Market momentum expected to continue beyond 2H2024 on investment inflows

This article first appeared in Capital, The Edge Malaysia Weekly on June 17, 2024 - June 23, 2024

IS the local bourse on the cusp of a new bull cycle or is it already in the throes of one as some contend?

The jury is still out, but the signs point to a more bullish performance in the second half of the year and beyond, based on a confluence of institutional and foreign direct investment (FDI) inflows, improving corporate earnings and thematic plays that have buoyed Bursa Malaysia thus far this year.

TA Securities head of research Kaladher Govindan projects that the FBM KLCI may exceed the 2,000-point mark by 2027. The benchmark index had risen 10.69% year to date to 1,629.18 points on May 23 but ended at 1,615.19 last Thursday.

Fund managers and analysts are not concerned about the dip as they expect major catalysts to come on stream in the coming months. These include structural reforms that will improve the nation’s financial standing, continuing inflow of FDI in growth sectors that will lift domestic direct investment and the economy along with it.

They also point to resilient domestic spending aided by a boost in job security, higher civil servant salaries and withdrawals from the Employees Provident Fund’s (EPF) Account 3.

“The index is in a new bull cycle that started in March 2020, after witnessing a down cycle from July 2014 to March 2020. Like the previous up cycle that started with the October 2008 low of 801.27 points and ended higher at 1,896.23 points in July 2014, we believe the FBM KLCI is in the middle of another major up cycle that will propel the benchmark index to a new high from its historical high of 1,896.23. It is possible to rise beyond 2,000 points before the next general election in 2027,” Kaladher tells The Edge.

Market momentum expected to continue beyond 2H2024 on investment inflows

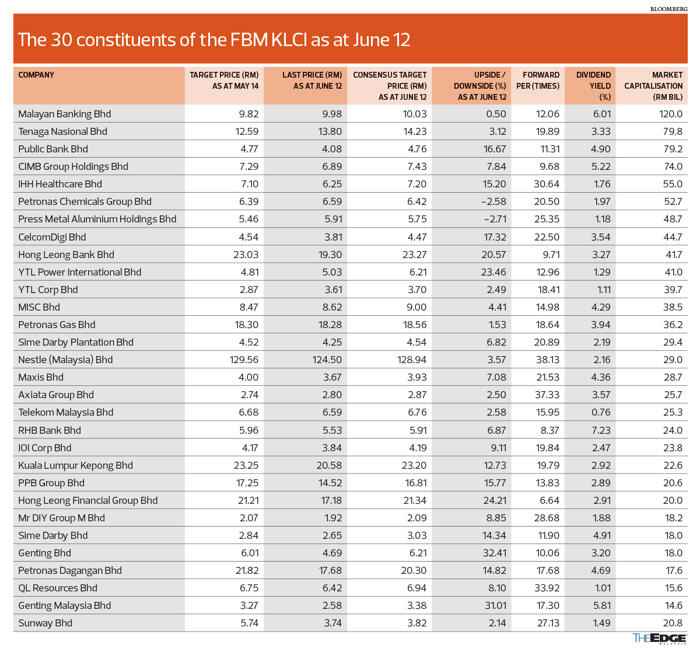

Bursa Malaysia-listed companies’ first-quarter 2024 (1Q2024) earnings report card shows that at least a third of the 30 constituents of the FBM KLCI hit or surpassed analysts’ consensus target prices, with the majority of the remaining counters coming close to the target prices (see table on next page).

MIDF Research head of research Imran Yassin Md Yusof concurs with Kaladher, noting that share prices have moved ahead following the 1Q2024 results, reflecting expectations of better earnings in the future under improved economic conditions.

Fund managers and analysts The Edge spoke to emphasise that the FBM KLCI’s price-earnings ratio (PER) of 14.4 times compared with its historical range of 16 to 17 times positions the counters to gain from positive market sentiment and inflow of foreign funds.

“Moreover, many of the upward revisions in target prices were due to the rollover of valuations to 2025. Therefore, we need to look at these two factors — that is, earnings and valuation — to determine whether the momentum will be sustained,” says Imran.

“We believe the earnings momentum can continue into the remaining quarters of the year, supported by expectations of better economic performance. We expect gross domestic product growth to come in at 4.7% for this year. Meanwhile, we believe [the FBM KLCI’s] valuation will gradually revert to its historical range.”

Ang Kok Heng, chief investment officer at Phillip Capital in Kuala Lumpur, agrees. He points out that the stocks generally are not expensive, although there are a number of counters with PERs of more than 30 times with the market reacting to news flow on data centre developments and services.

“But those are one-off deals. Overall, investor bullishness [and hype] will propel the market forward,” he says.

Nevertheless, Ang cautions investors to be selective when it comes to stocks.

“The ongoing rotational play in the market will push the market to greater heights as different types of stocks replace certain [overbought] counters within the same sector. There have been plenty of promotions, with institutional investors entering and exiting,” he says, describing the trading scenario on Bursa.

Where retail investors are concerned, Ang believes the market will continue to be rife with speculation on penny stocks where “share prices are being supported by strong sentiments, however, making [them] all the more risky and susceptible to negative impacts from bad news”.

Note that the US Federal Reserve said last Wednesday that it would maintain its key policy rate at the current level for the seventh time in a row, while signalling just one rate cut this year compared with the three cuts it forecast in March.

Kaladher points out that the market is expected to maintain its upward trend in general but is bound to see some corrections. “Nonetheless, as the index does not move in a straight line, it should be subject to bouts of profit-taking consolidations along the way while continuing its northbound journey,” he adds.

