated European Union competition rules with “possibly abusive” practices by tying its Teams messaging and videoconferencing app to its widely used business software, the bloc has claimed.

The European Commission said it has informed Microsoft that it believes the US tech giant has been “restricting competition” by bundling Teams with Microsoft 365, the subscription service that includes Word and Excel.

The advantage this gives might have been widened by limits on the ability of rival messaging apps to work with Microsoft software, it said.

Brad Smith, president of Microsoft, said:

Having unbundled Teams and taken initial interoperability steps, we appreciate the additional clarity provided ... and will work to find solutions to address the Commission‘s remaining concerns.

In April, the company gave customers worldwide the option to get Microsoft 365 and Microsoft Office without Teams.

Microsoft now has a chance to respond to the accusations before the commission makes its final decision. The company could face a fine worth up to 10pc of its annual global revenue, or be forced to carry out remedies to satisfy the competition concerns.

03:42 PM BST

Nasdaq gains as chip stocks recover ground

The Nasdaq jumped on Tuesday as Nvidia and other AI-linked stocks rose after bruising selloffs, while the Dow slipped from a one-month high as investors awaited key inflation data this week for further cues on the Fed’s monetary policy path.

AI chip firm Nvidia advanced 3pc, recouping some losses after three consecutive days of declines. The stock has still lost 11pc since a record high close last week.

The US listing of Taiwan Semiconductor Manufacturing, Broadcom and Qualcomm were up between 0.5pc and 1.6%pc, while an index of semiconductor stocks gained 0.8pc after slumping over 3pc in the previous session.

The S&P 500 technology sector gained 1pc, recovering some of Monday’s losses.

Sectors including utilities and energy pulled back after rising in Monday’s session, while the industrial and material sectors led declines.

03:39 PM BST

Ukraine’s Zelenskiy hails start of EU accession talks

President Volodymyr Zelenskiy hailed the official start of the EU accession negotiations with his country saying that the European project was only truly complete with Ukraine as its part.

“As of today, we have full confidence – Ukraine will definitely become a full member of the European Union,” he said in a video address from Kyiv published on his Telegram channel.

03:38 PM BST

Tesla’s futuristic new Cybertruck is recalled - for the fourth time

Tesla is recalling its futuristic new Cybertruck pickup for the fourth time in the US to fix problems with trim pieces that can come loose and front windshield wipers that can fail.

Tesla has recalled the stainless steel-clad Cybertruck four times since it went on sale Nov. 30.

The new recalls, announced in documents posted Tuesday by the National Highway Traffic Safety Administration, each affect more than 11,000 trucks.

The company says in the documents that the front windshield wiper motor controller can stop working because it is getting too much electrical current. A wiper that fails can cut visibility, increasing the risk of a crash.

The company says it knows of no crashes or injuries caused by the problem.

A Tesla Cybertruck at the Tesla Gigafactory, in Austin, Texas, earlier this month - Eric Gay/AP Photo

03:30 PM BST

US consumer confidence edges lower

American consumers lost some confidence in June as expectations over the near-term future fell again in a potential boost to hopes for interest rate cuts.

The Conference Board, a business research group, said that its consumer confidence index fell in June to 100.4 from 101.3 in May. The index’s decline was not quite as bad as analysts were expecting.

The index measures both Americans’ assessment of current economic conditions and their outlook for the next six months.

The measure of Americans’ short-term expectations for income, business and the job market fell to 73 from 74.9 in May. A reading under 80 can signal a potential recession in the near future.

Consumers’ view of current conditions rose in June to 141.5, up from 140.8 in May.

With that I will head off for the day and hand over the reins to Alex Singleton, who will keep the live updates coming.

03:14 PM BST

Canada inflation unexpectedly rises to 2.9pc weeks after rate cut

Inflation in Canada unexpectedly ticked up to 2.9pc in May led by higher prices for services, the national statistical agency said, three weeks after it announced its first interest rate cut in four years.

