(Bloomberg) — A meltdown in Chinese shares is wreaking havoc on the country’s asset management sector, pushing mutual fund closures to a five-year high in another sign of waning investor confidence.

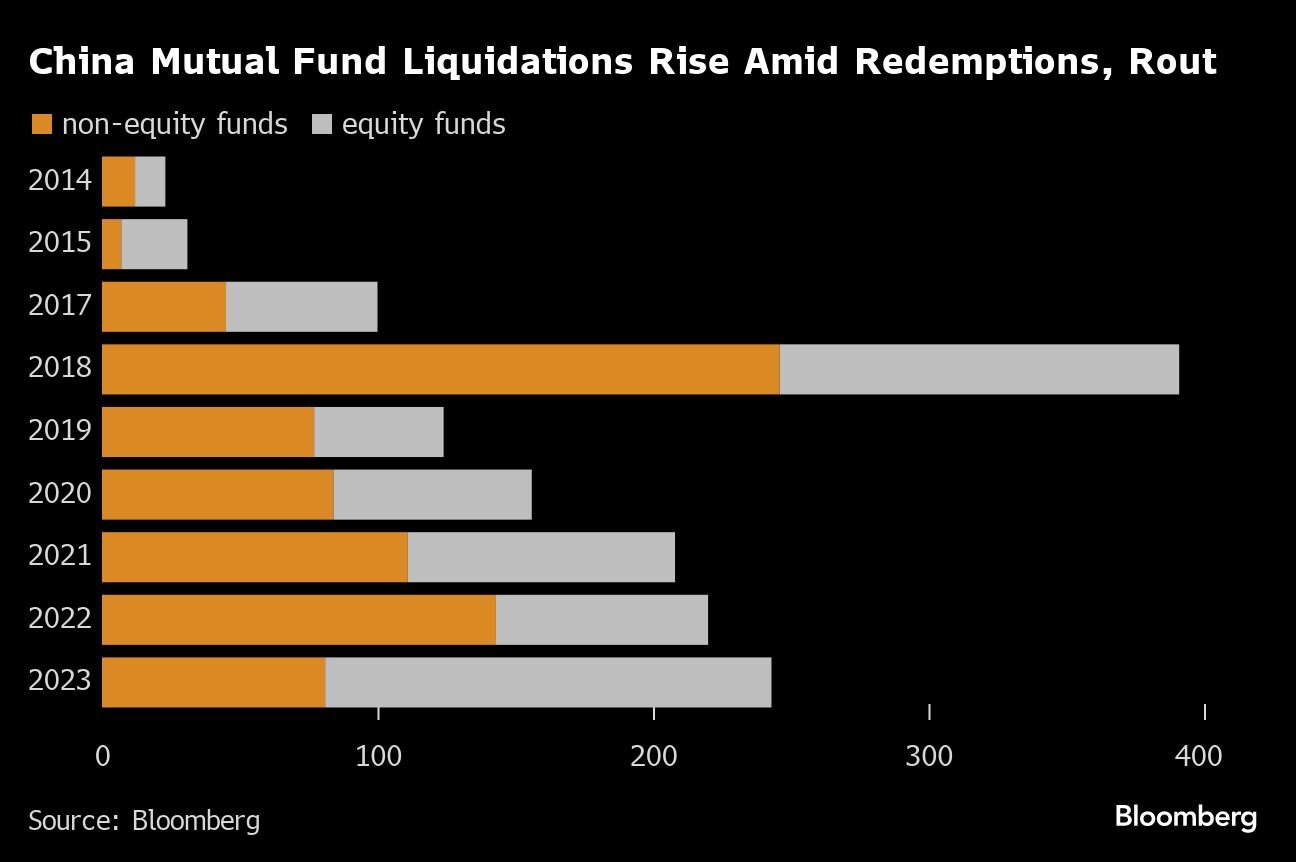

About 240 local mutual funds were liquidated last year, according to Bloomberg-compiled data dating back to 2014. That’s the most since 2018, when stricter asset management rules triggered a major industry shakeup. Among the closed funds, four out of five had a stock-focused mandate, which was a record.

The trend has continued into this year, with another 14 funds already liquidated and two dozen more warning of imminent closures, according to Bloomberg calculations of official data.

China’s mutual fund industry is confronting a double whammy as the country’s stock selloff intensifies, with the surge in product closures coinciding with a plunge in the amount of new subscriptions to a decade-low. The fund liquidations have accelerated the downward spiral in the world’s second-largest stock market, forming a vicious cycle as retail investors abandon their once-preferred product for the safety of cash.

China Mutual Fund Liquidations Rise Amid Redemptions, Rout |

“Weak performance was an important factor behind mutual fund shrinkage and even liquidations,” said Li Yiming, senior analyst at Morningstar Inc.’s fund research center in China. “When investors find it hard to make money in a market, underperforming products face the greater risk of becoming so-called mini funds.”

A relentless selloff has turned China into the world’s worst-performing major market in the new year, as a deepening housing slump and stubborn deflationary pressures weigh on the economic outlook.

The benchmark CSI 300 Index gained 1.4% Thursday amid signs of heavy purchases by state funds dubbed the “national team.” The mainland Chinese stock gauge remains 4.9% down in 2024, following a record three consecutive years of losses.

