May is unlikely to be financial change-heavy month unlike its predecessor April or even March.

However, there are some key changes that individuals – particularly mutual fund investors and banking customers – will have to take note of.

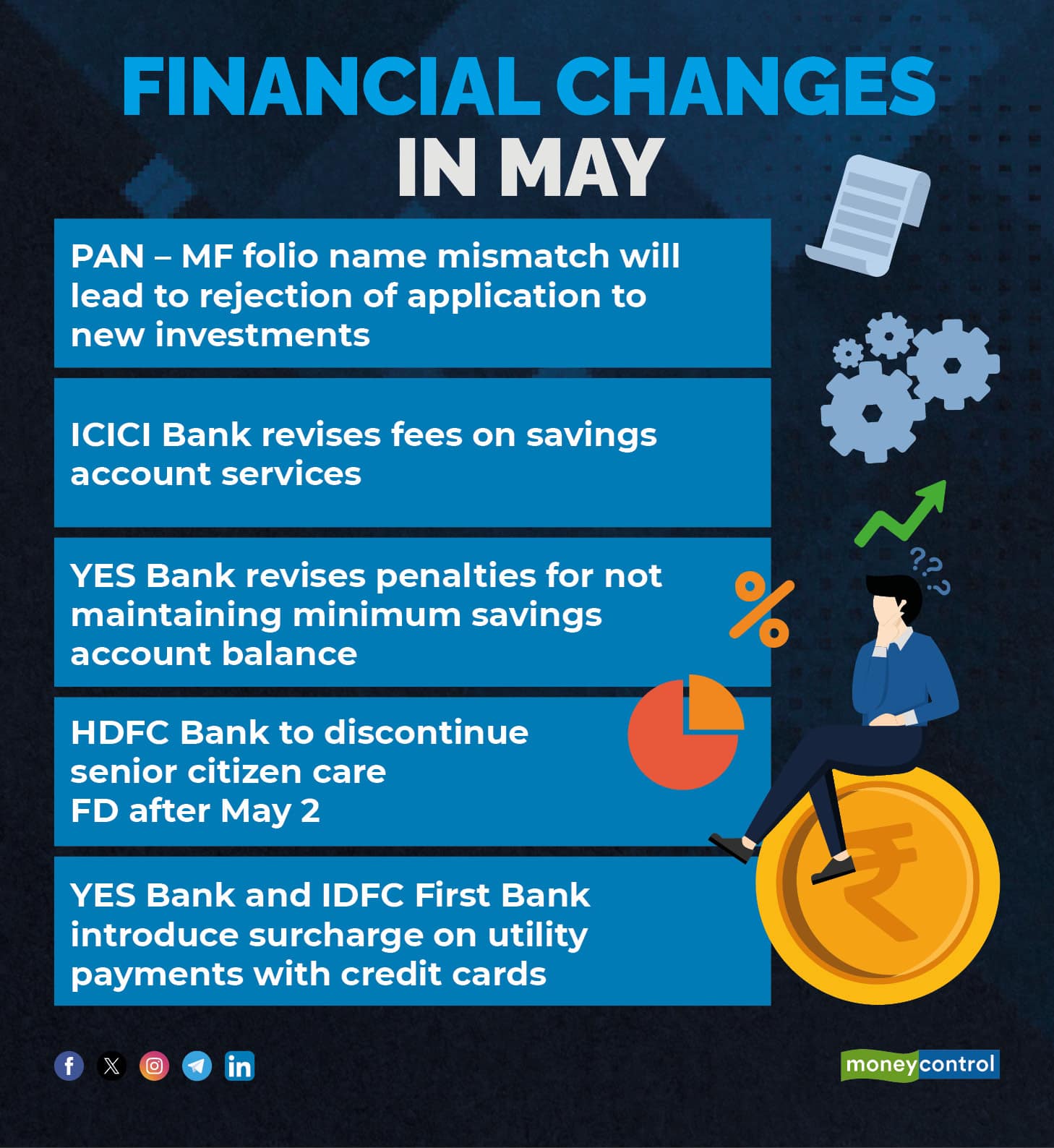

Some banks will be revising charges on savings account services, while others have decided to introduce surcharges on utility payments using credit cards, and yet others may introduce a deadline for senior citizen fixed deposits (FDs).

Let’s look at some of the most important money changes that’ll impact you during the month.

PAN – MF folio name mismatch will lead to rejection of application

Effective April 30, if your name on your mutual fund application doesn’t match with that of your PAN (Permanent Account Number) card, your application will get rejected. In a move to harmonise how your name appears across official records, the Securities and Exchange Board of India – mandated KYC rules say that your name must be uniform. As a result, if you are investing in a mutual fund folio for the first time, your name and date of birth must be identical to the that appears on your PAN, and by extension, to your income-tax records.

This rule will affect new investments, and not existing investments.