Analysts were expecting a slight slowing following a 2.7pc hike the previous month.

Statistics Canada said prices increased in May for rent and mortgage interest costs, travel tours and airfares, petrol and car insurance premiums, and groceries.

Housing prices, and the costs of telephone and Internet services, computers and men’s clothing fell in the month.

Announcing a first rate cut since 2020 earlier this month, governor Tiff Macklem said that “monetary policy no longer needs to be as restrictive”.

Desjardins analyst Royce Mendes said: “The past few months had seen price pressures cooling more than expected, so today’s release might simply represent some give back.”

03:00 PM BST

Frankfurt skyscraper owner files for insolvency amid German property crisis

The owner of a prominent skyscraper in Germany’s banking capital of Frankfurt has filed for insolvency, as the country reels from its biggest property crisis in a generation.

The tower, described on its website as an “essential part of the Frankfurt skyline”, is home to part of Germany’s central bank and to Deka, one of its biggest asset managers.

Geschaeftshaus am Gendarmenmarkt, which owns the 186-metre, 45-floor Trianon building, filed for insolvency in a Frankfurt court on Monday and an insolvency manager has been appointed, a filing published today showed.

For years, low interest rates, cheap energy and a strong economy sustained a boom across the German property sector, which broadly contributes €730bn (£615bn) a year to the nation’s economy, or roughly a fifth of Germany’s output.

That boom ended when rampant inflation forced the European Central Bank to swiftly raise borrowing costs.

Real-estate financing dried up, deals fizzled, projects stalled, major developers went bust, and some banks teetered. The industry has called on Berlin to intervene.

The owners of the Trianon building, which is part of the skyline of Frankfurt's financial district, have filed for insolvency - Alex Kraus/Bloomberg

02:38 PM BST

Wall Street gains as Nvidia bounces back

The Nasdaq and the S&P 500 opened higher as Nvidia and some other AI-linked stocks rose after bruising selloffs.

The Dow Jones Industrial Average fell 12.42 points, or less than 0.1pc, at the open to 39,398.79 as investors awaited crucial inflation data due later this week.

The S&P 500 opened higher by 12.86 points, or 0.2pc, at 5,460.73, while the Nasdaq Composite gained 75.34 points, or 0.4pc, to 17,572.16 at the opening bell.

02:24 PM BST

Three big banks slash mortgage rates ahead of election

Three of the UK’s biggest lenders have cut their fixed mortgage rates in the past week in anticipation of interest rate cuts after the election.

Our senior money writer Fran Ivens has the details:

HSBC has followed Barclays and NatWest to become the latest lender to bring down home loan costs, and more are expected to follow.

The bank will cut rates across its residential and buy-to-let loans from Wednesday, June 26.

On Monday, Barclays announced rate cuts of up to 0.31 percentage points for home buyers.

Last week, the Bank of England held its Bank Rate at 5.25pc for the seventh time despite inflation falling to its target of 2pc in May.

Read why analysts think there is space for lenders to lower rates from their current levels.

02:08 PM BST

Banks ‘cannot go cold turkey’ on oil and gas, says Barclays boss

The boss of Barclays has said it is unrealistic for the financial sector to abandon the oil and gas industry amid increasing activism from climate campaigners.

CS Venkatakrishnan said banks “cannot go cold turkey” on the fossil fuel sector despite its contribution to global warming.

He insisted that Barclays is “very much moving away from” coal and oil, but cautioned that the “reality is that for quite some time, fossil fuels will be with us”.

The Barclays chief executive told the Bloomberg Sustainable Finance Forum in London that this was particularly true for natural gas, as industry switches towards less polluting forms of energy.

It comes as Wimbledon organisers have put on extra security to prepare for the next wave of protesters who are planning to disrupt Britain’s Grand Slam which starts on July 1, where Barclays is a sponsor.

It emerged last week that the University of Cambridge is considering cutting ties with Barclays and Lloyds amid concerns over the banks’ investments in fossil fuels.

