Private Credit Has Too Much Cash and Not Enough Places to Put It

(Bloomberg) -- Private credit’s historic rise is creating a problem that most asset managers would love to have: too much cash in their coffers.

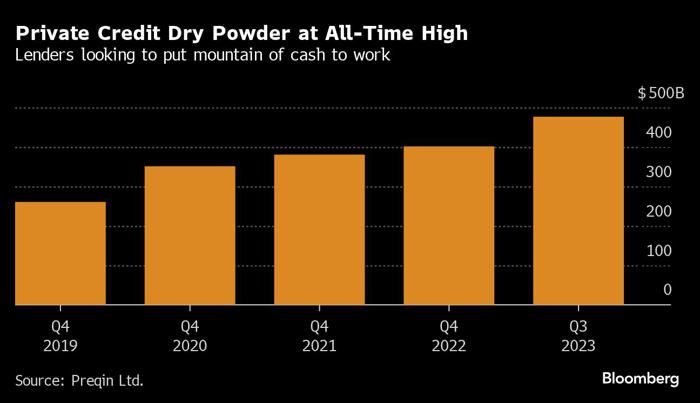

Dry powder, or the amount of money committed to private credit funds that has yet to be deployed, is at a record. That’s in part because demand for their capital from buyout firms remains tepid. What’s more, bank leveraged finance desks are increasingly seeking to poach back business. The result has been what some have called a ‘race to the bottom’ among private credit managers.

“Because of this supply-demand imbalance you’re starting to see this behavior shift in parts of the private credit market — turning into a bit of an auction for the tightest terms,” said Sachin Khajuria, who runs family office firm Achilles Management and invests across private assets. “That means weaker underwriting standards due to competition.”

To win deals, managers in the $1.7 trillion industry are offering cheaper pricing and giving up key investor protections. They’re also keeping larger slices of financings for themselves, and even swooping in at the last minute to snatch business from the leveraged loan market.

“Right now I’d be really selective in private credit,” said Khajuria, a former partner at Apollo Global Management Inc.

Private Credit Dry Powder at All-Time High | Lenders looking to put mountain of cash to work

In recent weeks direct lenders have offered some of the most aggressive financing terms ever seen in the market.

Last month a group of private credit providers offered EQT AB a loan for its buyout of supply chain risk-management software provider Avetta at 4.5 percentage points over SOFR, one of the cheapest rates on record.

And earlier this month direct lenders provided a loan to KKR’s Depot Connect International with a 99.75 cent issue discount, one of the smallest ever in private credit.

“All it takes is one or two institutions to like a deal to create that competitive pricing, and there’s real desperation to put money to work given all the dry powder raised by third-party capital,” said Bill Eckmann, head of principal finance in the Americas at Macquarie Capital.

Funds are also becoming less willing to share deals with their competitors, often cutting multibillion-dollar checks to individual companies.

That’s a 180 degree shift from the “clubbing” days, when a dozen or more direct lenders would join hands, taking small pieces of a financing. Last week Blackstone Inc. provided a $4.5 billion commitment to CoreWeave Inc., it’s largest-ever single commitment, leaving a handful of rivals to split $3 billion between themselves.

But slashing prices or taking bigger bites of loans sometimes isn’t enough. Direct lenders are also fighting tooth and nail to win transactions from the broadly syndicated market. Earlier this month a group of direct lenders provided $385 million of debt to Ribbon Communications Inc. after the firm had already launched a leveraged loan sale, Bloomberg reported.

“The demand for deals is very strong, but the need for credit is not there,” David Mechlin, a portfolio manager in the credit investments group at UBS Asset Management, said during a roundtable earlier this week. “There’s a deficit of credit supply right now.”

There’s now growing attention on how managers are navigating this tricky market. Some, such as HPS Investment Partners, are pumping the breaks. The firm has taken the rare step of limiting inflows into one of its funds, betting that it will give it the flexibility to walk away from deals and ultimately boost returns.