ICICI Bank revises fees on savings account services

Effective May 1, ICICI Bank will revise charges on savings account services.

This includes annual fees on a debit card of up to Rs 200 per annum. For rural locations, the charges are Rs 99 per annum. On cheque books, the charges will be nil for 25 cheque leaflets in a year and beyond this, the bank will charge Rs 4 per leaf. The bank will charge for outward Immediate Payment Service (IMPS) transactions between Rs 2.5 to Rs 15 per transaction as per transferred amount.

Then, for cancellation, duplicate or revalidation of demand draft or pay order the bank will charge Rs 100 per instance. The bank will also charge Rs 100 per application or letter for signature attestation and Rs 100 for stop-payment of a particular cheque through the bank branch (free through customer care IVR and net banking).

There will also be penalty charges of Rs 500 per ECS / NACH debit returns for financial reasons. Maximum recovery will be done for three instances per month for the same mandate.

Also read | SIPs in MC30 top mutual funds deliver consistent returns

YES Bank revises fees on maintaining low balance in the savings account

YES Bank also announced its decision to revise fees on savings account services effective from May 1.

The bank has hiked the maximum charges for maintaining less-than-mandated average monthly balance (AMB) in the savings accounts. The bank will charge between Rs 250 to Rs 1,000. Earlier, the charges were between Rs 250 to Rs 750. The charges vary with the type of savings account, location of the bank branch and shortfall amount in the account.

With ECS (electronic clearing service) returns because of insufficient funds, the bank will now charge Rs 500 for the first instance. From the second return onwards, the bank will charge Rs 550.

Financial changes May_graphic

HDFC Bank to discontinue senior citizen care FD

The last date to invest in HDFC Bank’s senior citizen care fixed deposit is May 2, 2024. This deposit offers interest rate higher by 0.75 percentage point, compared to regular FDs. This offer is for resident senior citizens aged 60 years and above, (not applicable to NRI) who wish to book an FD less than Rs 5 crore for a tenure of five years and one day to 10 years.

Also read | Why are banks charging 1% fee on utility payments using credit cards?

Banks are introducing surcharge on utility payments with credit cards

YES Bank and IDFC First Bank have introduced a surcharge on utility transactions in statement cycles effective from May 1. The utility expenses include telecommunications, electric, gas, water, internet services and cable services.

YES Bank will levy a surcharge of 1 percent plus GST when the aggregate of utility bill payments made with a credit card crosses Rs 15,000. This utility surcharge is not applicable to YES Bank’s Private credit card. So, if your aggregate utility bill transactions (gas, electricity and internet) amount to Rs 15,000 or less in a statement cycle, then there is no surcharge. But if they exceed Rs 15,000, then a 1 percent surcharge plus 18 percent GST on the surcharge will be applicable on the excess.

IDFC First Bank meanwhile has announced that it will levy a surcharge of 1 percent plus GST only when the aggregate of utility bill payments made with a credit card crosses Rs 20,000. The utility surcharge is not applicable on FIRST Private Credit Card, LIC Classic Credit Card, and LIC Select Credit Card. So, if your aggregate utility bill transactions (gas, electricity and internet) amount to Rs 20,000 or less in a statement cycle, then there is no surcharge. But if they exceed Rs 20,000, then a 1 percent surcharge plus 18 percent GST on the surcharge will be applicable on the excess.

For instance, if you are using IDFC First Bank credit card, then utility spends of Rs 10,000 in a statement cycle will not attract a fee, as it is below the threshold. But, if you are spending Rs 30,000 on utility spends in a statement cycle, then a fee of Rs 300 (1 percent fee) plus GST will be applicable.

News Related-

Anurag Kashyap unveils teaser of ‘Kastoori’

-

Shehar Lakhot: Meet The Intriguing Characters Of The Upcoming Noir Crime Drama

-

Watch: 'My name is VVS Laxman...': When Ishan Kishan gave wrong answers to right questions

-

Tennis-Sabalenka, Rybakina to open new season in Brisbane

-

Sikandar Raza Makes History For Zimbabwe With Hattrick A Day After Punjab Kings Retain Him- WATCH

-

Delayed Barapullah work yet to begin despite land transfer

-

Army called in to help in tunnel rescue operation

-

FIR against Redbird aviation school for non-cooperation, obstructing DGCA officials in probe

-

IPL 2024 Auction: Why Gujarat Titans allowed Hardik Pandya to join Mumbai Indians? GT explain

-

From puff sleeves to sustainable designs: Top 5 bridal fashion trends redefining elegance and style for brides-to-be

-

The Judge behind China's financial reckoning

-

Arshdeep Singh & Axar Patel Out, Avesh Khan & Washington Sundar IN? India's Likely Playing XI For 3rd T20I

-

Horoscope Today, November 28, 2023: Check here Astrological prediction for all zodiac signs

-

'Gurdwaras are...': US Sikh body on Indian envoy's heckling by Khalistani backers