In February, the bank announced it would stop directly financing new oil and gas projects after bowing to pressure from net zero activists.

Barclays chief executive CS Venkatakrishnan said banks cannot 'go cold turkey' on the oil and gas industries - Lam Yik/Bloomberg

01:49 PM BST

Shein listing would be ‘badge of shame’ for UK, says Amnesty International

A £50bn listing in the UK by Chinese retailer Shein would be “a badge of shame for the London Stock Exchange”, Amnesty International has said, as it questioned the fast-fashion giant’s human rights record.

The brand has drawn criticism for the allegedly poor working conditions in its factories.

More recently, Marco Rubio, a US senator in the race to be Donald Trump’s presidential running mate, sent a letter to the Chancellor this week calling for an investigation ahead of Shein’s potential £50bn London stock market listing, accusing the company of using “slave labour and sweatshops”.

Amnesty International researcher Dominique Muller said:

It’s deeply troubling that a company with questionable labour and human rights standards and an unsustainable fast fashion business model could be set to reap hundreds of millions of pounds via a sale of shares and a listing on the London Stock Exchange.

Where Shein goes, others will try to follow. The UK authorities and the London Stock Exchange should not facilitate Shein’s listing until transparent and binding safeguards regarding internationally accepted human rights standards covering its entire supply chain are agreed and applied, and any abuses identified fully remedied.

Rewarding Shein’s current methods via a flotation would be a badge of shame for the London Stock Exchange, the bankers helping bring it to market, and any investors set to profit from it.

It would be an appalling example of a process which delivers for the rich by squeezing the poor. It validates the view that it is acceptable to regard workers and their rights, company products and the environment as expendable – which cheapens us all.

British influencer Cally Jane browses Shein clothing at a recent Liverpool pop-up - Anthony Devlin/Getty Images

01:26 PM BST

US economy still not ready for interest rate cuts, says Fed governor

The US economy still faces too many inflation risks to consider cutting interest rates, according to a Federal Reserve governor.

Michelle Bowman said prices could still rise as a result of the American economy benefiting from improvements in supply chains and limited growth in new people joining the jobs market.

Interest rates in the US stand at 23-year highs of 5.25pc to 5.5pc, where they have stood since July last year.

Speaking at Policy Exchange in London, she said:

We are still not yet at the point where it is appropriate to lower the policy rate.

Given the risks and uncertainties regarding my economic outlook, I will remain cautious in my approach to considering future changes in the stance of policy.

Reducing our policy rate too soon or too quickly could result in a rebound in inflation, requiring further future policy rate increases to return inflation to 2pc over the longer run.

US Federal Reserve governor Michelle Bowman spoke at Policy Exchange in London - Julia Nikhinson/Bloomberg

01:10 PM BST

Robinsons squash maker suspends share buybacks after Carlsberg takeover bid

Britvic, the maker of Robinsons squash, has announced it is suspending its £75m share buyback plans after a £3.1bn takeover offer from Carlsberg.

The soft drinks company, which is also behind the Tango and 7up brands, said it would halt the buybacks on June 25 after rejecting an acquisition attempt last week.

Carlsberg is considering its options and was given a boost after Pepsi effectively gave its blessing to a takeover by waiving the change of control clause in its bottling arrangements it has with Britvic.

Britvic said the share buybacks would resume “should the circumstances change”.

Its shares have fell as much as 1.9pc following the announcement.

Bottles of soft drink made by Britvic at its plant in London - REUTERS/Luke MacGregor

12:56 PM BST

Tortilla wraps up £3m deal for rival ahead of Olympics

Burrito chain Tortilla has bought its biggest European competitor in a deal worth more than £3m, as it hopes to attract new consumers on the go, ahead of the Paris Olympics.

Tortilla is buying 13 restaurants from rival Fresh Burritos, in prime locations in Paris and other cities in France.

The acquisition also includes a network of 19 franchised locations and the rights to the brand.

