Is Dutch Bros Stock a Buy Near Its 52-Week High?

Dutch Bros (NYSE: BROS) is serving up impressive growth with accelerating profitability. Shares of the drive-thru coffee shop operator and franchiser are up more than 20% so far in 2024.

There's a lot to like about this innovative quick-service beverage concept still in the early stages of a national expansion strategy. At the same time, a pricey valuation warrants some caution and could be one reason for investors to avoid chasing this caffeine buzz.

So is the stock a buy now? Here's what you need to know.

A strong start to 2024

The adage "if you build it, they will come" is central to the Dutch Bros investment thesis. The business dates back to 1992 from a single pushcart selling coffee drinks in Grants Pass, Oregon, and now counts 876 shops across 17 states. Simply put, open up more stores and the sales should follow.

That's exactly what Dutch Bros is managing, inaugurating 45 new locations already this year, marking 11 straight quarters with 30 or more openings. The dynamic has been a powerful financial driver that's helped Dutch Bros start to see the benefits of scale.

In May, Dutch Bros reported first-quarter results (for the three months ended March 31) with revenue of $275 million, up 39% year over year. System same-shop sales climbed by 10% from the prior-year quarter, capturing both higher customer traffic as well as higher pricing.

The trend helped company-operated stores' contribution margin reach 29.8%, expanding from 24.2% in Q1 2023. Earnings per share (EPS) of $0.09 came in ahead of the negative $0.01 average Wall Street estimate. Separately, adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) grew by 120% to a record $52.5 million.

Recent developments include the beta launch of a mobile ordering app, while an advertising campaign is seen as a sales tailwind for the rest of the year.

The better-than-expected start to 2024 was good enough for Dutch Bros to hike its full-year guidance. Management now sees 2024 revenue growth of around 25% compared to a midpoint range of 24% announced earlier in the year. Adjusted EBITDA for the year estimated between $195 million and $205 million is up from the prior $190 million midpoint target.

Person in drive-through retrieving beverages from car window.

Valuation looks expensive

As great as the trends from Dutch Bros appear, the stock commands a hefty growth premium, implying investors are paying up for an outlook that is far from certain.

Management has cited a plan to open more than 4,000 shops over the next 10 to 15 years. If that roadmap is already being priced in, the challenge for the company will be to surpass that high bar of expectations.

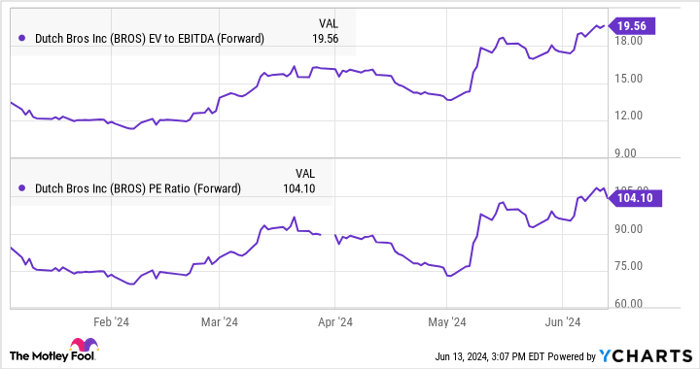

Shares trade at an enterprise value (EV)-to-EBITDA multiple of 20 times the company's 2024 adjusted EBITDA guidance. The valuation is even more expensive in terms of the forward price-to-earnings (P/E) ratio at 104 times the consensus 2024 EPS of $0.38.

On their own, these ratios don't necessarily mean the stock needs to sell off, but they add to the risk of increasing volatility should results begin to disappoint.

BROS EV to EBITDA (Forward)

The drive-thru model that makes Dutch Bros unique could also be a long-term roadblock. On one hand, not featuring restaurant seating saves on operating expenses and supports margins, but may also limit expansion opportunities.

In contrast to Starbucks, which has nearly 39,000 locations globally, Dutch Bros doesn't target high-foot-traffic commercial venues like airports or shopping malls where customers can't drive through.

Unless the company plans to reinvent itself, prime locations will become harder to secure. There is also a thought that margins through pricing power on core coffee beverages are up against highly competitive local markets.

Final thoughts

As long as Dutch Bros keeps posting strong growth, shares should remain supported, but there are plenty of uncertainties when thinking about the stock as an investment.

So to answer the original question, I don't believe Dutch Bros is a buy right now, with a hold rating more appropriate at the current level. Patient investors may be able to pick up shares at a more attractive price at a later date.

Should you invest $1,000 in Dutch Bros right now?

Before you buy stock in Dutch Bros, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dutch Bros wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of June 10, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.