A day after the Reserve Bank of India (RBI) imposed curbs on Kotak Mahindra Bank, the stock closed 11 percent lower on April 25.

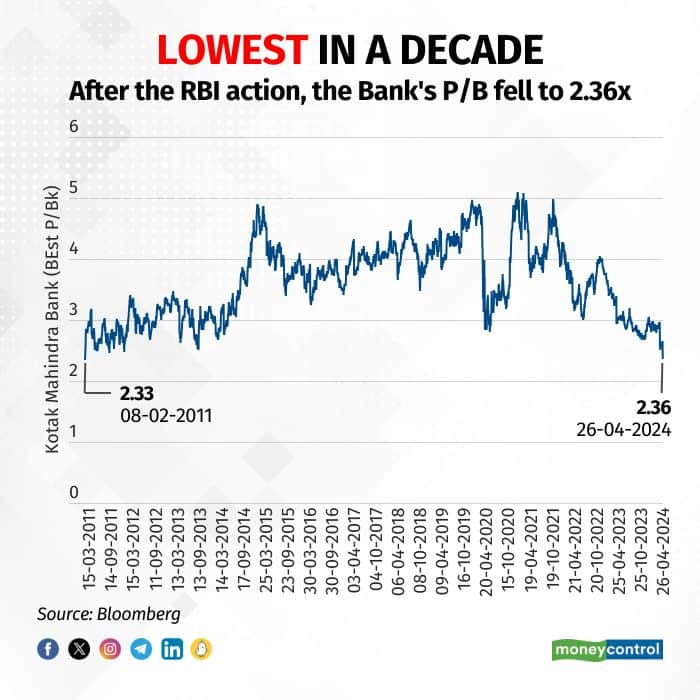

The stock now trades at a price-to-book value of around 2.36x, the lowest in over 10 years. Based on forward estimates, the stock trades at FY25 PB 2.37 and FY26 PB 2.07. Kotak Bank has consistently traded at book value multiples above 4.5x and, on occasions, close to 6x.

anishaa_april26 (1)

Depends on the timeframe for investment, say experts.

Siddarth Bhamre, Head of Research at Asit C Mehta Investment Intermediates, says: “From price to adjusted book value, it might look attractive. But from one quarter’s perspective, I don’t think we should start looking at valuations because the price is still correcting and the sentiment is negative,” he said.

Nirav Karkera, Head of Research at Fisdom, seconds that view. “At this juncture, investors can’t look at valuations in isolation. One must view the change in metric in the context of the event that has unfolded,” he adds.