The London-based company, which has 89 stores, predominantly in the UK, said the purchase will give it a “launchpad” to expand further into Europe.

Chief executive Andy Naylor said:

Tortilla’s international ambitions are no secret, and acquiring Fresh Burritos is our gateway to mainland Europe.

With Mexican cuisine surging in popularity, these prime French locations give us a solid launchpad.

He said the purchase comes “just in time for the Paris Olympics”, with businesses hoping to cash in on the millions of expected visitors to the French capital to watch the games.

The €3.95m (£3.3m) acquisition has been funded through a combination of cash payment and existing debt facilities, Tortilla said.

Tortilla has bought Fresh Burritos for €3.95m - Alan Hackett

12:20 PM BST

Gas prices rise amid Asian demand

Wholesale gas prices are on track to have risen by a quarter since April as the summer season gets underway.

Dutch front-month futures, the benchmark contract in Europe, were up as much as 2.9pc today amid high temperatures in Japan and South Korea, which is expected to boost demand for liquefied natural gas (LNG).

Europe has shifted more towards the LNG market since Russia’s invasion of Ukraine, which is more exposed to global fluctuations in demand.

The cost of shipping is also increasing as tankers avoid the Red Sea amid attacks from Houthi rebels.

The UK’s equivalent contract was up as much as 2.8pc.

12:06 PM BST

Tech stocks posed for rally on Wall Street

The Nasdaq climbed in premarket trading as Nvidia and other AI-linked stocks rebounded after a bruising sell-off.

Nvidia was up 2.1pc in premarket as fellow chip stocks Micron Technology, Broadcom and Qualcomm also recovered some lost ground.

Ipek Ozkardeskaya, senior analyst at Swissquote Bank, said:

There has certainly been strong speculation in Nvidia’s exponential surge since the beginning of last year ... strong rallies were often followed by sharp sell-offs.

It’s too early to call the end of the Nvidia mania but given the high amount of speculation around the stock, we shall see the price action getting worse before it gets better.

The tech-heavy Nasdaq logged its steepest one-day fall since late April - dropping 1pc - as investors pulled out of AI stocks and moved to other sectors, causing the blue-chip Dow to hit a one-month high on Monday.

Ahead of today’s opening bell, the Dow Jones Industrial Average was down 0.1pc, the S&P 500 was up 0.2pc and the Nasdaq 100 had gained 0.4pc.

11:40 AM BST

Pound holds firm despite stocks sell-off

The pound held steady despite a global stock market sell-off amid doubts over high valuations.

Sterling was unchanged against the dollar at just under $1.27 compared with declines in the value of the euro and yen versus the greenback.

The pound was trading around its highest in 16 years against the yen, which has weakened against the dollar towards levels last seen in April that triggered official Japanese buying to support it.

The UK currency was up 0.1pc against the euro, which is worth 84.5p.

Investors have been unsettled by a 10pc sell-off in shares of chip giant Nvidia in the days after it briefly became the world’s most valuable company.

That has driven money into safe havens like government bonds and the dollar.

11:13 AM BST

Funding Circle offloads loss-making US business

Small business lender Funding Circle has sold its loss-making US arm for £33m as part of an attempt to simplify the company and stem mounting losses.

Funding Circle said it will offload the unit to Florida-based iBusiness Funding, which lends to banks and small finance businesses, and is part of US financial giant Ready Capital Corporation.

Once viewed as a UK fintech darling, Funding Circle has suffered a torrid last few years, with losses mounting from nearly £13m in 2022 to £33m last year.

Its shares have plummeted 78pc since it listed on the London Stock Exchange in 2018, valued at 94p today versus a 440p listing price.

It also said it would cut 120 jobs last month as part of a cost-cutting drive. Chief financial officer Oliver White stepped down at the same time.

While bosses have not yet decided what to do with the proceeds of the deal, chief executive Lisa Jacobs said the UK business is “on track to be profitable” in the second half of the year.

