After consistent correction in the past three consecutive trading sessions following record highs, experts expect the market to enter into consolidation phase with immediate support at 22,100 (which coincides with the 50-day EMA) and key support at 22,000 mark (which coincides with the upward sloping support trendline). In case of bounce back, the 22,300-22,400 are the levels to watch out for on the higher side.

The formation of Spinning Top kind of candlestick pattern (not a classic one) after the recent downtrend indicated that the market may make an attempt of recovery but experts advised sell on rise strategy as sentiment remains in favour of bears.

On April 16, the BSE Sensex plunged 456 points to 72,944, while the Nifty 50 was down 125 points to 22,148. The market was shut on April 17 for Ram Navami.

“Technically, the trend has weakened as the index fell below the 21-day EMA (22,342). However, following the sharp decline, the index may find short-term support within the 21,930-22,030 bands, where previous congestion occurred,” Rupak De, senior technical analyst at LKP Securities said.

Conversely, failure to maintain support at 21,930 could exacerbate panic in the market, he said, adding on the higher end, resistance for the short term is positioned at 22,400.

The weekly options data hints at support in the range of 22,000-21950, which also coincides with a rising trendline support. “Only if this support is breached, then one can expect correction towards the 89 DEMA which is placed around 21,750,” said Ruchit Jain, lead research at 5paisa.com.

However, he feels as the hourly readings are oversold and the market breadth was positive, there could be a pullback move in the index towards 22,400. Traders should keep a close tab on the above mentioned levels in the index and trade accordingly, he advised.

Image1416042024

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty, and Bank Nifty

The pivot point calculator indicates that the Nifty 50 may take immediate support at the 22,096 level followed by 22,064 and 22,013 levels. On the higher side, the index may face resistance at the 22,160 level followed by the 22,230 and 22,281 levels.

On April 16, the Bank Nifty was also under pressure, falling 288 points to 47,485 and formed Spinning Top kind of candlestick pattern on the daily charts, which may act as a bullish reversal pattern given its formation at the downtrend. The index has seen 168 points recovery from day’s low and moved closer to 47,500 level.

“Bank Nifty has managed to hold on to the 50 percent Fibonacci retracement level 47,440 and witnessed a pullback during the last hour of trade. We expect the pullback to continue till 48,000 – 48,200 over the next few trading sessions. The crucial support level is placed at 47,300,” Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

According to the pivot point calculator, the Bank Nifty index is expected to take support at 47,358, followed by 47,289 and 47,178. On the higher side, it may see resistance at 47,512, followed by 47,651 and 47,763.

Image1516042024

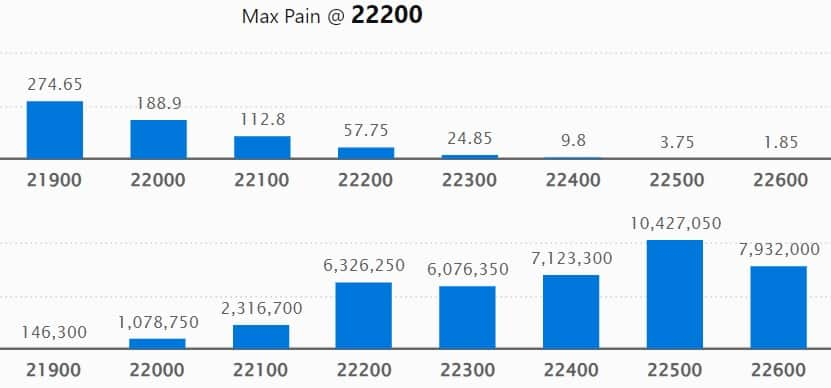

Call options data

As per the weekly options data, the maximum Call open interest was seen at 22,500 strike, with 1.04 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,700 strike, which had 94.99 lakh contracts, while the 22,600 strike had 79.32 lakh contracts.

Meaningful Call writing was seen at the 22,200 strike, which added 53.45 lakh contracts followed by 22,300 strike and 22,500 strike, which added 32.58 lakh and 31.58 lakh contracts, respectively.

The maximum Call unwinding was at the 23,100 strike, which shed 15.72 lakh contracts followed by 22,900 and 23,200 strikes, which shed 12.6 lakh contracts and 11.78 lakh contracts, respectively.