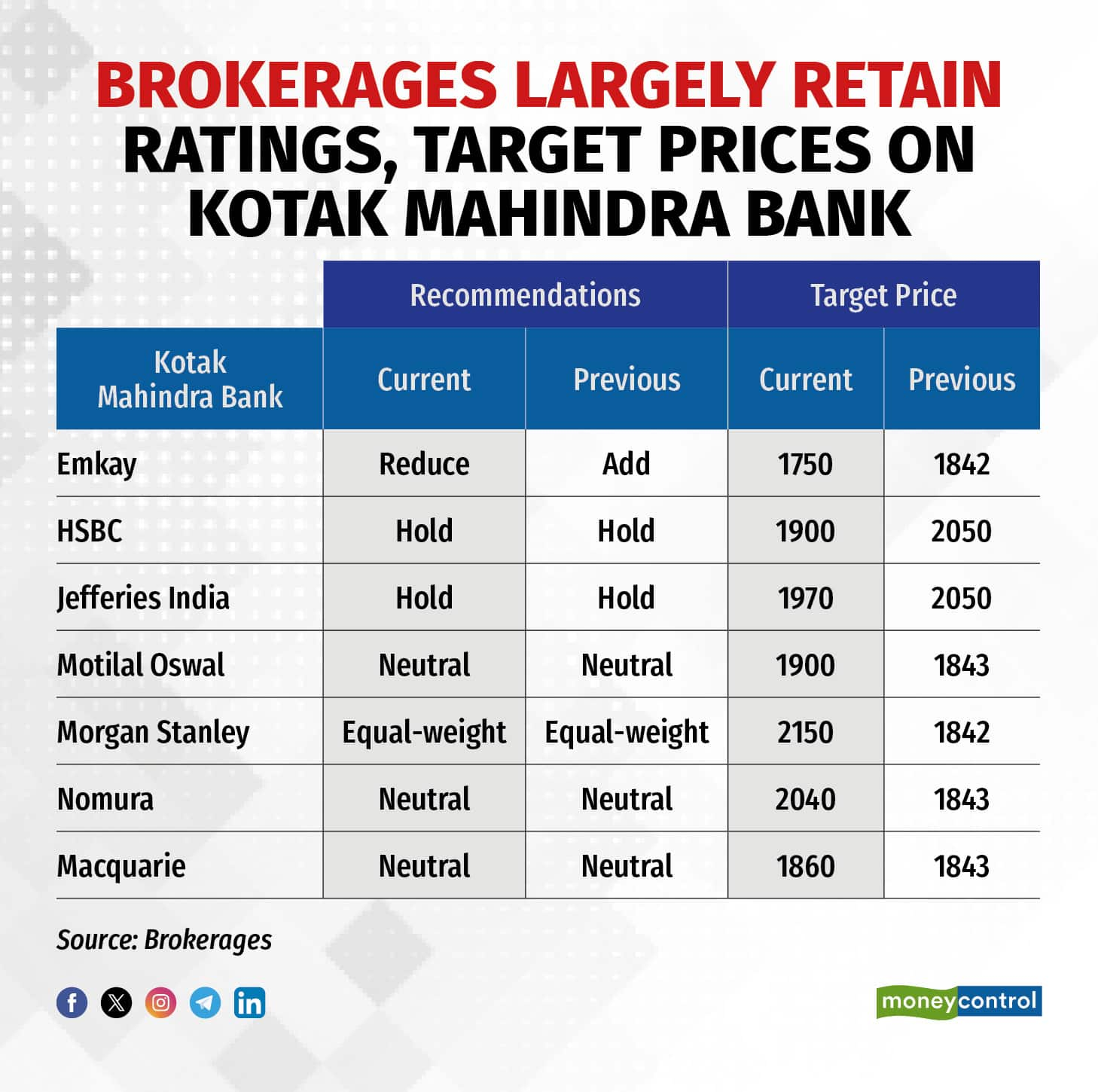

How various brokerages changed recommendations

Brokerages largely retain

Currently, around 24 brokerages have a buy call, 15 have a sell call, and 5 have a hold call on the stock.

Analysts at Emkay Global revised their rating on the stock from ‘add’ to ‘reduce’ as they believe that restrictions, like the ones by the RBI, should impact business growth, including “Kotak’s dwindling CASA ratio, which is down 13 percent from its peak to around 48 percent, and its new card acquisition. This could impact earnings in the medium term. Additionally, the regulatory overhang would delay any hope of a re-rating after the recent management change.”

Jefferies is the only other brokerage to revise its call. The brokerage downgraded its rating to ‘hold’ from ‘add/buy’ and lowered its target price to Rs 1,970 per share from Rs 2,050.

Emkay has also cut the target price to Rs 1,750 from Rs 1,950, and valued the standalone bank at 2.1x FY26E ABV against an earlier 2.5x.

While Motilal Oswal analysts have maintained their neutral call, they have revised the target price to Rs 1,900.

In previous instances, banks that have faced RBI action have taken time to see a resolution, an Elara Capital report noted. For example, HDFC Bank (restricted in December 2020) took more than 15 months to finally resolve the concerns. Bank of Baroda and some NBFCs, which have faced action over the last nine months, are yet resolve the issues.