TA Securities has a 2024 target of 1,690 points for the FBM KLCI, based on a CY2025 PER of 14 times.

Small caps, selected sectors in focus

Ang says small-cap stocks are currently favoured by institutional investors.

“Institutions now tend to be looking at small market capitalisation stocks with good fundamentals,” he notes, highlighting furniture designer and exporter Synergy House Bhd (KL:SYNERGY) and pawnbroker Evergreen Max Cash Capital Bhd (KL:EMCC) as such counters with a long runway for growth.

Trading at the RM1.85 level, Synergy House appears to be highly priced at a PER of 27.61 times. Analysts covering the counter, however, remain bullish on its export prospects, premised on affordability and positive take-up as well as anticipation of robust growth in the coming years from its sales penetration strategies. “With its market positioning and strategy, the company will never have negative growth as its e-commerce [business-to-consumer] segment is growing 100% a year,” says Ang.

As for Evergreen Max Cash, he believes it has plenty of room for growth given its aggressive expansion plan. The pawnbroker aims to open at least five new pawnshops in financial year 2024 (FY2024). As at 1Q2024, the company had acquired five pawnshops, bringing its total to 27 outlets to date.

Ang says there are also selected gems in the consumer sector as it is seen to benefit from the EPF Account 3 withdrawals. The provident fund has allowed pre-retirement account holders to withdraw up to 10% of their balance since May 11.

“A number of consumer companies have enjoyed improved earnings since Account 3 went live. I believe we will continue to see increased spending in discretionary goods in the second half of 2024 (2H2024) and towards the year-end festive season. It is the middle income group and not the B40 that is loosening their purse strings, therefore, counters in that space will benefit,” he says.

Ang also advises investors to be prepared for the recovery of the semiconductor industry 2H2024, given the signs of a rebound.

Meanwhile, MIDF Research likes the transport, construction, property and oil and gas sectors.

“The basis for our positive stance is the expectation of external trade recovery, better prospects for more construction jobs such as data centres, improved demand for residential housing and stable Brent crude pricing, which leads to a stable capital expenditure outlook for the oil and gas sector,” says Imran.

The research house is particularly bullish on the transport and oil and gas sectors, highlighting Westports Holdings Bhd (KL:WPRTS), with a “buy” call and target price of RM4.30, and MISC Bhd (KL:MISC), also with a “buy” recommendation and target price of RM9.75).

MIDF Research forecasts that the trend of a higher gateway-to-transshipment ratio exceeding 40%, compared with the historical 30%, will continue throughout the year, thanks to the operations established by FDIs last year.

“This is expected to benefit Westports through higher charges for gateway containers. Our expectation remains unchanged with a forecast of +4.2% year on year overall container volume growth for FY2024,” says Imran.

“Intra-Asia’s regional trade is expected to drive overall volume growth, while Asia-Europe’s volume may experience a slight disruption as liners opt for the longer route around the Cape of Good Hope. The terminal experienced fluctuations in its utilisation in certain weeks due to disruptions in shipping schedules and vessel bunching, but this should normalise over time.”

As for oil and gas, he expects a robust outlook for the LNG shipping business following seasonal demand as well as strong demand for tankers and floating production storage and offloading vessels on the anticipation of Brent crude prices remaining elevated and stable this year.

MIDF Research is also keeping a close tab on the construction sector and maintains Gamuda Bhd (KL:GAMUDA) as its top pick for the outfit’s strong overseas expansion plan and consistency in clinching sizeable jobs in the absence of mega projects in Malaysia.

“Its bulging order book provides strong earnings visibility and is expected to grow larger with expected wins from Australia, data centre jobs and upcoming infrastructure projects such as the Penang LRT, Pan Borneo Highway Sabah and the Penang International Airport expansion. It is also the front runner for the Mass Rapid Transit Line 3 tunnelling package with its partner MMC [Corp Bhd (KL:MMCCORP)]. The group’s balance sheet remains healthy with a net gearing of 28.6%, well below its self-imposed limit of 70%,” says Imran, who ascribed a “buy” recommendation and target price of RM6.83 on Gamuda.

Similarly, the research house is sanguine on the long-term prospects of Mah Sing Group Bhd (KL:MAHSING), with a “buy” call and target price of RM1.83, for its strong play in the affordable housing space. “Its entry into data centres will spur earnings growth in the long term,” says Imran, pointing out that the company has a strong balance sheet with a low net gearing of 0.06 times.

MIDF Research is also bullish on the banking sector and has Public Bank Bhd (KL:PBBank) and Hong Leong Bank Bhd (KL:HLBank) as its top picks.

“Public Bank [‘buy’ and target price of RM4.78] saw strong net interest margin (NIM) improvement in 1QFY2024. This was attributable to this quarter’s steep NIM bump that was the effect of previous FD (fixed deposit) rate repricing which has begun to kick in,” it says.

“Nevertheless, the cost of funds is expected to remain roughly stable, while the brunt of loan yield compression effects will likely be reflected only in subsequent years. We are pleased to note that Public Bank’s small and medium enterprise segment’s growth seems to be growing once again.”

As for Hong Leong Bank, the research house has a “buy” call with a target price of RM21.38.

“Hong Leong Bank expects FY2024 loan growth to hit the upper band of its 6% to 7% target. The fourth quarter of the financial year tends to be stronger on the loan front. Also, we expect that next quarter will likely see net writebacks and strong loan and deposit growth,” says Imran.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.