GFM Services sees O&G segment taking off this year

This article first appeared in The Edge Malaysia Weekly on April 29, 2024 – May 5, 2024

WHEN GFM Services Bhd announced the acquisition of loss-making oil and gas (O&G) maintenance service provider Highbase Strategic Sdn Bhd in 2019 in a bid to diversify its revenue, it raised eyebrows.

GFM was then known as an integrated facilities management (IFM) company focusing on civil and structural, electrical systems, landscaping and mechanical systems.

The Covid-19 pandemic further challenged GFM, with many economic activities stalling. The group saw revenue drop 12% in the financial year ended Dec 31, 2020 (FY2020), reflecting the broader economic slowdown.

Fast forward to today, the O&G segment has become one of the group’s key drivers, following a successful turnaround of Highbase.

GFM founder and group managing director Ruslan Nordin tells The Edge: “Highbase held a viable Integrated Turnaround Main Mechanical and Maintenance Mechanical Static (TA4MS) contract with Petroliam Nasional Bhd (Petronas). However, the company was a distressed asset. Leveraging GFM’s expertise as an IFM, we managed to turn Highbase around. But it took a while because of the pandemic.”

Ruslan, 64, returned to the helm at GFM in March last year. The former executive vice-chairman was re-designated to his current role when Mohammad Shahrizal Mohammad Idris was re-designated from managing director to non-executive director. Ruslan holds a direct stake of 8.84% and an indirect stake of 10.83% in GFM through GFM Global Sdn Bhd.

Meanwhile, Ruslan sees Highbase taking off this year, on track to contributing 30% to 35% to GFM’s revenue from FY2024.

The TA4MS contract covers operations and maintenance (O&M) services for three facilities within the Pengerang Integrated Petroleum Complex (PIPC) in Johor. Highbase was awarded the contract in a joint venture (JV) with Singapore-listed Mun Siong Engineering Ltd (MSEL) in 2019, spanning a five-year period. The JV, in which Highbase owns a 51% stake, recently secured another three-year contract extension from Petronas until March 2027, with an outstanding contract value of RM171.4 million.

Ruslan expects contribution from the O&G segment to be higher next year, driven by scheduled maintenance works and turnarounds in Pengerang.

“The plant turnaround in Pengerang would also provide an opportunity for GFM to bid for workers’ accommodation at Pengerang, which is estimated to see 25,000 people working on the project,” he says.

Ruslan believes the group’s exposure in Pengerang will open up new opportunities to tap the downstream O&G sector.

