- Some $929 billion in commercial real estate loans will come due in 2024

- About 14% of all CRE loans and 44% of office loans appear to be underwater

- Recent study warns of widespread risk of bank failures if defaults spike to 10%

Experts are sounding alarms that the distressed US commercial real estate market could trigger a new banking crisis, if default rates on commercial mortgages rise sharply.

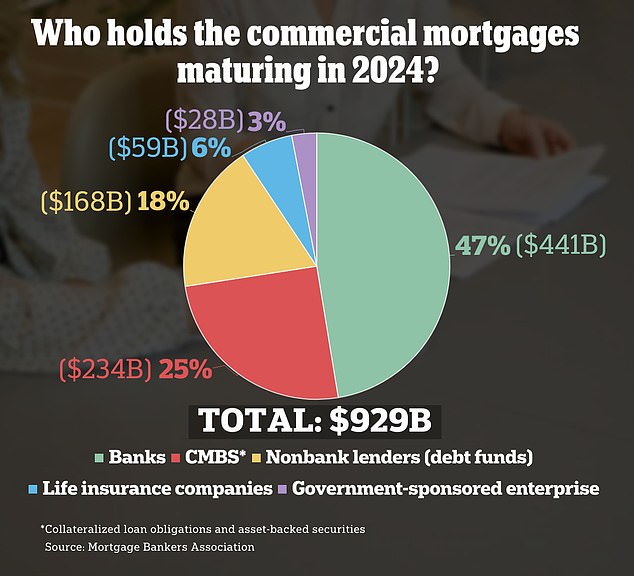

Some $929 billion of outstanding commercial mortgages held by lenders and investors will mature in 2024, or 20 percent of the $4.7 trillion total outstanding debt, according to recent data from the Mortgage Bankers Association.

Meanwhile, higher interest rates are battering commercial real estate (CRE) property values across the board, with office buildings hit particularly hard due to the enduring popularity of remote and hybrid working.

Disturbingly, about 14 percent of all CRE loans, and 44 percent of office loans, appear to be ‘underwater,’ with current property values that are less than the outstanding loan balances, according to a recent working paper for the National Bureau of Economic Research.

‘If nothing changes — if interest rates remain elevated and property values do not improve — we do view defaults at the rate of the Great Recession, and in fact even higher, as quite a possibility,’ one of the co-authors, Columbia Business School professor Tomasz Piskorski, told DailyMail.com.

Traditional banks hold roughly half of the $929 billion in commercial mortgages set to hit maturity this year. That total is a 28% increase from the $728 billion that matured in 2023

180 Grand Avenue in Oakland, California (above) sold for $119 million in 2017, but the loan is now listed as ‘non-performing’ and control of the building is up for sale

If default rates on CRE loans jumped to 10 percent, the study estimates that 231 US banks, with aggregate assets of $1 trillion, would see the market value of their assets fall below the value of their customer deposits.

That situation could spur panicked customers to withdraw their uninsured deposits, in the same kind of rapid bank run that triggered the collapse of Silicon Valley Bank last year.

‘Because of the high interest rates, there are dozens to hundreds of banks that are at the brink of solvency. So this additional commercial real estate distress puts them into the group of banks that potentially are susceptible to runs by depositors,’ Piskorski said in a Zoom interview this week.

‘This is the icing on the cake that can really create a problem for quite a few banks, mainly smaller and mid-sized banks,’ he added.

Piskorski said that he and his co-authors view a commercial mortgage default rate of 10 percent or more as ‘quite likely’ given the current share of underwater loans.

Unlike home mortgages, where the principle is paid down over time, most CRE loans are interest-only — meaning that when they mature, they must either be paid in full or refinanced.

Given that many outstanding CRE loans were issued when interest rates were lower, even properties that are not underwater may struggle to find a bank willing to refinance. Others may struggle to meet higher interest payments.

For consumers, Shark Tank star Kevin O’Leary advises avoiding small regional banks, and keeping deposits in large national banks that are ‘too big to fail’

‘Regional banks are doomed,’ he wrote in a recent column for DailyMail.com. ‘Start moving your money now.’

Others fear contagion from a possible banking crisis could threaten the broader financial system.

A recent report from a financial regulator established in the wake of the Great Recession listed the commercial real estate market as first among financial risks to the US economy.

‘As losses from a CRE loan portfolio accumulate, they can spill over into the broader financial system,’ states the annual report from the Financial Stability Oversight Council.

FSOC warned of the potential for a ‘downward CRE valuation spiral’ in which sales of financially distressed properties flood the market, reducing the market values of nearby properties.