Image716042024

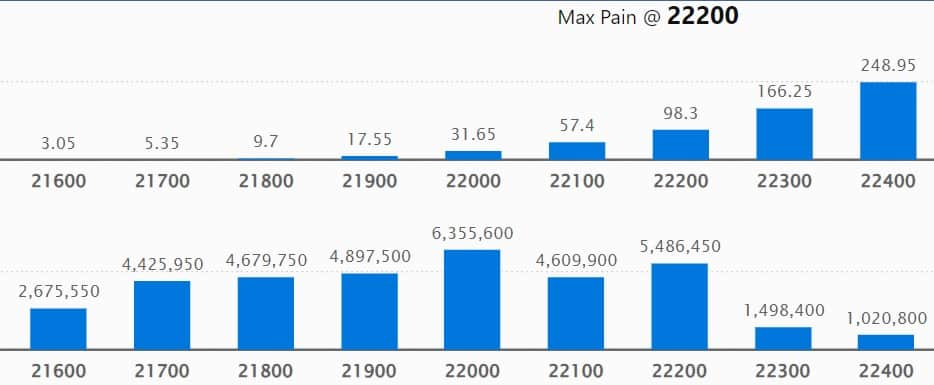

Put option data

On the Put side, the 22,000 strike owned the maximum open interest, which can act as a key support level for the Nifty with 63.55 lakh contracts. It was followed by the 21,500 strike comprising 59.89 lakh contracts and then the 22,200 strike with 54.86 lakh contracts.

Meaningful Put writing was at the 21,900 strike, which added 30.57 lakh contracts followed by the 21,500 strike and 22,100 strike adding 22.22 lakh and 19.78 lakh contracts, respectively.

Put unwinding was seen at 22,300 strike, which shed 25.77 lakh contracts followed by 22,400 and 22,200 strikes, which shed 10.12 lakh and 10.02 lakh contracts, respectively.

Image816042024

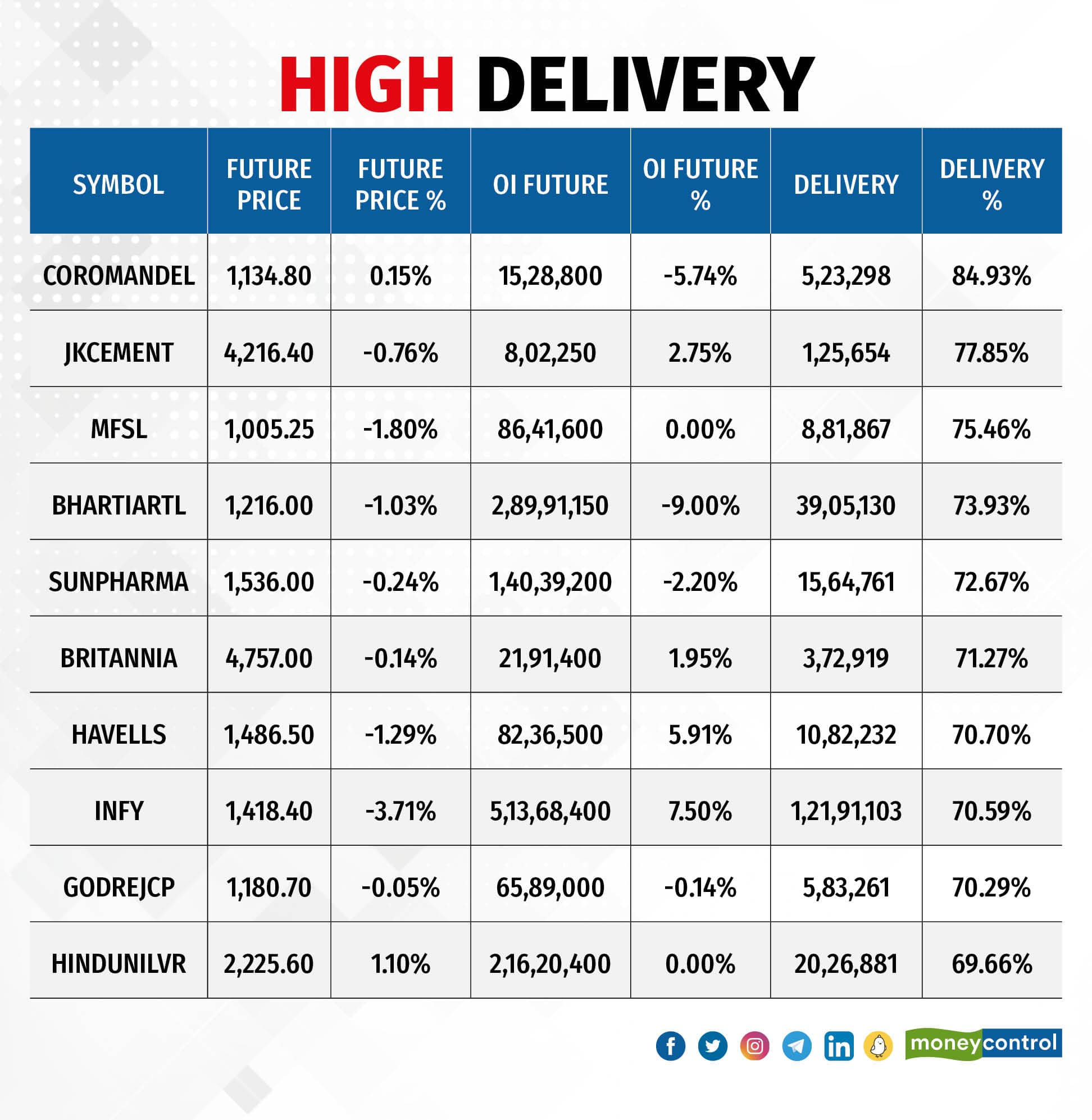

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Coromandel International, JK Cement, Max Financial Services, Bharti Airtel, and Sun Pharmaceutical Industries saw the highest delivery among the F&O stocks.