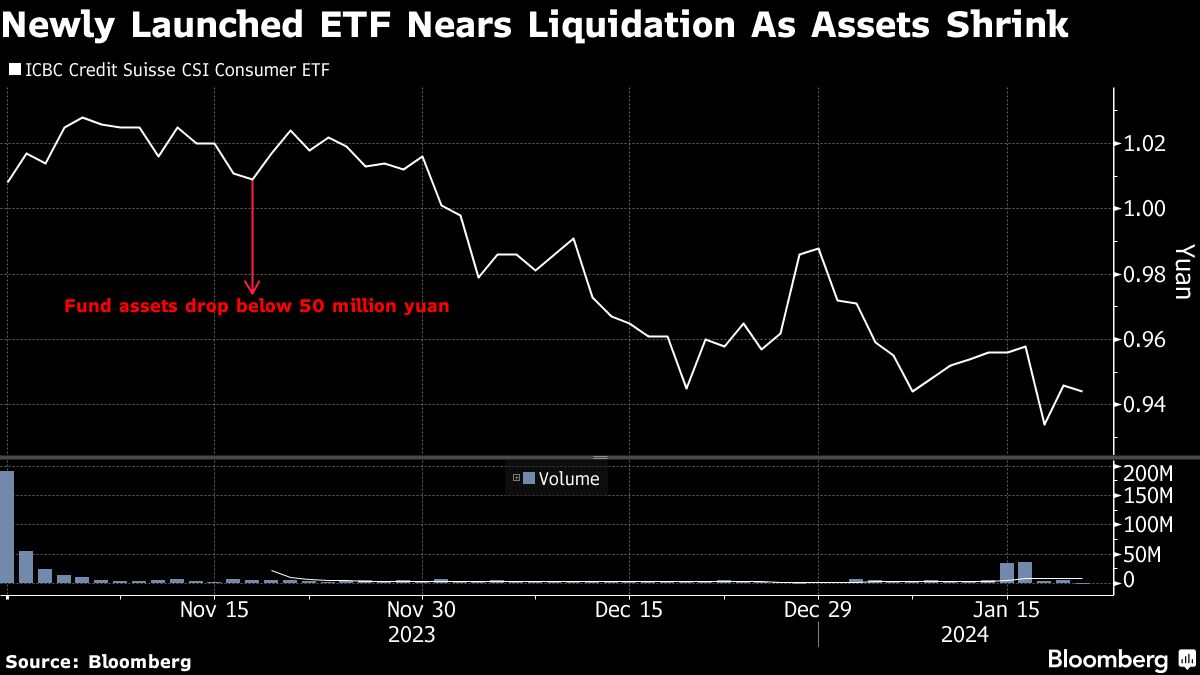

China’s securities regulator requires mutual fund products to have at least 200 investors and raise a minimum of 200 million yuan ($27.8 million) in order to be launched. Once a product’s asset value drops below 50 million yuan for 60 consecutive trading days, the fund house must alert the regulator and propose solutions, including contract termination.

Many funds prefer liquidations given the complexity of other options such as merging with another fund. Such product closures would mean forced selling of the portfolio’s holdings and returning the remaining assets to investors at a loss. This would be especially painful for retail investors who continued to buy these products in hopes of being rewarded in the long run for bargain hunting.

In one example, the CCB Principal Quantitative Event-driven Equity Fund, an open-end fund run by CCB Principal Asset Management Co., was liquidated in August after its assets under management plunged to 30 million yuan, or a little over a tenth of its value at its 2017 launch, according to public filings.

Newly Launched ETF Nears Liquidation As Assets Shrink

Actively managed mutual funds, once a favored investment tool among Chinese retail investors, are fast losing their appeal: a gauge of stock-focused mutual funds has declined 7.7% this year, according to China Securities Index Co. Meantime, investors also are falling out of love with exchange-traded funds that drew record subscriptions last year but now suffer a supply glut, said Morningstar’s Li.

ICBC Credit Suisse CSI Consumer Top ETF, launched in October, is among peers that are struggling to survive. The fund warned investors earlier this month that its net asset value had been below the 50 million yuan mark for 45 trading sessions. If the situation continued for another five trading days, it would trigger product termination based on its contract.

“The market also is aware that there has been a lot of redemption. There are funds that were set up three years ago and now we have come to the end of that lockup,” said Nicholas Yeo, head of China equities at abrdn at a briefing Thursday. “So there is a concern about short-term pressure on selling and that’s why domestic investors are not willing to go into the market right now.”

–With assistance from Xinyi Shen and Charlotte Yang.

Most Read from Bloomberg

©2024 Bloomberg L.P.

News Related-

Russian court extends detention of Wall Street Journal reporter Gershkovich until end of January

-

Russian court extends detention of Wall Street Journal reporter Evan Gershkovich, arrested on espionage charges

-

Israel's economy recovered from previous wars with Hamas, but this one might go longer, hit harder

-

Stock market today: Asian shares mixed ahead of US consumer confidence and price data

-

EXCLUSIVE: ‘Sister Wives' star Christine Brown says her kids' happy marriages inspired her leave Kody Brown

-

NBA fans roast Clippers for losing to Nuggets without Jokic, Murray, Gordon

-

Panthers-Senators brawl ends in 10-minute penalty for all players on ice

-

CNBC Daily Open: Is record Black Friday sales spike a false dawn?

-

Freed Israeli hostage describes deteriorating conditions while being held by Hamas

-

High stakes and glitz mark the vote in Paris for the 2030 World Expo host

-

Biden’s unworkable nursing rule will harm seniors

-

Jalen Hurts: We did what we needed to do when it mattered the most

-

LeBron James takes NBA all-time minutes lead in career-worst loss

-

Vikings' Kevin O'Connell to evaluate Josh Dobbs, path forward at QB