Shares rose as much as 17.7pc in morning trading.

10:51 AM BST

French bondholders fear fresh eurozone debt crisis, warns Allianz

France’s government borrowing costs will keep rising unless officials can convince investors that the nation’s finances are in order and not on the cusp of triggering a fresh eurozone debt crisis, insurer Allianz has warned.

The premium being paid on French debt compared to Germany last week hit its highest level since the single currency area was in the depths of its crisis between 2009 and the mid 2010s, when Greece, Portugal, Ireland, Spain, and Cyprus were unable to refinance their government debt.

The sharp rise in French bond yields occurred after Emmanuel Macron called a snap parliamentary election, which could leave voters with a choice between the hard-left or the hard-right, who have both made big spending promises.

Stocks markets have been hit as a result, with the Cac 40 in France down 0.6pc today and the Dax in Germany down 1.1pc.

Allianz Global Investors’ chief investment officer Gregor Hirt said: “Any reminder of the European sovereign debt crisis is a red flag for many international investors.”

He added: “We need some action from the French government, some stabilisation, so these large investors are reassured.”

Marine Le Pen's far-right National Rally is expected to perform well in the French parliamentary elections - Nathan Laine/Bloomberg

10:25 AM BST

Labour warnings on public finances ‘won’t wash’, say economists

Labour has been accused of “political management” after a shadow minister claimed it may “open the books and discover the situation is even worse” in the economy if it wins the election.

Nick Thomas-Symonds said that a Labour government was not able to conduct a spending review about spending plans beyond March 2025.

However, economists have said the excuse “won’t wash” as more information is publicly available than ever before.

Mr Thomas-Symonds told Times Radio:

Obviously the Government is in a very different position from us, because, as the Institute for Fiscal Studies set out, there are no specific departmental spending plans beyond March of 2025 that’s because the Government hasn’t conducted a spending review.

We obviously can’t do that from opposition, and we’ve also been open, always that we may open the books and discover the situation is even worse than it is at the moment. We’ve never hidden from that.

Mr Thomas-Symonds comments come after the Institute for Fiscal Studies (IFS) think tank on Monday cast doubt on the spending plans laid out by both Labour and the Conservatives.

Economists have said the lack of clarity on future spending is just “political management”:

10:06 AM BST

Morrisons sales rise as it battles Aldi and Lidl on price

Morrisons has posted another rise in sales over the latest quarter, as it has sought to shake off competition from discount rivals Aldi and Lidl.

The Bradford-based supermarket said group like-for-like sales, excluding fuel and VAT, grew by 4.1pc over the three months to April 28, boosted by a “great start” to its Aldi and Lidl Price Match scheme launched in February.

However, the growth represents a slowdown on the 4.6pc increase reported in the previous quarter.

The group, which was bought by US private equity firm Clayton, Dubilier & Rice in 2022, also reported that it has reduced its debt levels to £4bn from a peak of £6.2bn.

Morrisons revealed sales increased as it launched its Aldi and Lidl price match initiative - Paul Maguire/iStock Editorial

09:57 AM BST

Vauxhall maker threatens to close UK plants over net zero targets

Vauxhall and Fiat maker Stellantis could stop making vans in Britain as a result of the Government’s electric vehicle targets, according to its UK boss.

Maria Grazia Davino said the sales mandates for zero-emission vehicles “could be very damaging”.

Speaking at the SMMT UK car lobby summit, she pointed out that the company has made investments at its sites in Ellesmere Port and Luton.

She said: “But if this market becomes hostile for us we will enter an evaluation of producting elsewhere”.

In September, Stellantis started making its small electric van at Ellesmere Port, making it an EV-only factory.

Stellantis has a Vauxhall plant in Ellesmere Port - Peter Byrne/PA Wire

09:26 AM BST

Airbus dives as it cuts forecast for plane deliveries

European aerospace giant Airbus said it would deliver fewer aircraft than previously planned in 2024 due to supply chain problems.

