When the Economy Hurts, We Kill the Pain. How We Got Hooked.

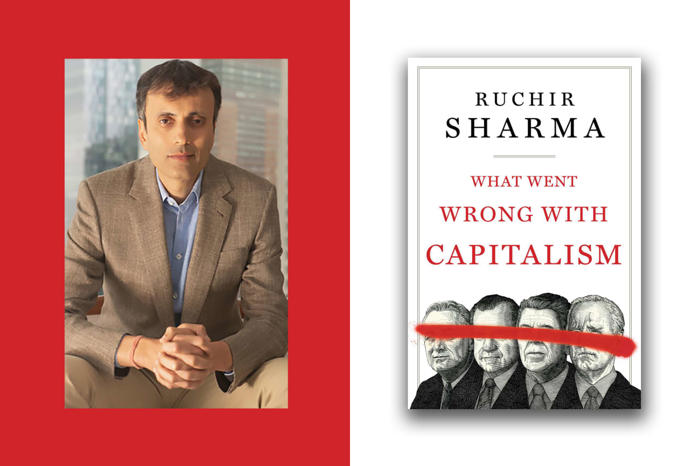

One of capitalism’s most skillful practitioners is deeply concerned about the whole enterprise.

Veteran market strategist Ruchir Sharma’s new book is What Went Wrong With Capitalism. And what did go wrong? While we looked away, the state devoured the economy, Sharma says. “In the past, financial markets typically reflected and followed the economy, up and down,” he writes. “Now they float only upward, levitating on a magic carpet of stimulus.”

The book is a kind of full-hearted revisionist history. It argues that many of the tenets of faith of those in the markets are based on false premises. The idea that a tradition of small U.S. government is what gives markets room to thrive may be right in spirit, Sharma says, but hasn’t been tried in this country since before the Great Depression. Instead, presidents of all political stripes—notably including Ronald Reagan—have embraced debts and deficits, committed to unnecessary corporate bailouts, and supported a Federal Reserve that has looked away while financial markets ballooned but snapped to attention the moment prices start to fall.

“Capitalism’s premise, that limited government is the necessary condition for individual liberty and opportunity, has yet to be tested in a modern setting,” Sharma writes. That failure helps to explain the deep dissatisfaction so many people feel right now, and it puts us at grave risk of a financial crisis that will one day break the capacity of even the mighty American state, Sharma says.

Sharma spent 25 years with Morgan Stanley and is now the chairman of Rockefeller International and the founder and chief investment officer of Breakout Capital. He spoke to Barron’s by phone on June 10, a day before his book was released. The transcript of this conversation has been edited.

Barron’s: Your book makes the case that we have, in a sense, become addicted to economic painkillers. What happened?

Ruchir Sharma: I draw a parallel between pain management as a cultural issue in America, and how we have come to deal with economic cycles. Every time anyone feels even the slightest amount of pain, you give them drugs, which is what has led to the opiate crisis. When it comes to economic cycles, I think something similar has happened, which is that at the slightest sign of any pain, what we want to do in America is give the economy some stimulus.

We’re hooked to always being supported by the government. That’s what leads to this problem that we have today where the creative-destructive fiber of the economy has been destroyed or undermined, and we have low productivity growth.

You’re predicting a growthless future for the U.S. and elsewhere, if we don’t fix this.

If we go down this path. The book is, more than anything else, an examination of what’s happened and why we’re in this current state. Why is productivity growth so low in the middle of this incredible tech revolution? Why are so many people unhappy with the state of economic affairs in America, even though economic growth itself has been relatively resilient in the past couple of years? Why are so many political leaders around the Western world getting thrown out of office at increasing frequency over the last few years? Where is all this dissatisfaction coming from?

You answer those questions in part by saying parts of our national story are actually myths. For instance, you say there never really was a Reagan revolution. What is the story of American politics that we have misunderstood?

The story that we’ve misunderstood is this myth that we ever had an era of small government. People spoke about that a lot, including Reagan. But if you look at government spending as a share of GDP, if you look at it in terms of the regulatory state—you’ve have financial sector deregulation, but you had massive amounts of regulation in pretty much every other sector. And then you’ve had the impulse to bail out. Until the 1980s, the concept of the American government bailing out any private sector company was considered too heretical. But now bailouts have become a standard feature of the American system.

Adjusted for the economic cycle, the number of bankruptcies we typically have in any crisis has been going down over time. And as that old line goes, capitalism without bankruptcies is like Christianity without hell.

Every decade there has been more and more government intervention in the economy. And not just government spending, which has gone up from 3% of GDP in the 1920s to 36% of GDP in GDP now, but to do with everything, in terms of bailouts and regulatory culture.

You think this problem goes all the way back to the Great Depression. What did we get wrong then?