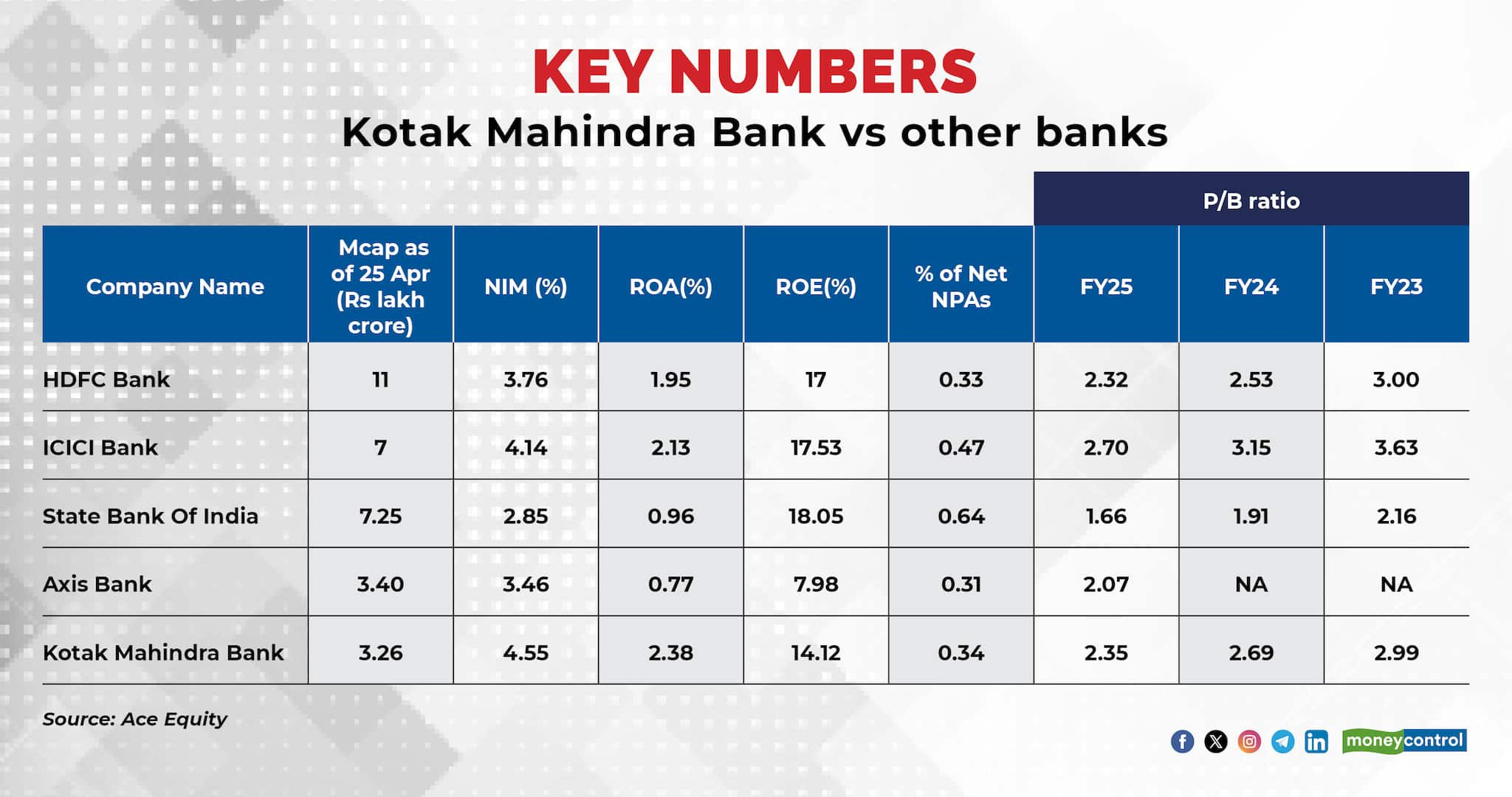

Key numbers

How this could impact business

Analysts believe that the RBI move could impact business and growth. Motilal Oswal said in its report that this move could disturb growth,

the trajectory of retail products and overall margins and

profitability.

