Stressed Aussies adding years of debt to make home payments

Police searching for a driver over an alleged hit and run in Western Sydney

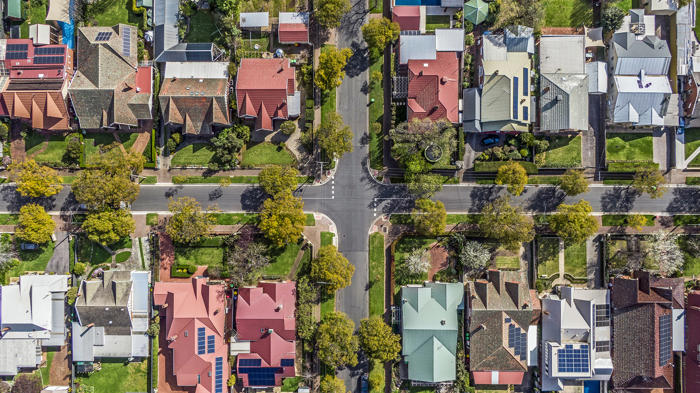

Stressed mortgage holders are adding extra years and extra debt to their loans as they battle to make monthly repayments, new research shows.

Comparison website Finder said in a survey of just over 1000 respondents, 13 per cent of mortgage holders had extended their home loan in the past 12 months in order to lower their repayments.

That equates to 429,000 people Australia-wide.

Mortgage holders are adding years of debt to their home loans so they can make repayments.

Households paying the current average loan have seen their mortgage repayments rise more than $21,000 a year on average since April 2022, when the Reserve Bank of Australia began increasing interest rates.

Finder's research found seven per cent of mortgage holders (equivalent to 231,000 borrowers) have extended the term of their loan by less than five years.

But six per cent have added five years or more onto their mortgage, meaning the interest implications potentially adding up to thousands of dollars over the life of the loan.

"While extending the length of your home loan will lower your monthly repayments in the short term, it's probably going to cost you a fortune over the long run," Finder home loans expert Richard Whitten said.

"The average Aussie household has much less disposable income compared to a few years ago.

"Many are desperate for ways to slash their monthly outgoings, even if it means sacrificing their long-term financial health."

Whitten said even a small increase in the length of a loan term could add up to big differences in interest over the life of a home loan.

The average loan size in Australia is $625,050, according to ABS data.

Finder analysis showed paying that size loan off over 30 years would cost a typical homeowner $722,602 in interest based on a competitive variable rate of 5.99 per cent.

Pushing this out to 35 years would add a whopping $147,457 extra to the total interest over the life of the loan.

For a borrower with a $1 million mortgage, the interest soars from $1,156,066 over the life of a 30-year loan, to $1,391,980 over 35 years.

Whitten encouraged those who extended their loan to look at ways to pay their debts down faster when they can afford to.

"When you're stretched, you need to lower repayments straight away," he said.

"But if you find yourself in a position to do so down the track, consider putting extra money into your home loan to make up for the costs that come with extending your loan.

"Most variable mortgages have a redraw facility, so homeowners can make extra repayments and still get access to those funds in an emergency.

"If your loan has an offset account it's even better. You can park any extra savings there, get the full benefit of offsetting the interest charges and have complete access to the money when you need it."

Over a third (34 per cent) of Australians say they struggled to pay their home loan in June, up from 26 per cent in June 2022, according to data from Finder's Consumer Sentiment Tracker.

The information provided on this website is general in nature only and does not constitute personal financial advice. The information has been prepared without taking into account your personal objectives, financial situation or needs. Before acting on any information on this website you should consider the appropriateness of the information having regard to your objectives, financial situation and needs.