Shares in the planemaker dropped 9.9pc in early trading as it cut industrial and financial targets, and took a hefty €900m euro (£760.1m) charge for its troubled space satellite business.

The company said: “In commercial aircraft, Airbus is facing persistent specific supply chain issues mainly in engines, aerostructures and cabin equipment.”

It said it now intends to deliver around 770 commercial aircraft in 2024, down from the 800 it forecast at the beginning of the year.

It delivered 735 commercial aircraft last year. Deliveries are key for Airbus’s finances as it gets paid when aircraft are transferred to customers.

Airbus’s poor performance helped drag down European markets, with the Stoxx 600 down 0.3pc.

In the eurozone, the Paris Cac 40 index fell 0.6pc and Frankfurt’s Dax sank 1.3pc.

Airbus said it would deliver fewer aircraft than previously expected this year - AP Photo/Armando Franca

09:16 AM BST

Royal wedding winemaker considers sale

Chapel Down, the English sparkling winemaker, is considering a sale of the company as it tries to achieve its long-term growth plans.

The drinks brand, which provided the wine served at the wedding of the Prince and Princess of Wales, said it wants to invest in new vineyards and a new purpose-built winery ready for the 2026 harvest, as well as developing its headquarters in Tenterden, Kent.

Under a strategic review, it is considering options that include seeking more investment from existing shareholders, investment from new shareholders or a sale of the company, as well as other potential transactions.

It said it remains on-track to deliver double digit sales growth this year and “retains a strong balance sheet with significant headroom to its existing debt facility of £12m”. It has reached agreement in principle to extend and increase this facility.

Shares were down 5pc in early trading.

Chapel Down wants to acquire new vineyards under its long-term expansion plans - REUTERS/Toby Melville

08:50 AM BST

FTSE 100 inches higher amid caution over US inflation

The FTSE 100 edged higher even as investors stayed cautious ahead of economic data that could sway expectations on the path of UK and US interest rates.

The blue-chip index rose 0.1pc as gains in energy shares offset declines in defence stocks, while the mid-cap FTSE 250 dipped 0.3pc.

Energy majors Shell and BP rose about 1pc each as crude prices steadied near recent highs.

Shares of aerospace and defence firms were the worst performer, with Melrose Industries and Rolls-Royce at the bottom of the FTSE 100 after European aerospace group Airbus cut its industrial and financial guidance for the year.

Traders largely refrained from placing big bets ahead of the US personal consumption expenditure (PCE) data due on Friday.

Meanwhile, Britain’s gross domestic product (GDP) figures are due this week and could potentially add to Bank of England policymakers’ confidence for an interest rate cut in August.

Among individual stocks, Ocado shares dropped 5.1pc to the bottom of the FTSE 250 after Morgan Stanley slashed its price target for the online retailer.

Landsec was up 0.8pc after increasing its stake in Bluewater shopping centre, putting it on course to boost annual returns.

08:31 AM BST

Net zero risks ‘volatility’ in car market, warns Vertu

Vertu Motors has cheered the recovery of used vehicle sales as prices continue to steady but cautioned that incoming zero emission rules could spark further upheaval in the market.

The car dealership, which has 189 sales and aftersales sites, reported 6.7pc growth in like-for-like used car sales by volume in its first quarter to May 31.

It saw comparable sales of new car and motability vehicles rise 6.8pc in the quarter.

Vertu has reported more stability of used car prices, having seen them tumble by 10.3pc in the final quarter of 2023 following steep gains in the previous few years.

But the company warned that stretching targets for car manufacturers to achieve specific zero emissions vehicle (ZEV) sales targets could cause volatility in the market and send prices for new and used motors higher once again. It said:

The Zero Emission Mandate to force the uptake of zero emission vehicles sold in the UK has the potential to create volatility in the new car market.

This may include reduced supply of new petrol and diesel cars in the coming periods and would lead to a strengthening of petrol and diesel used car values.