“Besides, the IT deficiencies that have continued over the

past couple of years, as mentioned by the regulator, do pose a concern

as KMB has been one of the most revered banks when it comes to risk

management and overall governance practices,” the report notes.

Currently, the credit card segment accounts for around 3.7 percent of its overall advances. Krishna Appala, senior analyst at Capital Minds, noted in a post on social media platform ‘X’ that this will be the most impacted business segment.

Even though the bank will continue to lend to existing customers, there will not be any incremental business in this segment until the RBI’s next plan of action.

Another segment he believes will be impacted is loans (personal, business, and consumer finance), which drive around 60 percent of its revenue digitally and make around 5.2 percent of the overall advances. As a result, Appala says that one can expect around 9–10 percent of the overall book to be impacted over the next few months.

New customer acquisition could also be hit, as the digital platform has played an important role in this domain.

Should you buy into the dip?

Some analysts believe that it would be better to wait before investing, as the stock could see further corrections. Appala believes that one should not be in a hurry to jump in and grab the stock, as issues like these take time to stabilise. “It is better to wait on the sidelines for a better opportunity to emerge as the story unfolds,” he said.

Some analysts say that a high-quality bank like Kotak may never be available cheap, unless there is bad news that impacts sentiment badly. From a long-term perspective, the RBI curb is unlikely to make a big dent in the bank’s worth.

Purvesh Shelatkar, head of institutional broking at Monarch Networth Capital, believes that any dip in the bank’s share price from here on will present an investment opportunity for long-term investors.

“Kotak Mahindra Bank is one of the high-quality banks, and markets will trust the ability of Uday Kotak to resolve the issue with the utmost efficiency,” he said.

Kranthi Bathini, Head of Research at WealthMills Securities, adds that this could also be an opportunity for long-term investors to buy the stock in a staggered manner.

Could there be selling from long-term investors? Not really, believe most analysts. Bhamre says that, for long-term investors, this could just be a “blip.”

While there could be some selling among fund managers, one might not expect to see this happen immediately. Most fund managers, he explains, are looking at their performance every month; hence, they could possibly reduce their weightage in Kotak and look at other banks that are doing well, if the stock continues to underperform over the next couple of months.

“From a near-term perspective, I think there will be challenges, and the stock may not perform well. But from a very long-term perspective, it’s still a good stock to be in,” he adds.

As of March 2024, 148 MFs bought and 60 MFs sold Kotak Mahindra Bank. Currently, around 351 MF schemes have Kotak Mahindra Bank in their portfolio.

On April 26, the stock opened at Rs 1,638.60, around 0.24 percent lower than previous day’s close.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

News Related-

Anurag Kashyap unveils teaser of ‘Kastoori’

-

Shehar Lakhot: Meet The Intriguing Characters Of The Upcoming Noir Crime Drama

-

Watch: 'My name is VVS Laxman...': When Ishan Kishan gave wrong answers to right questions

-

Tennis-Sabalenka, Rybakina to open new season in Brisbane

-

Sikandar Raza Makes History For Zimbabwe With Hattrick A Day After Punjab Kings Retain Him- WATCH

-

Delayed Barapullah work yet to begin despite land transfer

-

Army called in to help in tunnel rescue operation

-

FIR against Redbird aviation school for non-cooperation, obstructing DGCA officials in probe

-

IPL 2024 Auction: Why Gujarat Titans allowed Hardik Pandya to join Mumbai Indians? GT explain

-

From puff sleeves to sustainable designs: Top 5 bridal fashion trends redefining elegance and style for brides-to-be

-

The Judge behind China's financial reckoning

-

Arshdeep Singh & Axar Patel Out, Avesh Khan & Washington Sundar IN? India's Likely Playing XI For 3rd T20I

-

Horoscope Today, November 28, 2023: Check here Astrological prediction for all zodiac signs

-

'Gurdwaras are...': US Sikh body on Indian envoy's heckling by Khalistani backers