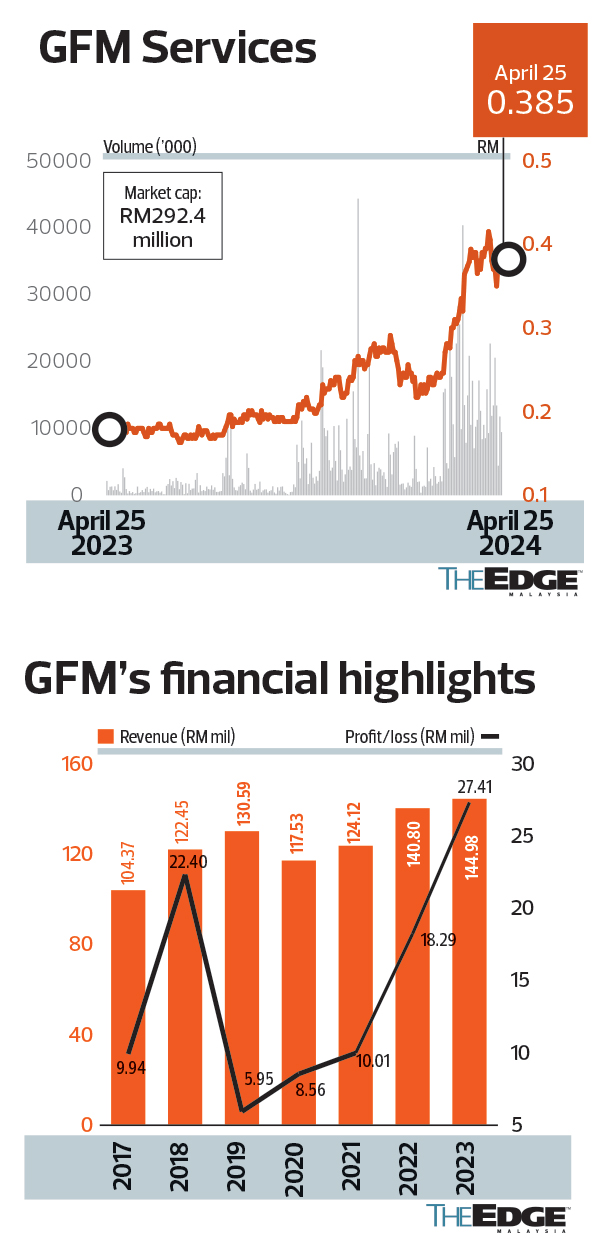

GFM posted a record net profit of RM27.41 million in FY2023, up 50% year on year from RM18.29 million. It has been recording a compound annual growth rate (CAGR) of 37% in net profit from FY2019 to FY2023.

Revenue for FY2023 rose 2% y-o-y to RM144.98 million, from RM 140.8 million.

In terms of segmental breakdown, the FM division remained the group’s top revenue driver in FY2023, contributing RM90.9 million, or 63%, followed by its concession segment, which made up 35%, or RM52.8 million, and the O&G segment, which accounted for about 2%, or RM3.3 million.

GFM successfully transferred its listing status to the Main Market of Bursa Malaysia last Friday. To transfer to the Main Market, the group is required to have had an aggregate profit after tax of at least RM20 million for the past three financial years.

As at end-December 2023, GFM’s outstanding order book stood at RM1.18 billion. The bulk of its order book of RM824.7 million is contributed by KP Mukah Development Sdn Bhd, which holds the concession for UiTM Mukah campus until 2035, and RM269.4 million comes from a contract with the Public Works Department (JKR) to provide facilities management services for Istana Negara that expires in 2027.

Shares in GFM have been on a steady upward momentum, almost doubling that a year ago. The counter closed at 38.5 sen a share last Thursday, giving it a market capitalisation of RM292.4 million. Based on Thursday’s closing price, GFM’s trailing 12-month price-earnings ratio (PER) stood at 9.7 times, lower than its IFM peers on Bursa. AWC Bhd is trading at a PER of 15.85 times, UEM Edgenta Bhd is trading at 24.51 times and Widad Group Bhd is a loss-making entity.

UEM Edgenta fetches higher valuations than other IFMs on Bursa as the company is involved in asset management that includes healthcare support and has operations across six countries.

Eyeing acquisitions for more recurring income

Ruslan recognises that the group needs to expand its recurring income because of fluctuations in earnings as an IFM contractor.

“We will continue to look for more possible merger and acquisition (M&A) opportunities, like what we have done with KP Mukah and Highbase, where we can also expand into other areas of IFM,” he says.

In February, GFM entered into a share sale agreement to acquire Era Gema Sdn Bhd for RM23 million to expand into the highway rest and service area (RSA) business. Era Gema has been awarded the rights by the Malaysian Highway Authority to undertake the proposed development of an RSA on a 1.74ha tract located in Sungai Muda, Penang.

The acquisition will enable GFM to develop, operate and maintain the RSA in Sungai Muda, says Ruslan.

He adds that it will take at least two years to build the RSA, but it will further bolster the group’s recurring income.

“We have almost completed the fundraising. People are not very familiar with the RSA business but are aware of shopping mall development. If you think about it, we are looking at traffic of 14,000 vehicles a day using the highway, which is more than shopping mall traffic,” he says.

“At the end of the day, the RSA is about providing facilities, which is in line with GFM’s core strength. We also recognise that the FM sector is becoming saturated, as the barrier of entry is low. That is why we need to look into other areas in the FM space.”

Ruslan notes that GFM has identified three other locations for RSA projects, which is a five-year growth strategy for the group. The first RSA project by GFM is estimated to cost RM78 million.

As at end-December 2023, GFM had net debt of RM172.85 million. Its cash and bank balances amounted to RM99.53 million, and borrowings totalled RM272.38 million.

Asked how the group would finance potential M&As, Ruslan says its current borrowings are mainly ring-fenced by its concession contract for the UiTM Mukah.

“As such, this will not affect our ability to fundraise for other projects,” he adds.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple’s App Store and Android’s Google Play.