Late last year, Prime Minister Rishi Sunak pushed back the ban on the sale of new petrol and diesel cars in the UK from 2030 to 2035.

08:10 AM BST

Argentina slumps into recession amid Milei’s austerity plan

Argentina entered a technical recession in the first three months of the year amid President Javier Milei’s brutal programme of government spending cuts.

Gross domestic product (GDP) fell 2.6pc compared to the end of 2023, when the economy contracted by 2.5pc. Two consecutive quarters of contraction are considered the definition of a recession.

It comes amid sharp cuts to pensions, public sector wages and spending on infrastructure projects implemented by the President’s administration.

Mr Mileo devalued the peso by more than 50pc when he took office in December, sending real wages down 17pc from November to March and triggering a 10pc drop in supermarket sales over the same period.

However, the painful contraction has left the government with five consecutive monthly budget surpluses and a faster-than-expected easing of monthly inflation from 25.5pc in December to 4.2pc in May.

Argentina's President Javier Milei has imposed sharp spending cuts - MARTIN DIVISEK/EPA-EFE/Shutterstock

08:06 AM BST

UK markets subdued at the open

Stock markets were muted as trading began in London ahead of important US inflation data at the end of the week.

On a weak day for economic news, the FTSE 100 was up 0.1pc to 8,290.19 while the midcap FTSE 250 was down 0.2pc to 20,521.72.

07:56 AM BST

AstraZeneca suffer lung cancer drug blow

AstraZeneca has revealed a drug aimed at early stage lung cancer treatment failed its latest clinical trials.

The Anglo-Swedish pharmaceutical giant said imfinzi did not meet the main goal of its phase three trial.

Imfinzi, knwon as durvalumab, “did not achieve statistical significance for the primary endpoint of disease-free survival,” the drugmaker said.

It added that the drug is also being investigated as a potential treatment and in combinations in several other early-stage lung cancer settings.

AstraZeneca revealed its imfinzi suffered a setback in clinical trials - REUTERS/Yves Herman

07:43 AM BST

Saga hails ‘exceptional’ bookings as travel demand returns

Over 50s group Saga has said its cruise business has seen an “exceptional” level of bookings this year, but cautioned over a challenging market squeezing its insurance division.

The London-listed travel company, which specialises in products and services for people over 50, highlighted a buoyant start to the year for its ocean and river cruises.

Bookings are ahead of the same time last year, with revenues 14pc higher as more passengers secured their holidays, Saga said.

However, the company flagged that conditions have remained challenging in the insurance sector, with inflation continuing to put pressure on its business costs.

It holds is annual shareholder meeting today.

Saga said it has traded as expected so far this year and remains on track

07:24 AM BST

Landsec pays £120m for bigger stake in Bluewater shopping centre

Commercial property giant Landsec has added to its stake in Bluewater shopping centre for £120m amid an expected recovery in the retail sector.

The real estate investor aquired an additional 17.5pc stake in the site from Singaporean sovereign wealth fund GIC, taking its total ownership to 66.25pc.

It said the deal would increase the company’s net rental income by £10.3m a year.

Bruce Findlay, managing director of retail at Landsec said:

This transaction underscores our ability to continue to create value through prime investments in scarce, major retail destinations with attractive return profiles.

Bluewater is one of the UK’s top retail destinations and a key part of our strategy to further build our relationships with key brands.

Landsec has increased its stake in Bluewater shopping centre - Chris Ratcliffe/Bloomberg

07:13 AM BST

$550bn wiped off Nvidia after stint as world’s most valuable company

Nvidia has suffered a sharp slump since a brief stint as the world’s most valuable company, with more than $550bn (£433bn) wiped off its valuation.

The poster child of the artificial intelligence revolution slid nearly 7pc on Monday as its market capitalisation dropped to $2.91 trillion (£2.29 trillion).

It also recently became the third company to achieve a market valuation of more than $3 trillion.