Such a downward spiral could send other commercial mortgages underwater, raising default rates and even reducing municipalities’ property tax revenues.

Why are commercial property values down?

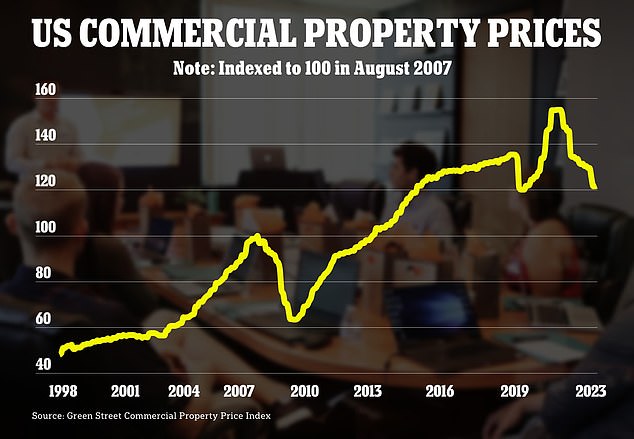

Overall, US commercial property values are down 21 percent from their recent peak in March 2022, when interest rates began to rise, according to real estate advisory firm Green Street.

Office values have dropped most sharply, down 35 percent from that peak, but the decline has hit across the board, from apartment buildings and strip malls to healthcare and self-storage facilities.

Dylan Burzinski, an analyst and head of office sector research at Green Street, told DailyMail.com that the 35 percent decline in values reflected trends in the highest-quality ‘Class A’ office sector, and that lower-tier properties are down more than 60 percent from pre-pandemic levels.

‘The office sector is facing many headwinds,’ said Burzinski, citing the shift to remote work, a general economic slowdown and layoffs, and tightening debt capital markets as factors battering office values.

Four years on, remote and hybrid working arrangements remain popular with white collar workers, who cite the convenience factor and significant savings in time and money on commuting.

Last month, the office vacancy rate in the US reached a 40-year high of 19.6 percent, according to Moody’s Analytics.

Overall, US commercial property values are down 21 percent from their recent peak in March 2022, when interest rates began to rise, according to Green Street

A ‘Retail Space For Lease’ is seen on a storefront building on Third Avenue in New York. Property values for all kinds of commercial real estate have dropped over the last two years

That has helped drive office vacancy rates to record highs. Last month, the US office vacancy rate hit 19.6 percent, according to Moody Analytics, the highest at least since 1979, which is as far back as Moody’s records go.

While property values in the office sector have been hardest hit, remote work also has the potential for ‘negative spillover’ in other commercial real estate, experts say.

Urban retail faces pressure as fewer people travel for work, multifamily housing units could see lower demand as the need to live close to the office declines, and hotels are under threat of declining business travel.

Piskorski shared exclusively with DailyMail.com his unpublished research indicating that 12 percent of all multi-family property mortgages are currently underwater.

Meanwhile, the Federal Reserve’s rate hikes have also weighed heavily on commercial property values across the board, by raising borrowing costs and reducing demand from potential buyers.

‘Interest rates decrease the value of bank assets, but also decrease the value of commercial buildings,’ said Piskorski.

‘Many of these commercial buildings have long term leases. So when the interest rates increase, the value of the cash flow from these buildings is lower,’ he explained.

‘Yes, the office is absolutely the worst sector, there’s no doubt about it,’ he added. ‘But even if you don’t have an office loan, as a bank, it doesn’t mean you are off the hook.’

Why are banks at risk if commercial mortgage defaults rise?

Traditional banks hold roughly half of the $929 billion in commercial mortgages set to hit maturity this year. That total is a 28 percent increase from the $728 billion that matured in 2023, according to MBA data.

Explaining the current solvency risk to banks

1. Interest rate hikes over the past two years have reduced the aggregate market value of US bank assets by about $2 trillion

2. This has put dozens to hundreds of smaller banks on the cusp of having assets that are worth less than what they owe depositors

3. A 10% default rate on CRE loans would wipe another $80 billion in asset value off bank balance sheets

4. While that number is small relative to total bank assets, for some 231 banks, it could tip the lenders into technical insolvency

5. Those 231 banks would be at risk of failure if they faced bank runs by uninsured depositors seeking to move their money

Source: Jiang et al. (2023)

CRE loans account for about quarter of assets for an average bank, and about $2.7 trillion of bank assets in the aggregate, according to the NBER study.

The study found that, if default rates on CRE loans had jumped to 10 percent in early 2022, when interest rates were still low, every US bank would have been able to absorb the shock without risk of failure.