High Delivery

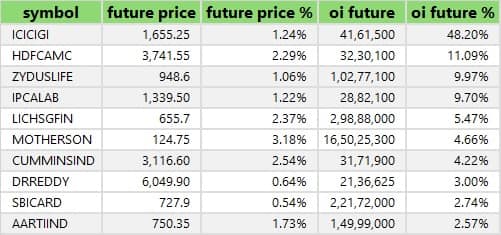

35 stocks see long build-up

A long build-up was seen in 35 stocks, which included ICICI Lombard General Insurance Company, HDFC AMC, Zydus Lifesciences, Ipca Laboratories, and LIC Housing Finance. An increase in open interest (OI) and price indicates a build-up of long positions.

Image1016042024

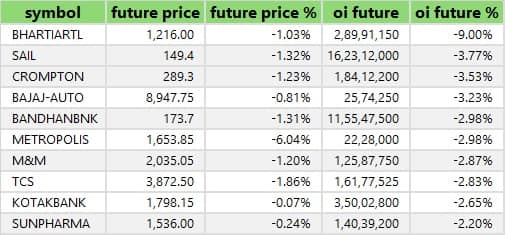

34 stocks see long unwinding

Based on the OI percentage, 34 stocks saw long unwinding, which included Bharti Airtel, SAIL, Crompton Greaves Consumer Electricals, Bajaj Auto, and Bandhan Bank. A decline in OI and price indicates long unwinding.

Image1116042024

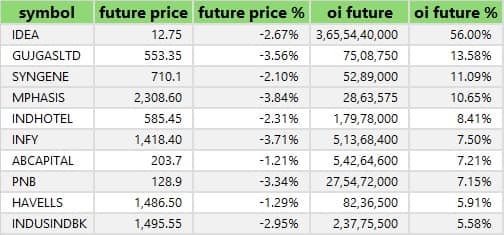

71 stocks see a short build-up

A short build-up was seen in 71 stocks, including Vodafone Idea, Gujarat Gas, Syngene International, Mphasis, and Indian Hotels. An increase in OI, along with a fall in price points to a build-up of short positions.

Image1216042024

44 stocks see short covering

Based on the OI percentage, a total of 44 stocks were on the short-covering list which included Exide Industries, Coromandel International, Mahanagar Gas, Birlasoft, and Dr Lal PathLabs. A decrease in OI along with a price increase is an indication of short-covering.

Image1316042024

Put Call Ratio

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 0.76 on April 16, from 0.81 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