Many investors are thought to be taking profits after the semiconductor manufacturer’s valuation surged.

Chris Weston, head of research for Pepperstone Group said: “People are working out now that momentum works both ways.”

More than $550bn has been wiped off the value of Nvidia, which is led by chief executive Jensen Huang - I-HWA CHENG/AFP via Getty Images

07:05 AM BST

Lowest earners close gap on middle class after minimum wage leaps

The pay gap between Britain’s middle class and low earners has shrunk to its lowest level on record after significant jumps in the minimum wage, analysis has revealed.

Our senior economics reporter Eir Nolsøe has the details:

The pay-per-hour difference between workers on the lowest rates and those in the middle has narrowed the most since at least the mid-1970s, according to the Resolution Foundation.

Big uplifts in the minimum wage mean that the average worker makes only 1.5 times as much as someone in the lowest-paid tenth of all employees.

The gap was at its widest in the mid-1990s when middle earners made 1.8 times more per hour than those on the lowest wages.

The decline comes after a record cash uplift to the National Living Wage in April when it rose by 9.8pc to £11.44 an hour.

Read on for the concerns about Labour’s pledge to create a “genuine” living wage.

Wages for bar staff have risen by 26pc in the last decade - ANTONIO BAT/EPA-EFE/Shutterstock

06:47 AM BST

Good morning

Thanks for joining us. We begin the day with data on the pay gap between the middle class and low earners, which has shrunk to its lowest level on record.

The rising minimum wage means the pay-per-hour of workers on the lowest rates and those in the middle has narrowed the most since at least the mid-1970s, according to the Resolution Foundation.

5 things to start your day

1) Tech boss ‘felt like he was bribed’ to move company from UK to China | Ex-chief sues chip maker for £200m, claiming he was sacked for whistleblowing

2) Hargreaves Lansdown takeover bid not fair to all investors, chairman warned | Concerns raised over value of offer and its impact on the London Stock Exchange

3) ‘James Bond’ tourist attraction to snub London market | Tourism developer seeking to create attraction under Tube station hopes to float on Euronext exchange with a value of £130m

4) Lowest earners close gap on middle class after minimum wage leaps | Pay-per-hour difference falls to lowest level since 1970s, reveals Resolution Foundation

5) ‘Ozempic face’ supplements to combat side effects of rapid weight loss | Nestlé to roll out hair growth and collagen products

What happened overnight

Asian stocks rose after another slide for Wall Street heavyweight Nvidia kept US indexes mixed.

Japan’s benchmark Nikkei 225 added 0.5pc to 39,001.39 after data from the Bank of Japan Tuesday showed the services producer price index in May was up 2.5pc compared to the same period last year, a slowdown from the 2.7pc increase seen in April.

The Japanese yen remains a focus of attention, with the US dollar to Japanese yen exchange rate still trading near its weakest level in approximately 34 years. The yen rose to 159.37 to the dollar in Tuesday morning trading. The dollar closed at 159.59 yen on Monday.

The Hang Seng in Hong Kong was 0.5pc higher to 18,121.78 and the Shanghai Composite index dipped 0.3pc to 2,954.51.

Australia’s S&P/ASX 200 gained 0.9pc to 7,799.20. In South Korea, the Kospi climbed 0.5pc to 2,777.69.

Elsewhere, Taiwan’s Taiex lost 0.3pc, while the SET in Bangkok edged 0.1pc higher.

On Wall Street, the Dow Jones Industrial Average of 30 leading US companies hit a one-month high while the Nasdaq fell more than 1pc.

The Dow Jones rose 0.7pc, to 39,411.21, the S&P 500 lost 0.3pc, to 5,447.87, and the Nasdaq Composite lost 1pc, to 17,496.82.

The yield on benchmark 10-year US Treasury bonds feel to 4.23pc, from 4.257pc late on Friday.

Sign up to the Front Page newsletter for free: Your essential guide to the day's agenda from The Telegraph - direct to your inbox seven days a week.