The Aadhar Housing Finance IPO had a slow and steady start on the first day, with only the employee portion being fully booked. Aadhar Housing Finance IPO subscription status was 44% on day 1. The category for retail investors got booked at 41%, while the portion for non-institutional investors received a 60% subscription. The quota for qualified institutional buyers (QIBs) was booked at 33%.

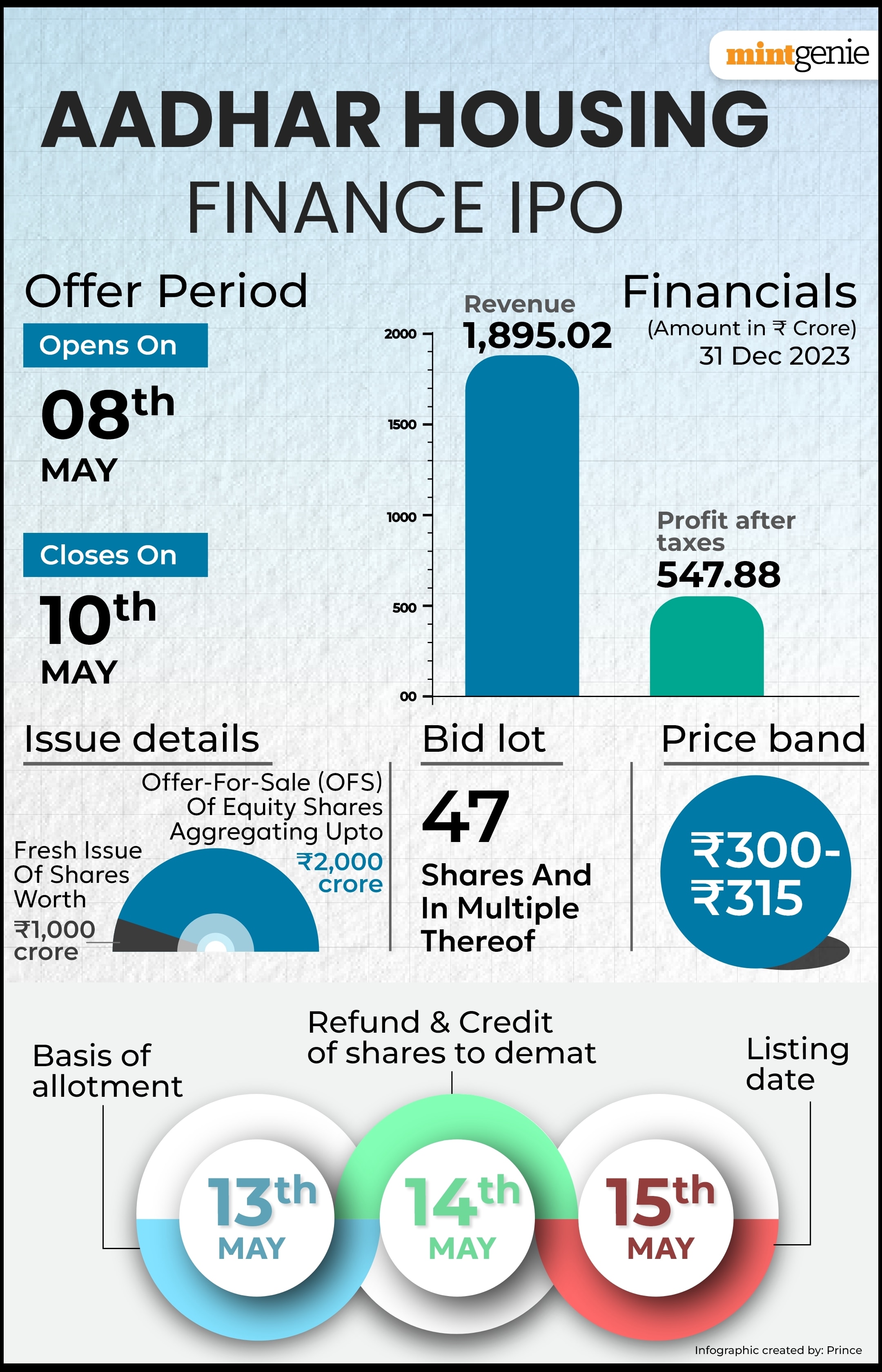

The subscription period for the Aadhar Housing Finance IPO began on Wednesday, May 8, and will finish on Friday, May 10. The Blackstone-backed company’s initial public offering price bandis set at ₹300 to ₹315 per share. Tuesday, May 7, saw the Aadhar Housing Finance IPO raise Rs. 898 crore from anchor investors. There is a minimum bid of 47 shares and bids can be made for multiples of 47 shares.

Retail investors has been allocated 35% of the issue size from the Aadhar Housing Finance IPO, followed by non-institutional investors (NIIs) at 15% and qualified institutional buyers (QIBs) at 50%. Employees of the firm are eligible for a discount of ₹23 per share.

Arun Kejriwal, the founder of Kejriwal Research and Investment Services, claims that the business was purchased from the DHFL group after they went bankrupt in the years between 2016 and 2017.

While the organisation was dealing with a number of challenges, the firm that was bought was spotless and had no issues. The firm is a house finance company that caps ticket sizes at ₹15 lakh and focuses on the low-income housing market.

