More home sellers are paying capital gains taxes — here’s how to reduce your bill

- Married couples can shield up to $500,000 in home sale profits from capital gains and single filers can exempt up to $250,000.

- In 2023, nearly 8% of U.S. home sales yielded profits exceeding $500,000, compared to about 3% in 2019, according to a new report.

- If your home sale profit exceeds the limit, you can reduce it by adding to the “basis” or original purchase price with capital improvements.

More home sellers are paying capital gains taxes — here’s how to reduce your bill

More Americans are paying capital gains taxes on home sale profits amid soaring property values — but there are ways to reduce your bill, experts say.

In 2023, nearly 8% of U.S. home sales yielded profits exceeding $500,000, compared to about 3% in 2019, according to an April report from real estate data firm CoreLogic.

There’s a reason the report called out that threshold.

It’s key for a special tax break for homeowners who make a profit when selling a primary residence. Married couples filing together can make up to $500,000 on the sale without owing capital gains taxes. The threshold for single filers is $250,000.

More from Personal Finance:

How to reduce taxes on your inherited individual retirement account, experts say

Americans can’t stop ‘spaving’ — here’s how to avoid this financial trap

Women farmers are key decision-makers, according to USDA data

Those capital gains exemption thresholds haven’t been indexed for inflation since 1997, said certified financial planner Jaime Quinones with Stockade Wealth Management in Marlboro, New Jersey.

“With the recent rise in home values, more sellers have been facing a capital gains tax hit,” Quinones said.

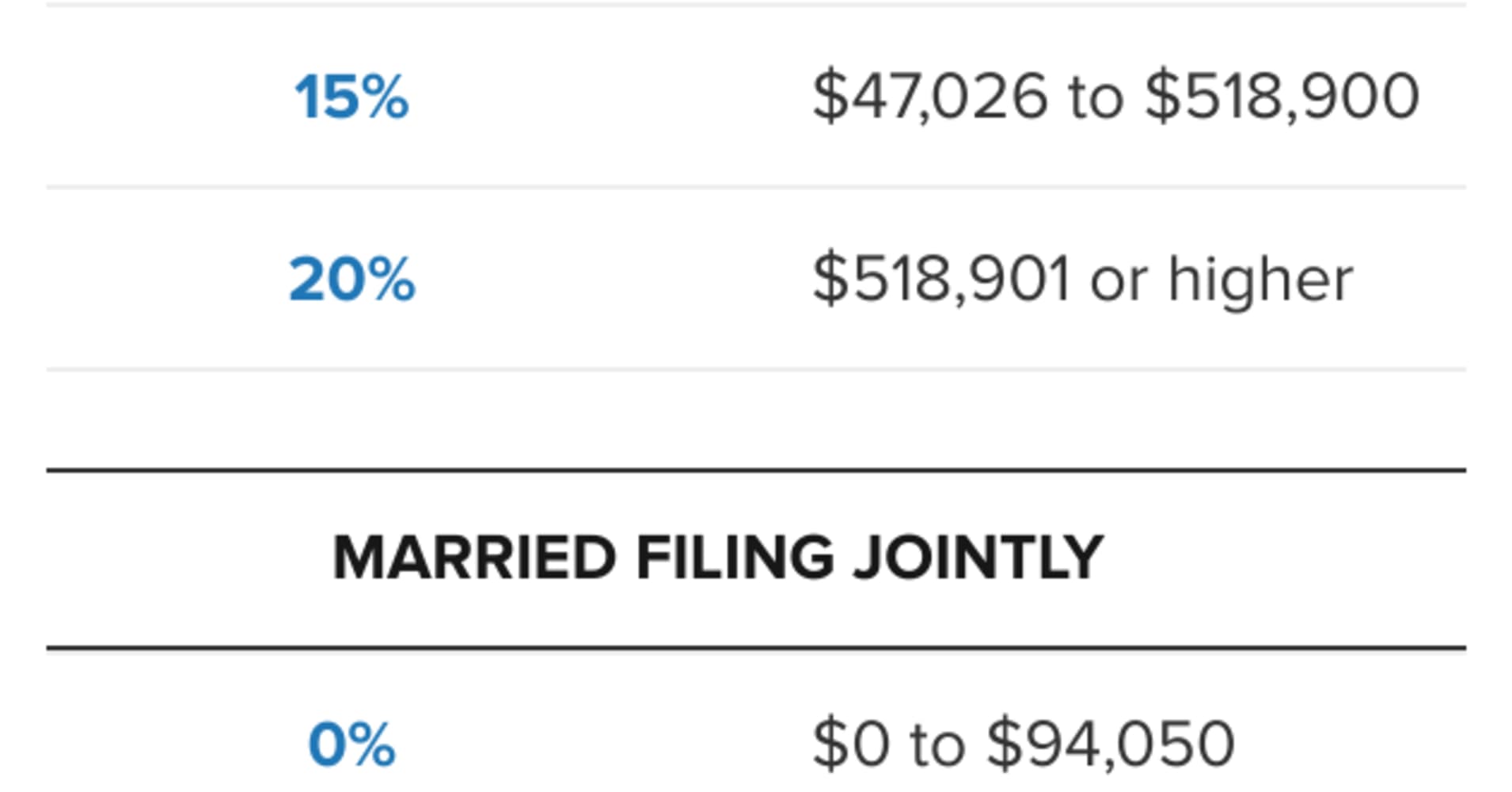

Home sale profits above the $250,000 or $500,000 thresholds incur capital gains taxes of 0%, 15% or 20%, depending on your income.

Capital gains taxes on a home sale are more common in high-cost areas. In 2023, the percentage of home sales that had profits exceeding $500,000 hit double digits in Colorado, Massachusetts, New Jersey, New York and Washington, the CoreLogic report found.

How to qualify for the capital gains exemption

The IRS has strict rules to qualify for the $250,000 or $500,000 capital gains exemption, according to the IRS. To that point, you must own the home for at least two of the past five years before your home sale to satisfy the “ownership test.”

The “residence test” says the home must be your primary residence for any 24 months of the five years before the sale, with some exceptions. The 24 months don’t need to be consecutive.

How to reduce your capital gains tax bill

If you’ve lived in a home long enough to exceed the capital gains exemptions, there’s a “high probability” you’ve made improvements to the home, said Falls Church, Virginia-based CFP Parker Trasborg, Senior Financial Adviser at CJM Wealth Advisers.

You can use those improvements to increase your home’s “basis,” or original purchase price, which reduces your profit, he said.

But routine maintenance and repairs don’t count. For example, you can increase your home’s basis by adding the cost of a new roof or addition. But fixes to leaky pipes won’t qualify.

After selling a home, the IRS receives Form 1099-S, which shows your closing date and gross proceeds. But you’ll need paperwork to prove any changes to your home’s basis in the case of an IRS audit.