1 Supercharged Growth Stock Poised to Trounce the S&P 500

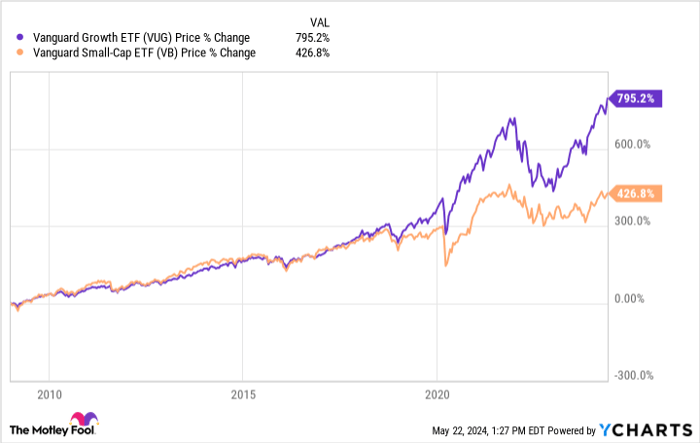

In the first part of the 21st century, value stocks handily outperformed growth stocks in the United States. However, a sharp trend reversal began to take hold after the 2008 financial crisis -- one that holds till this day. Namely, growth stocks, particularly large-cap U.S. firms, have markedly outperformed value stocks over the past 16 years. The chart below lays this pattern bare.

VUG

Interestingly, small- and mid-cap growth stocks have largely lagged behind the benchmark S&P 500 index over this period, underscoring the market's emphasis on large-cap entities. When the Federal Reserve eventually cuts interest rates, though, small- and mid-cap equities should have their moment in the sun. After all, most smaller firms are sensitive to interest rates due to their reliance on debt instruments for funding.

Growth chart with upward arrow.

Which growth stocks stand out as top market-beating candidates leading into this all-important catalyst? Medical imaging specialist Nanox (NASDAQ: NNOX) has the ingredients to be a top performer in the stock market over the current decade. After all, interest rates tend to go hand-in-hand with the market's appetite for risk. Read on to find out more about this intriguing medical technology growth stock.

Revolutionizing medical imaging: Nanox's innovative approach

In the ever-evolving landscape of medical technology (medtech), Nanox is making waves with its groundbreaking solutions. The company's multi-source digital tomosynthesis system Nanox.ARC and its Nanox.AI platform are poised to transform the field of medical imaging, making advanced diagnostic services more accessible worldwide.

Nanox's technology aims to streamline medical imaging processes, reducing costs and enhancing efficiency. The medtech's platform enables faster and more accurate diagnoses by optimizing workflows and minimizing resource-intensive steps. Most importantly, Nanox's more efficient process ought to improve patient outcomes.

One of the company's key attributes is its cloud-based infrastructure. Nanox uses cloud computing to store and process imaging data, allowing radiologists to access and analyze images remotely. This innovation creates a decentralized healthcare ecosystem that aims to directly address the global shortage of radiologists, especially in developing countries.

What's the opportunity? Nanox is expected to remain cash-flow-negative in the short term, but profitability is a real possibility by 2026. After all, the company is staring down a multi-billion-dollar marketplace with few real competitors.

So, with a market cap of only $503 million, this medtech stock has a decent shot at going on a multi-year bull run, which could deliver gains significantly above those of the broader market. That said, execution will be critical to Nanox's success. Regulatory setbacks or slow adoption rates could hamper share price appreciation in a big way.

Like the story but not the risk profile?

Early commercial-stage medtech companies are inherently risky. Nanox, for its part, is particularly risky because the company is attempting to develop a cutting-edge medical imaging platform.

One way to get exposure to Nanox's stellar upside potential without its equally hefty risk profile is to buy an exchange-traded fund (ETF) that owns a stake in the medtech.

In this regard, two ETFs stand out:

- iShares Russell 2000 ETF

- iShares Russell 2000 Value ETF

Both funds hold positions in Nanox at the time of this writing.

These two growth ETFs are somewhat volatile due to their focus on innovation companies. However, each fund is considerably less risky than directly owning shares of Nanox.

Should you invest $1,000 in Nano-X Imaging right now?

Before you buy stock in Nano-X Imaging, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nano-X Imaging wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $584,435!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of May 13, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.