Why did the Great Depression happen? It’s not as if policymakers acted in a vacuum. It’s easy to sit back today and say how wrong they were. But as I point out in the book, the reason why policymakers acted naturally was that for the preceding century, the approach of politics was that every time there is an economic crisis, it’s better to let the weak fail, because in the following crisis, you have a much stronger, productivity-led recovery.

That approach seemed to be validated when you had a sort of mini-Depression in 1920 or so. Policymakers said, “Oh, we won’t do anything about this.” And that was followed by, famously, the roaring ‘20s. Then you get to 1929 where you end up with this big speculative bubble. The bubble burst. By then policymakers were saying, “There’s no need for us to do anything. In fact, given our experience in 1920, why don’t we almost liquidate this bubble so that it ends and we can set the scene for a new era?” A strength taken too far becomes a weakness.

Today, I’m saying there’s no return to the 1920s-type, laisse faire capitalism. It’s not going to happen. We’re in a different environment. You need a welfare state when things go bad. You still need a role for the government when markets completely freeze.

But I think that we’ve gone to the other extreme, which is we’ve gone from the Great Depression to now fearing every single flutter. Every single wrinkle in the business cycle is going to lead to a Great Depression.

That is just totally wrong and is having many negative consequences in the economy already.

What are those negative consequences?

I pointed out declining productivity. There are two things going on. One, remember that every time the government intervenes, or every time the government introduces new regulations, that tends to be pro-incumbent, pro-big business. Big businesses are the ones that benefit from regulation, because they’re able to first meet the regulatory burden. Two, they’re able to help manipulate those regulations, so to speak. The biggest lobbyists in Washington today are predominantly big tech companies, and that’s for a reason. That raises the cost of new people coming in, in terms of a much higher barrier to entry for those businesses.

The second is that it’s leading to a lot of political disaffection. So many Americans are unhappy—and justifiably so, when 35% of Americans feel that they are unlikely to be better off than their parents. That number used to be more than double that 50 years ago. That’s a very dispiriting outcome for the average American. Capitalism has stopped working for the average person in its current distorted form, and you’re seeing that political anger in many ways.

We were talking about the Great Depression. The Covid recession in 2020 was the other extreme. Government intervention quickly ended a steep recession. But you think that was at least in part a mistake, given the disaffection you’re talking about four years later. What went wrong in your view?

There’s an analogy between what happened in the Covid era and what happened in the 1920s. As I said, the 1920s was the strength taken too far, where the complete hands-off approach is what led to the policy mistake of 1929. This time, we learned the wrong lesson from the 2008-2009 financial crisis. The lesson that many policy makers walked away with was that not enough was done to stimulate the economy after the recession ended.

Now comes the pandemic in 2020, and two things happened. One was that the government locked the whole economy down because they felt that they had the resources at will to spend as much as they wanted to prevent the obvious economic damage that happens when you shut businesses down. And then, two, they learned the lesson from 2008-2009 that you need to err on the side of doing too much rather than doing too little. And so we end up getting this mess, which benefits a lot of rich corporations. The kind of wealth explosion we had in the year after the pandemic, with billionaire wealth exploding, was almost unprecedented.

We haven’t mentioned the Federal Reserve. What role is it playing in these problems?

The Fed is very much part of this culture. There’s no attention paid to asset-price inflation. On the other hand, the approach is that every time there is a slight downturn in the markets, we have to intervene before it gets worse. There’s a totally asymmetrical reaction function of the Fed in terms of how to deal with financial markets.

The second issue is how much the Fed has expanded over time in terms of, for instance, buying A-grade commercial paper during the pandemic. [The Fed was] doing quantitative easing even in the middle of an economic recovery, not just when the markets freeze.

That mission creep has happened systematically over time.

What do you say to investors who may read your book and say, it’s too bad productivity growth is dead, but at least whatever I buy is likely to go up in value?

I think investors are behaving rationally. But again, [the stock market is] more and more concentrated. The incumbents keep doing well. A few favorite sectors keep doing better. The concentration of the S&P 500 has never been this extreme, at least in modern history.

That is the frustrating part about it. The people on the inside know how distorted the system is, and so therefore the people who speak about it openly are some of the largest billionaire hedge fund guys in the world. The system is benefiting them, but they also feel something ridiculous and unjust about the system where risk has become this socialized. And the people who keep calling for more of the same are some of the liberal policymakers, who are calling for the Fed to cut rates, calling for this culture to continue without realizing that what they are doing is exactly exacerbating problems like corporate inequality and wealth inequality that have come to plague America.

How do we get on a better path?

Unfortunately, unless and until you get an outright crisis where the government’s ability to spend and rescue is curtailed, like in some other countries, I don’t think anything happens. It’s more of the same.

Thanks, Ruchir.

Write to Matt Peterson at [email protected]