Here’s how much extra tax Irish workers will have to pay to keep the state pension at 66

YOU, DEAR READER, know The Journal is a publication for humble writers. In fact, we think we’re much more humble than you would understand.

But sometimes, even we have to hold up our hands and admit it – we got it right.

In October after Budget 2024, we wrote about how a 0.1% increase in PRSI (Pay Related Social Insurance) was likely the first of many hikes in the charge to come.

PRSI is used to fund the social insurance fund, which in turn is primarily used for paying the state pension.

In what will come as old news to many, the sustainability of that fund is in big trouble.

The population is set to age in the coming decades, with gigantic annual deficits predicted.

There are a few ways this could be tackled – one is by increasing the state pension age.

This is exactly what the government previously planned to do, raising the pension age to 68, but then got cold feet when the issue blew up during the 2020 general election.

In committing to keeping the state pension age at 66, a new way of shoring up money had to be found. The one settled on last year was to raise PRSI.

For PAYE workers, employers currently pay up to 11% PRSI. Employees pay 4% of gross salary.

With the 0.1% rise sounding the starting gun, these numbers are set to slowly rise annually to 2028.

While this was known in theory, a study published by the Economic and Social Research Institute (ESRI) during the week gave some more detail on the reality of what this will mean for workers.

The study assumed the higher band of employer PRSI will rise from 11% to 11.75% by 2028, while employee PRSI would jump from 4% to 4.7%.

This will be a help – the ESRI estimated this would raise an extra €1.6 billion a year annually by 2028.

But what effect would this actually have on workers? Well, at a crude level, extra PRSI of 0.7 for someone on €40,000 a year would mean paying an extra €280 annually.

But given the situation tends to differ depending on how taxes apply to individual workers, the ESRI instead looked at certain aspects of the rise, such as effect by age group.

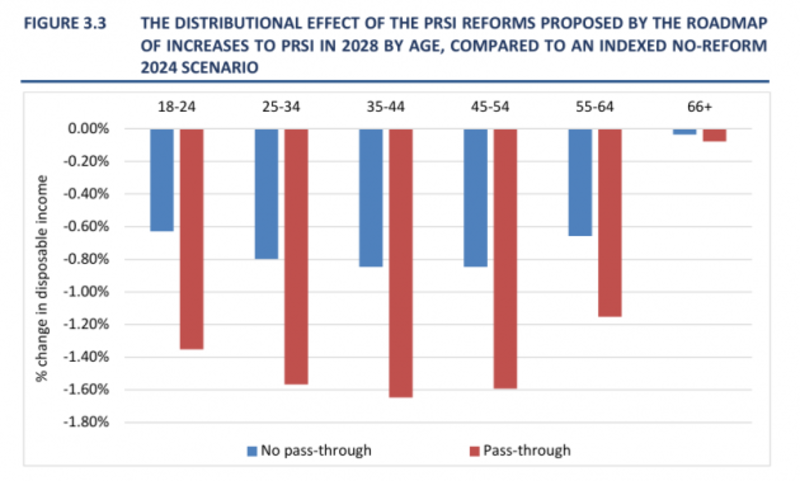

Here, it was found that those between 25 and 54 – at prime working age – will bear the brunt of extra PRSI, losing an average of 0.8% of their annual disposable income.

However, it also noted that rather than paying higher PRSI themselves, employers could ‘pass on’ the extra taxes to their workers.

In this scenario, these younger workers could lose up to 1.6% of their annual disposable income.

Losses for those just starting their careers, or coming to the end of them, were lower – estimated at 0.6% – 1.35% for those in the 18-24 and 55-65 groups depending on whether higher charges are passed on by employers.

Losses for the over 66 group were noted to be “close to zero”.

‘Well sure, losing 1.6% of my income is pretty bad, but it’s worth it if I’m still able to retire at 66,’ says you, possibly.

The problem – the PRSI hikes are unlikely to stop in 2028.

Despite what some people think, governments don’t tend to like raising taxes. People tend to dislike higher taxes, and governments like votes.

Public pushback was one of the reasons why the government ditched the idea of raising the state pension past 66.

And it is why the PRSI tax increases are slow and steady.

Perhaps like the (false) parable of a frog that doesn’t notice the rising water temperature in a slowly boiling container of water, the government is hoping people won’t be as miffed by PRSI little by little every year, rather than by a lot all at once.

The issue here is how things compound with time.

As the ESRI put it: “Given the relatively slow increases envisaged, further PRSI increases are likely to be needed well beyond 2028 to deal with the fact that the Social Insurance Fund is likely to be in deficit by 2035. This deficit is projected to rise exponentially in the decades that follow.”

Basically, the slower PRSI rises, the more it will eventually have to go up.

How much could it end up rising by?

Well, the current combined rate of employee PRSI (4%) and employer PRSI (11%) is 15% of someone’s gross pay.

Without raising the state pension age over 66 or diverting money elsewhere from the exchequer, the Pensions Commission (which reported to the government in 2021) estimated combined PRSI would have to rise to a combined rate of nearly 20% by 2040 (6.2% employee and 13.25% employer).

In a worst case scenario where this was all passed on to the employee, this would mean worker disposable income could drop by more than 5%. This could keep rising even after 2040.

The Irish Fiscal Advisory Council has recommended biting the bullet and raising PRSI more quickly by a combined 3.5%.

It said doing this would ensure “taxing baby boomers while they are working”, so those who are set to retire soon would contribute more to ease the burden on the young.

And this all is of course not even counting the government’s long-delayed plan to introduce auto-enrolment, where workers will be expected to contribute even more of their pay to their eventual retirements.

Now, that all sounds pretty bad.

That’s because it is.

The ESRI estimated the social insurance fund will go into the red in 2035, recording annual deficits of €3.5 billion from 2040 which will balloon to €32.2 billion a year by 2077.

Realistically, those are numbers too big on a timescale too long to mean much to most people.

But basically, if we want to keep the state pension age at 66, a whole lot of extra cash will have to come from somewhere.

The government has decided PRSI will be the somewhere.

The latest figures are just another indication of what these PRSI hikes will actually mean – and how much extra money could end up coming out of the pockets of younger and middle aged workers.