But with the Fed’s benchmark rate at 5.33 percent, up from near zero two years ago, the aggregate market value of assets held by US banks has decreased by roughly $2 trillion, according to the study.

The authors argue that many banks have not properly adjusted their portfolios to manage for risk, and warn that hundreds of lenders face insolvency if the default rate on CRE loans jumped to 10 percent.

Those banks could face collapse if customers with deposits of more than $250,000, which is the maximum guaranteed by the FDIC, seek to move their uninsured deposits.

‘What we have shown in the research is that hundreds of banks could potentially fail, if uninsured depositors withdraw their money,’ said Piskorski.

‘There is a good equilibrium when they don’t. For that good equilibrium to happen, the uninsured depositors need to have confidence in the banking system, and this is what the regulators are trying to instill,’ he added.

A 10 percent default rate or more is far from assured, but Piskorski and his co-authors view it as quite possible, given the high share of commercial mortgages that are already underwater.

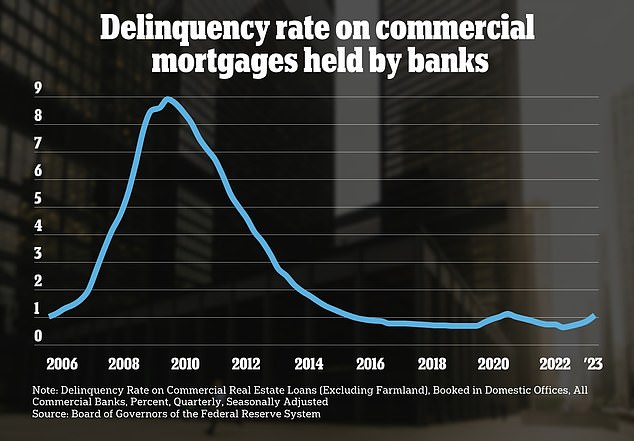

The delinquency rate on commercial mortgages, a leading indicator for defaults, was 3.2 percent in December, up from 2.7 percent the prior quarter, according to the MBA.

If defaults do spike, the banks most at risk of insolvency would be smaller regional lenders with a high proportion of CRE loans on their balance sheet.

Banking titans such as JPMorgan, Bank of America and Citigroup, would not be at risk, as commercial mortgages account for a small fraction of their balance sheet.

Small banks account for nearly 70 percent of all CRE loans outstanding, according to research from Apollo.

Commercial buildings across the country are struggling to find tenants, even as landlords contend with higher interest rates

The delinquency rate on commercial mortgages, a leading indicator for defaults, ticked up last year, but so far is well below the level seen in the Great Recession, when it approached 10%

Among smaller banks with significant CRE loan portfolios, lenders with significant shares of uninsured deposits would be the most susceptible to bank runs.

The recent trouble at New York Community Bancorp sounded alarm bells for the sector, after the lender posted a surprise fourth-quarter loss due to its loans tied to the stressed commercial real estate sector.

Since reporting the higher provision for bad loans and slashing its dividend on January 31, the market value of NYCB has dropped by nearly $4 billion, or roughly 50 percent.

Still, some observers expect the banking system to weather rising defaults on CRE loans without widespread failures.

Morningstar DBRS analysts predicted CRE woes will weigh on US banks’ financial performance, but expect the process to stretch over multiple years, with losses spread out as lenders work through maturing loans.

‘Some of these loans are well positioned and will be refinanced, some will be extended and some will go bad,’ the ratings agency wrote in a recent note.

Read more

News Related-

Pedestrian in his 70s dies after being struck by a lorry in Co Laois

-

Vermont shooting updates: Burlington police reveal suspect’s eerie reaction to arrest

-

Grace Dent says her ‘heart is broken’ as she exits I’m A Celebrity early

-

Stromer’s ST3 Urban E-Bike Goes Fancy With Minimalist Design, Modern Tech

-

Under-pressure Justice Minister announces review of the use of force for gardaí

-

My appearance has changed because of ageing, says Jennifer Lawrence

-

Man allegedly stabbed in the head during row in Co Wexford direct provision centre

-

Children escape without injury after petrol bomb allegedly thrown at house in Cork City

-

Wexford gardai investigating assault as man is bitten in the face during Main Street altercation

-

Child minder’s husband handed eight year sentence for abusing two children

-

The full list of the best London restaurants, cafes and takeaways revealed at the Good Food Awards

-

Mazda CEO Says EVs 'Not Taking Off' In The U.S.—Except Teslas

-

Leitrim locals set up checkpoint to deter asylum seekers

-

Ask A Doctor: Can You Get Shingles More Than Once?