“For managers that have to deploy capital, we want to see how they approach this market and are watchful for who grows the most in this environment,” Ana Arsov, global head of private credit at Moody’s Ratings, said in an interview.

Deals

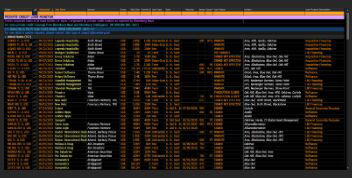

Private credit lenders and banks are competing to provide debt financing for a potential buyout of education software provider PowerSchool Holdings Inc. Direct lenders are seeking to provide a roughly $3 billion debt packagePrivate credit firms Antares Capital and Blackstone Inc. have provided a unitranche of around $250 million for UK-based data management company Rimes TechnologiesCarlyle Group Inc. and amicaa, an Australian private credit manager, are providing a NZ$140 million loan to finance a management buyout of New Zealand fuel retailer NPD by the company’s chief executive officerNewLink Group, a Bain Capital-backed firm that provides software to sectors including the electric vehicle-related industry, is seeking as much as $100 million in private debtPeloton Interactive Inc. kicked off the sale of a $1 billion loan offering. The loan is unrated and is being marketed to a broad range of investors, including direct lendersThe founders of Indian renewable energy firm Continuum Green Energy Ltd. have secured $230 million from private credit lenders including KKR & Co, BlackRock Inc. and Tahan CapitalCloud computing company CoreWeave Inc. has received $7.5 billion of debt financing, mostly in the form of investment-grade loans, led by Blackstone Inc.Private equity firm Charme Capital has lined up a debt package from private credit lender Arcmont and Carlyle’s direct lending arms to finance its acquisition of Italian veterinary clinics operator Gruppo AnimaliaSome private credit funds are holding talks about refinancing the debt stack of WildBrain Ltd., a kids’ content producer that counts Peanuts and Teletubbies among its brandsCerberus-backed Electrical Components International has secured a roughly $1.1 billion financing package from private credit firms to refinance its broadly syndicated debtHPS Investment Partners and WhiteHorse Capital Management have provided $385 million of debt to Ribbon Communications Inc.Aflac Inc. is buying a 40% stake in middle-market lender Tree Line Capital Partners, the latest insurance company to expand into the ballooning world of private creditA group of direct lenders provided a $650 million private credit package to Giving Home Health Care to refinance debt and pay a dividendMore on Private Credit Deals

Private Credit WSL - Final Bloomberg News is tracking corporate loans originated by private credit firms around the globe in the Private Credit Loan Monitor. Subscribe to the Private Credit Weekly for more news and analysis on the $1.7 trillion market. |

Fundraising

HPS Investment Partners has taken the rare step of limiting inflows in one of its funds to manage a surge in demand for private creditMubadala Investment Co. deployed 89 billion dirhams last year into a range of sectors including private credit and artificial intelligence, an area where Abu Dhabi is seeking to make greater inroads

Job Moves

Jean Hsu, the global head of private debt at California Public Employees’ Retirement System, resigned after almost a quarter-century at the largest US pension fundFidelity International has halted its European direct lending activities and let go members of its private markets teamDB Investment Partners is building up its private-credit team in Asia, citing the region’s attractive growth potential and relatively young populationBarings has hired Bob Shettle once again as a managing director, according to a Monday news release. He will join the company’s North America private finance investment committee effective at the end of MayFortress Investment Group hired former Goldman Sachs Group Inc. managing director Michel Dimitri

Did You Miss?

Ex-Apollo Partner Sees Cracks Emerging in Private-Credit BoomEU Proposes Stress-Testing Links Between Lenders, Shadow BanksAustralia’s No. 2 Pension to Allocate Billions to Private CreditBanks Are Now Targeting Some of Private Credit’s Riskiest DebtJPMorgan Sees More Capital Going Into Direct Lending

--With assistance from Ellen Schneider.

Most Read from Bloomberg

©2024 Bloomberg L.P.