According to Kejriwal, the company’s EPS for the year ending March 2023 was ₹13.8, or ₹13.4 on a fully diluted basis. The diluted earnings issue falls between the 22.4–23.5 PE range. As of December 23, the company’s net asset value is ₹107.6. At the top of the range, the price to book at this NAV is 2.92.

The NAV would increase to ₹123.07 at the top of the band based on the post-issue, and the ratio would remain at 2.56 times the price to book. This performed exceedingly well in comparison to the peer group. In the medium to long term, there is profit to be earned from this situation. Arun is of the opinion that there would also be some listing pop.

Aadhar Housing Finance IPO details.

Aadhar Housing Finance IPO details

Aadhar Housing Finance’s ₹3,000 crore initial public offering consists of an OFS (offer for sale) by promoter BCP Topco VII Pte Ltd, a Blackstone Group affiliate, for ₹2,000 crore and a fresh issue of equity shares valued at ₹1,000 crore.

The OFS’s promoter, BCP Topco VII Pte, will sell its stake. BCP Topco, the promoter and affiliate of Blackstone funds, now owns 98.7% of the pre-offer issued, subscribed, and paid-up equity share capital.

The firm intends to fulfill future capital requirements for more lending as well as use the net proceeds for general corporate operations.

SBI Capital Markets Limited, ICICI Securities Limited, Kotak Mahindra Capital Company Limited, Nomura Financial Advisory and Securities (India) Pvt Ltd, and Citigroup Global Markets India Private Limited are the lead managers for the book running. Kfin Technologies Limited is serving as the registrarfor this issue.

Aadhar Housing Finance IPO Review

Canara Bank Securities

The brokerage attributes the company’s higher cost-to-income ratio—which boosts its net interest margin—to its strategic efforts, which set it apart from competitors in the sector. Since 2021, the business has also continuously maintained high asset quality. Following the transfer of 80% of DHFL’s shares in 2019, BCP Topco VII PTE Ltd, supported by Blackrock Group, is currently in charge of the firm. Just 0.1% of the loan accounts in the DHFL pool are in the home finance company’s loan book. Even if the firm is facing legal actions of up to 269 crores, which might have an impact on its finances, the IPO seems fairly valued at a P/B of 3.36x. The brokerage advises subscribing to the issue in order to benefit from listing profits.

SMC Global

The brokerage stated that the company is valued at a pre-issue P/E of 17.02x on annualised FY24 EPS of ₹18.51, taking into account the P/E valuation, on the top end of the price band of ₹315. The stock is valued at a P/E of 18.39x after being issued, based on its annualised FY24 EPS of Rs. 17.13. Examining the pre-issue P/B ratio at Rs. 315, with a book value of Rs. 112.27, showing a 2.81x P/B ratio. Book value of Rs. 127.36 of P/Bvx 2.47x post-issue.

The brokerage claims that Aadhar Housing Finance Limited leads HFCs in the low-income housing market by a significant margin. With 498 branches, it has a strong presence throughout India. The business’s methods and procedures for underwriting, collecting, and keeping an eye on asset quality are strong and extensive. In order to cut expenses, analyse client data in real time, enhance control and underwriting capabilities, and expand its customer base and distribution reach, it moved to a digital IT architecture. The issue may be chosen by long-term investors.

Aadhar Housing Finance IPO GMP today

Aadhar Housing Finance IPO GMP is +71. This indicates Aadhar Housing Finance share price were trading at a premium of ₹71 in the grey market, according to investorgain.com.

When the upper end of the IPO pricing range and the present premium on the grey market are taken into consideration, it is projected that Aadhar Housing Finance shares will list at a price of ₹386 a share, which is 22.54% more than the IPO price of ₹315.

‘Grey market premium’ indicates investors’ readiness to pay more than the issue price.

Disclaimer: The views and recommendations above are those of individual analysts, experts and broking companies, not of Mint. We advise investors to check with certified experts before making any investment decisions.

News Related-

Anurag Kashyap unveils teaser of ‘Kastoori’

-

Shehar Lakhot: Meet The Intriguing Characters Of The Upcoming Noir Crime Drama

-

Watch: 'My name is VVS Laxman...': When Ishan Kishan gave wrong answers to right questions

-

Tennis-Sabalenka, Rybakina to open new season in Brisbane

-

Sikandar Raza Makes History For Zimbabwe With Hattrick A Day After Punjab Kings Retain Him- WATCH

-

Delayed Barapullah work yet to begin despite land transfer

-

Army called in to help in tunnel rescue operation

-

FIR against Redbird aviation school for non-cooperation, obstructing DGCA officials in probe

-

IPL 2024 Auction: Why Gujarat Titans allowed Hardik Pandya to join Mumbai Indians? GT explain

-

From puff sleeves to sustainable designs: Top 5 bridal fashion trends redefining elegance and style for brides-to-be

-

The Judge behind China's financial reckoning

-

Arshdeep Singh & Axar Patel Out, Avesh Khan & Washington Sundar IN? India's Likely Playing XI For 3rd T20I

-

Horoscope Today, November 28, 2023: Check here Astrological prediction for all zodiac signs

-

'Gurdwaras are...': US Sikh body on Indian envoy's heckling by Khalistani backers