Nvidia shares pass $1,000 for first time on AI-driven sales surge

- Nvidia reported fiscal first-quarter earnings on Wednesday that beat expectations for sales and earnings, and the stock rose in extended trading over the $1,000 per-share threshold.

- Its strong results on Wednesday suggest that demand for the AI chips Nvidia makes remains robust.

- CEO Jensen Huang said the company would begin to see revenue from its next-generation AI chip, called Blackwell, later this year.

Nvidia shares topped $1,000 for the first time in extended trading on Wednesday after the chipmaker reported fiscal first-quarter results that topped analyst estimates.

Nvidia's quarterly earnings report has become a way for investors to gauge the strength of the AI boom that has transfixed markets in recent months. Its strong results on Wednesday suggest that demand for the AI chips Nvidia makes remains robust, and CEO Jensen Huang said the company would see revenue from its next-generation AI chip, called Blackwell, later this year.

The stock rose 7% in extended trading. Nvidia also said it was splitting its stock 10 to 1. Based on the after-market move, the shares are poised to reach a fresh high on Thursday.

- Earnings Per Share: $6.12 adjusted vs. $5.59 adjusted, per LSEG consensus estimates.

- Revenue: $26.04 billion vs. $24.65 billion expected by LSEG

Nvidia said it expected sales of $28 billion in the current quarter. Wall Street was anticipating earnings per share of $5.95 on sales of $26.61 billion, according to LSEG.

The chipmaker reported net income for the quarter ended April 28 of $14.88 billion, or $5.98 per share, compared with $2.04 billion, or 82 cents, in the year-earlier period.

In the past year, Nvidia sales have skyrocketed as companies such as Google, Microsoft, Meta, Amazon and OpenAI buy billions of dollars of Nvidia's graphics processing units, which are advanced and pricey chips required for developing and deploying artificial intelligence applications.

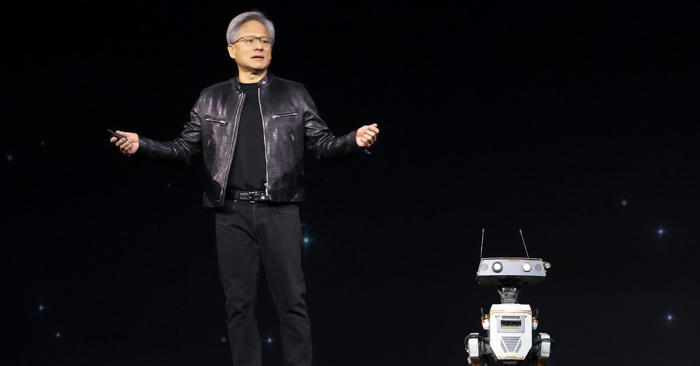

Nvidia CEO Jensen Huang delivers a keynote address during the Nvidia GTC Artificial Intelligence Conference at SAP Center on March 18, 2024 in San Jose, California.

The company's largest and most important business is its data center sales, which includes its AI chips as well as many of the additional parts needed to run big AI servers.

Nvidia said its data center category rose 427% from the year-ago quarter to $22.6 billion in revenue. Nvidia finance chief Colette Kress said in a statement that it was due to shipments of the company's Hopper graphics processors, which include the company's H100 GPU.

"A big highlight this quarter was Meta's announcement of Lama 3, their latest large language model which used 24,000 H100 GPUs," Kress said on a call with analysts. She added that large cloud providers make up about "mid-40%" of Nvidia's data center revenue.

Even as the company reports a tripling or more of its business, Huang said that the company's next-generation AI GPU, called Blackwell, would lead to more growth.

"We will see a lot of Blackwell revenue this year," the CEO said on a call with analysts, adding the new chip would be in data centers by the fourth quarter.

Nvidia also highlighted strong sales of its networking parts, which are increasingly important as companies build clusters of tens of thousands of chips that need to be connected. Nvidia said that it had $3.2 billion in networking revenue, primarily its InfiniBand products, which was over three times higher than sales in the year-earlier period.

Nvidia, before it became the top supplier to big companies building AI, was known primarily as a company making hardware for 3D gaming. Gaming revenue was up 18% during the quarter to $2.65 billion, which Nvidia attributed to strong demand.

The company also sells chips for cars and chips for advanced graphics workstations, which remain much smaller than its data center business. It reported $427 million in professional visualization sales, and $329 million in automotive sales.

Nvidia said it bought back $7.7 billion worth of its shares and paid $98 million in dividends during the quarter. Nvidia also said that it's increasing its quarterly cash dividend from 4 cents per share to 10 cents on a pre-split basis. After the split, the dividend will be a penny a share.