With Shares Down Nearly 83%, Is Now the Time to Buy This E-Signature Stock?

As time passes, it's easy to forget how many companies saw their valuations skyrocket during the pandemic. Many investors who bought stocks in 2020 and 2021 are still seeing red in their portfolios because of how far ahead of the business fundamentals those stock prices had gotten. In addition, the psychological aspect of knowing a stock is down significantly from its high can make it difficult to see a business clearly in the present and make an investing decision that will ultimately be based on the future.

E-signature company Docusign (NASDAQ: DOCU) is one of these businesses. In 2020, the stock rose by 200% as investors piled into any company that might benefit from the need for social distancing. Certainly, there was high demand for the ability to sign documents electronically in those early days of the pandemic. 2021 was a different year for Docusign -- the stock fell 31%, and today, shares trade nearly 83% below their early 2021 peak. However, that's all in the past. The question for investors now is whether or not Docusign is a smart buy at today's price.

Docusign is the clear leader in its industry

It's worth acknowledging that despite the stock's lackluster performance, Docusign is by far the leader in the e-signature space. According to Deloitte, it has a 75% market share. This is due in part to the company being one of the first to bring an e-signing product to the mass market. It was able to grow its presence before many competitors jumped into the fray.

However, it's facing competition from some formidable opponents, among them, Adobe (NASDAQ: ADBE). The Photoshop maker only has a 5% market share in the e-signature niche, but it certainly has a large enough scale to have Docusign looking in the rear-view mirror.

E-signing is a growing market

In 2020, the e-signature market was estimated to be approximately $2.5 billion, and it's expected to increase to $14 billion by 2026. Assuming that estimate is even remotely accurate, Docusign stands to see significant growth even if it doesn't increase its market share at all.

As encouraging as these market size estimates are, Docusign sees an even larger total addressable market of $50 billion in areas that go beyond simply signing documents digitally. Docusign's AIM Contract Lifecycle Management software is meant to increase its value proposition for customers by allowing them to more easily manage contracts.

This offering certainly expands the use case for Docusign and distinguishes it from competitors, but it remains to be seen if this will expand the company's total addressable market to the degree that management claims.

Some positive trends

Part of the reason that Docusign's stock fell over the past few years was that its growth slowed. During much of the pandemic, Docusign was posting revenue and customer growth in the 40% to 50% range. In its most recently reported quarter (Q1 of fiscal 2025), revenue increased by 7%, and total customers grew by 11%. Those growth rates are nothing to write home about, which helps explain why the stock trades for significantly less than it did.

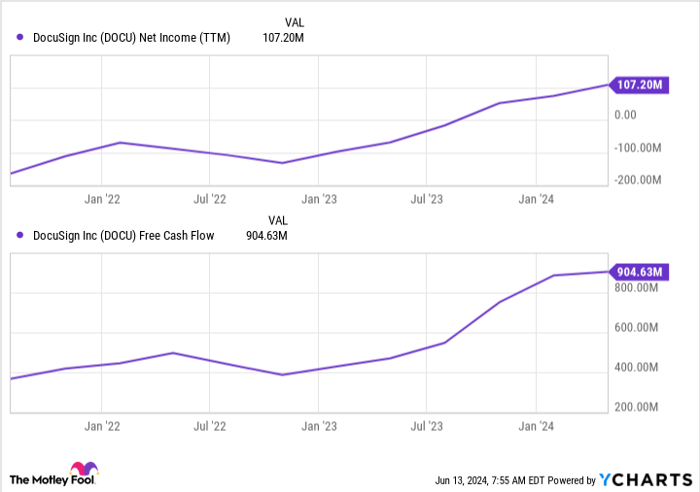

On the flip side, there have been some positive developments over the past several quarters. Consider the improvement in net income and free cash flow over the past three years.

DOCU Net Income (TTM)

To see Docusign turn sustainably profitable and increase its free-cash-flow generation even as revenue growth has slowed is certainly encouraging. This also makes sense. As the company grows, it should be expected that it will benefit from economies of scale.

The bottom line for investors

Docusign currently trades for 4 times sales and 12 times free cash flow, both of which are significantly lower multiples than it carried a few years ago. For investors who believe Docusign has a competitive advantage that distinguishes it from its rivals, its recent profitability and cash-flow trends could indicate better days are ahead, which would make the stock look compelling at today's valuation.

On the other hand, revenue and customer growth have slowed consistently for two years. If those trends continue, the future will look less encouraging. It would therefore be understandable if investors wanted to wait and see when or if growth stabilizes or reaccelerates before adding this stock to their portfolios.

Should you invest $1,000 in Docusign right now?

Before you buy stock in Docusign, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Docusign wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Jeff Santoro has positions in Adobe. The Motley Fool has positions in and recommends Adobe and Docusign. The Motley Fool has a disclosure policy.