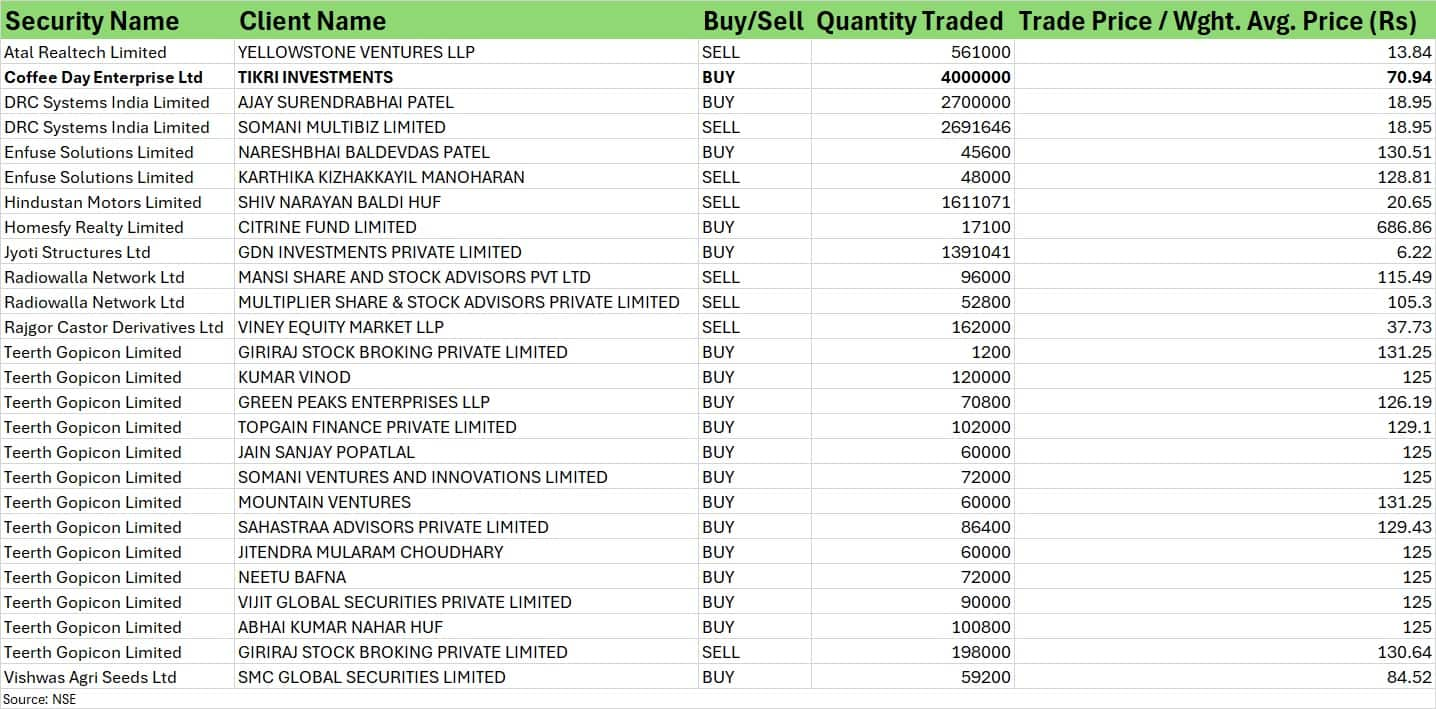

Bulk Deals

Image516042024

For more bulk deals, click here

Results on April 18

Results TODAY

Stocks in the news

Zee Entertainment Enterprises: The National Stock Exchange on April 16 has decided to remove the media and entertainment company from the Futures & Options segment, with effect from June 28. Meanwhile, ZEEL has decided to withdraw the merger implementation application filed before the National Company Law Tribunal (NCLT), Mumbai bench against Sony.

Power Grid Corporation of India: Power Grid has been declared as the successful bidder to establish inter-state transmission system in Gujarat and Rajasthan.

Adani Enterprises: Mumbai Travel Retail, a step-down subsidiary of Adani Enterprises, has completed the incorporation process of a joint venture company namely King Power Ospree Pte (KPO) in Singapore, with KING Power international Pte, Singapore, for retail and wholesale business.

Brigade Enterprises: The Bengaluru-based real estate developer has recorded pre-sales of Rs 6,013 crore in FY24 and Rs 2,243 crore in Q4 FY24, the highest ever for both in terms of a quarter as well as financial year.

Sunteck Realty: The real estate company had pre-sales of Rs 678 crore in Q4 FY24, up 26 percent on YoY basis. Its FY24 pre-sales stood at Rs 1,915 crore, a growth of 20 percent on a YoY basis.

Funds Flow (Rs crore)

Image616042024

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 4,468.09 crore, while domestic institutional investors (DIIs) purchased Rs 2,040.38 crore worth of stocks on April 16, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Vodafone Idea to the F&O ban list for April 18, while retaining Balrampur Chini Mills, Bandhan Bank, GNFC, Hindustan Copper, Metropolis Healthcare, National Aluminium Company, Piramal Enterprises, SAIL, and Zee Entertainment Enterprises to the said list. India Cements, and Exide Industries were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

News Related-

Anurag Kashyap unveils teaser of ‘Kastoori’

-

Shehar Lakhot: Meet The Intriguing Characters Of The Upcoming Noir Crime Drama

-

Watch: 'My name is VVS Laxman...': When Ishan Kishan gave wrong answers to right questions

-

Tennis-Sabalenka, Rybakina to open new season in Brisbane

-

Sikandar Raza Makes History For Zimbabwe With Hattrick A Day After Punjab Kings Retain Him- WATCH

-

Delayed Barapullah work yet to begin despite land transfer

-

Army called in to help in tunnel rescue operation

-

FIR against Redbird aviation school for non-cooperation, obstructing DGCA officials in probe

-

IPL 2024 Auction: Why Gujarat Titans allowed Hardik Pandya to join Mumbai Indians? GT explain

-

From puff sleeves to sustainable designs: Top 5 bridal fashion trends redefining elegance and style for brides-to-be

-

The Judge behind China's financial reckoning

-

Arshdeep Singh & Axar Patel Out, Avesh Khan & Washington Sundar IN? India's Likely Playing XI For 3rd T20I

-

Horoscope Today, November 28, 2023: Check here Astrological prediction for all zodiac signs

-

'Gurdwaras are...': US Sikh body on Indian envoy's heckling by Khalistani backers